佳兆業集團(01638.HK):大灣區城市更新絕對領軍者,維持“買入”評級

格隆匯 11-04 17:18

機構:國信證券

評級:買入

估值與投資建議

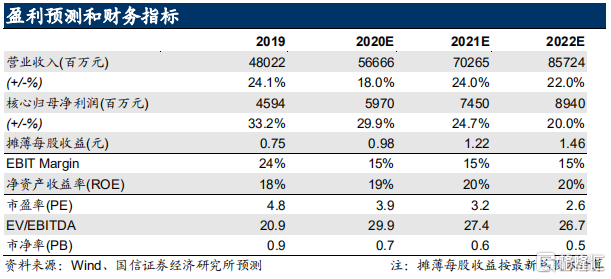

結合絕對估值與相對估值,基於保守審慎的原則,我們認為公司未來一個財年內合理股價區間為 4.55 至 5.93 元,較當前股價有 44.9%至88.8%的空間,預計公司 2020、2021 年歸母核心淨利潤分別為 59.7億、74.5 億元,對應最新股本的核心 EPS 分別為 0.98、1.22 元,對應最新股價的 PE 分別為 3.2、2.6X,維持“買入”評級。

城市更新進入加速時代

着眼於開發商的角度,一個城市更新項目分計劃階段、規劃階段、實施階段,當從開始介入一箇舊改項目,到拿到土地證,一般時長為 5 至 8 年。近期,大灣區針對加速舊改流程的利好頻出,預計可加速舊改流程三年左右的時間。

大灣區城市更新絕對領軍者

公司以地產開發為主業,借“城市更新”領域的專業優勢,經過二十餘年的發展,公司業務已覆蓋京津冀協同發展區域、粵港澳大灣區、長江經濟帶等主要經濟區域,進駐全國超 50 個重要城市。公司以“精耕深圳”為初期發展戰略,逐漸步入區域領先,擁有土地儲備總建築面積 2680 萬平方米,其中大灣區佔比超過 50%,可保證公司未來三年的發展及銷售的增長。在壁壘頗高的城市更新方面,公司經驗豐富、優勢明顯,更加聚焦於利潤豐厚的拆除重建類的項目,平均毛利率可達到 50%。

嚴格把控財務指標,降負債成效明顯

自 2016 年以來,公司毛利率、淨利率持續提升,均處於較高水平,考慮到公司高毛利的舊改項目佔整體銷售比例穩中有增,我們認為公司未來毛利率水平有望維持相對高位。公司嚴控負債水平,降負債成效明顯,預計 2020 全年公司的淨負債率將有望回落至 120%。

風險提示

若調控超預期導致未來銷售不及預期從而導致估值及盈利預測過高。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.