高通在当地时间11月4日盘后公布了2020Q4、2020FY财报,其中的Q4业绩远超预期,反映疫情过后,公司业绩逐渐得到修复。

业绩发布后,高通股票的盘后价格“一路向北”,截至美东时间11月4日19:59,涨幅已达到12.87%,报145.57美元每股。

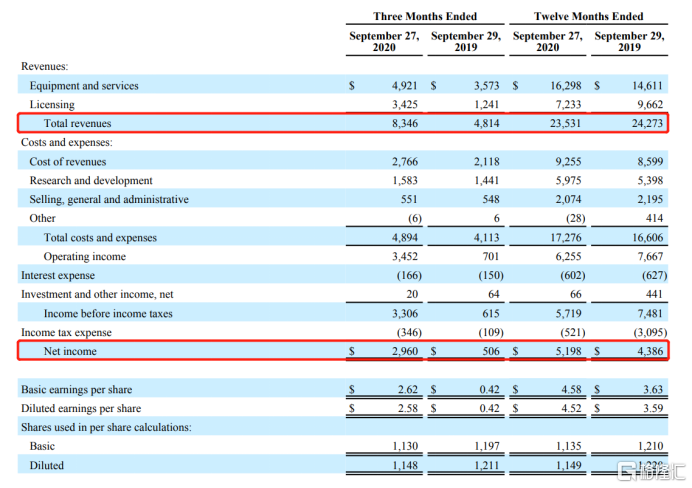

财报显示,高通Q4营收83.46亿美元,比去年同期48.14亿美元增长了73%。

净利润方面录得29.60亿美元,去年同期仅为5.06亿美元,因此今年Q4同比暴增484.98%。但若不计某些一次性项目,调整后净利润为16.69亿美元,与去年同期的9.47亿美元相比增长76%。

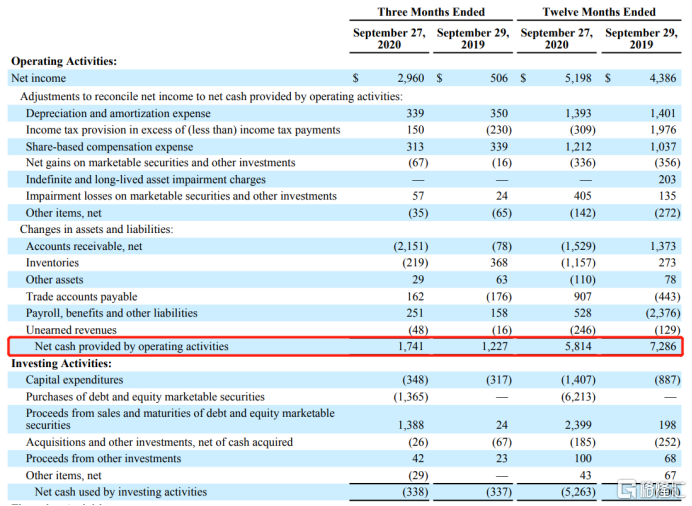

受良好销售业绩影响,高通Q4经营活动现金经录入17.41亿美元,同比增长41.89%。

当期,手机基带芯片营收49.67亿美元,同比增长38%;MSM芯片出货量1.62亿,同比增长7%。技术许可业务营收15.07亿美元,同比增长30%。

销售额的良好表现,一方面应归功于iPhone 12热销。苹果与高通以就专利问题达成多年协议,苹果同意向高通支付47万美元的“和解费”,以继续使用高通芯片。

消息显示,苹果计划至少在2023年之前继续使用高通公司的X60,X65和X70芯片。不过,苹果正在全力开发自己的芯片,并且会在未来的产品内投入使用。

另一方面,2020年7月与华为达成了和解协议,后者向高通支付18亿美元“和解费”。2020Q4,华为支付了和解协议下的第一笔款项,以及2020年3~6月两个季度的到期专利费。

高通首席执行官史蒂夫·莫伦科夫(Steve Mollenkopf)表示:“Q4业绩表明,公司在5G领域的投资正在取得成果,我们的授权和产品业务也从中受益。”

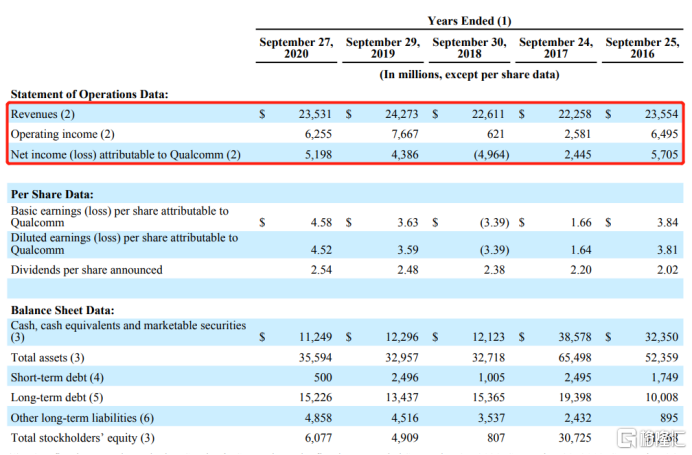

年报方面,新冠肺炎对公司主营业务的消费者需求产生了负面影响,对业绩产生了负面影响。

2020FY营收下降了3.06%至235.31亿美元,但净利润实现了18.51%的增幅至51.98亿美元。同期毛利率为60.67%,同比下降3.9个百分点。

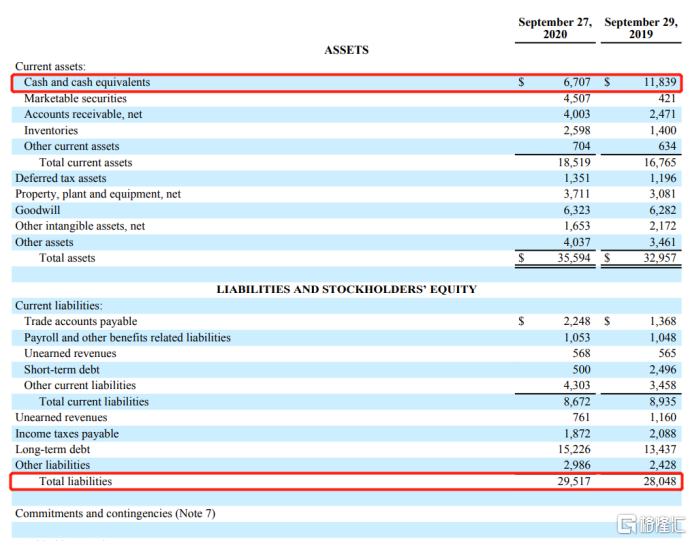

此外,公司经营现金流减少了20.2%至58.14亿美元,期末现金流余额更是从118.39亿美元下滑到67.07亿美元,减少了43.35%。

不过公司的负债状况没有过于恶化。2020FY公司负债率为82.93%,较上年略微下降了2.17个百分点。

莫伦科夫表示,公司已经为2021年及以后的增长做好了准备。

“随着无线技术颠覆步伐的加快,我们将继续推动射频前端、汽车和物联网周边业务的增长和规模扩大。”莫伦科夫说道。

财报同时表示,从第四季度和2020FY的结果开始,高通将在QCT领域通过手机、射频前端、汽车和物联网实现收入突破。从2021FY开始,公司将不再提供MSM芯片出货量预期和实际结果。

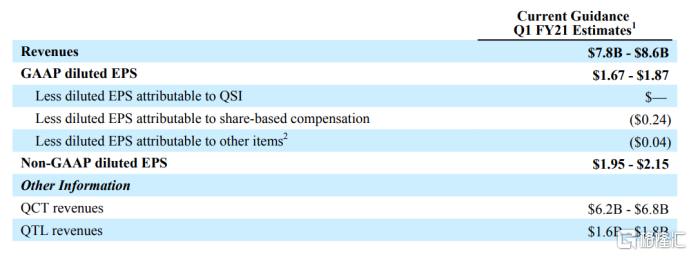

对于公司2021Q1的业绩前景,公司做出了如下预期:

营收预计将会达到78亿~86亿美元,均值82亿美元,超出分析师预期。据雅虎财经频道汇总的数据显示,分析师平均预期高通第一季度营收将达71.3亿美元。每股摊薄收益将会达到1.67~1.87美元;

不按照美国通用会计准则的调整后每股摊薄收益,将会达到1.95~2.15美元,均值2.05美元,超出分析师预期。据雅虎财经频道汇总的数据显示,分析师平均预期高通第一季度调整后每股收益将达1.68美元。