港股收評:恆指大漲1.96%,通信設備股普漲中興飆升7.5%

今日,港股市場延續上漲行情,主要指數均大幅收漲。恆指盤中一度站上25000點,收漲1.96%報24939點,恆生科技指數漲1.7%。盤面上,半導體、手機概念股強勢大漲,舜宇漲近8%;電訊設備股反彈明顯,中興通訊止跌漲7.5%;香港9月零售貨值跌幅收窄,香港本地股全線走強;保險股、銀行股、石油股持續活躍,助力大市走高;電池股、光伏股回落明顯,手遊股延續跌勢。今日南下資金淨流入77.46億港元,大市成交額為1296.32億港元。

電訊設備股普漲。其中, 中興通訊、京信通信均大漲超7%,中國鐵塔大漲5.74%,中國通信服務、酷派集團均大漲超2%。

國家工信部公佈數據顯示,2020年首三季度,3D打印設備、智能手錶等產品生產同比增速均在70%以上,電子及通信設備製造業增加值按年增長8.3%。截至9月底,全國累計建設開通5G基站69萬個。中信建投指出,當前,電訊通信行業配置低,估值較低、業績有兑現。展望2021年,5G與雲仍會推動行業需求向好,疊加近期美國大選將落地,建議關注通信設備商的反彈機會。

電子零件板塊表現造好。其中,舜宇光學科技大漲7.8%,天寶集團、高偉電子均上漲超4%,瑞聲科技、丘鈦科技上漲超3%,信利國際上漲2.3%。

半導體板塊同樣強勢。其中,華虹半導體上漲8.42%,節能元件上漲7.89%,上海復旦上漲5.8%,中芯國際、中電華大科技均上漲超4%。

友邦保險大漲6.27%,報價77.95港元,最新市值為9427.16億港元。自從6月底以來,友邦保險累計反彈23.6%。

摩根大通發表研究報告,指出友邦(1299.HK)剛宣佈獲中銀保監批准開始籌建四川分公司,為友邦中國獲批籌建的首家全資分公司。該行指,歡迎公司這一新進展,認為這為公司增加了未來的增長動力。今後,公司將會在中國三個省份(包括江蘇、廣東及四川);以及四個城市(包括北京、上海、天津及石家莊)營運。根據國家統計局數據,這些地方佔中國2019年GDP的40%。

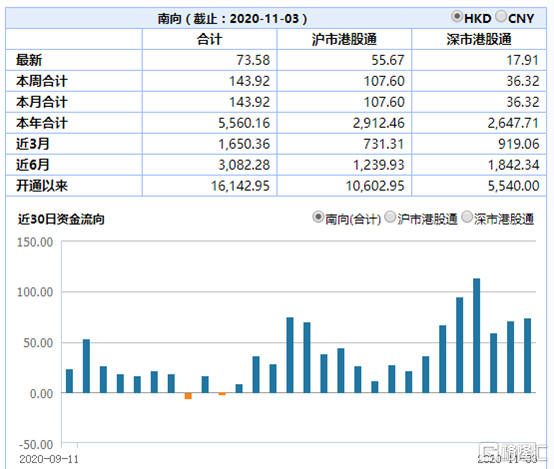

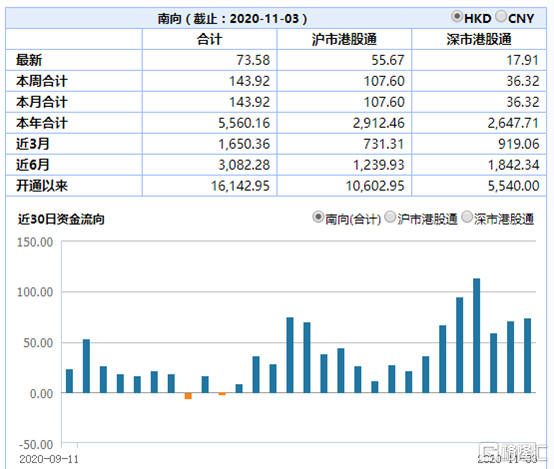

今日,南下資金總計淨流入73.58億港元。其中,港股通(滬)淨買入55.67億港元,港股通(深)淨買入17.91億港元。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.