港股收評:恆指收跌0.49%,光伏板塊爆發,騰訊美團再刷新高

今日港股主要指數均呈低開高走態勢,恆指午後近乎翻紅,收跌0.49%報24586點,恆生科技指數漲0.25%,大市成交額1332億港元。

數據來源:Wind

盤面上,光伏太陽能板塊表現亮眼,信義光能大漲超12%,福萊特玻璃升近10%;汽車股午後活躍,比亞迪股份一度大漲10%再創新高;風電股、物管股、家電股、內房股等多數板塊上漲;大型科技股美團收漲超6%創新高,騰訊亦再度破頂;豬肉概念股跌幅居前,保險股、電信股、濠賭股全天弱勢。

具體來看:

今日光伏股領漲大市,信義光能大漲超12%,福萊特玻璃、陽光能源、保利協鑫能源等跟漲。全球鼓勵減碳排放正推動光伏需求增長,市場看好光伏玻璃在光伏行業的前景。另外,日前工信部對全國人大代表所提光伏玻璃產能置換建議作出答覆時表示,允許合法合規開展產能置換新建光伏玻璃項目。

物管股集體走強,佳兆業漲超7%,新城悦、碧桂園、濱江服務等跟漲。中信證券近日發佈研報稱,2020年四季度龐大的物管股發行規模,直接誘發了板塊的調整;板塊的結構性分化雖然是長期的,優秀公司估值下降卻是暫時的。

汽車股漲幅居前,比亞迪盤中一度大漲10%,截至收盤迴落至5%,華晨中國、廣汽集團、雅迪控股等跟漲。

受近期業績披露影響,家電板塊走強,海信家電大漲近10%,建溢集團、海爾電器、創科實業。

電信股集體走弱,中國電信、中國聯通跌超3%,中國移動、和記電訊、香港電訊等跟跌。

保險股同樣受挫,中國人壽跌超3%,中國太保、中國平安、宏利金融等跟跌。

個股方面:

今日盤中騰訊一度大漲2%,連續第三日刷新歷史新高,收漲0.67%,報605港元,總市值達57987億港元。隨着螞蟻集團IPO認購火爆進行,螞蟻集團估值的不斷提高引發市場對騰訊金融科技價值的重估。匯豐測算,按照螞蟻估值打八折,騰訊金融科技業務價值2160億美元。麥格理則預計微信支付2022年估值可能在2640億-3460億美元。

美團早盤一度跌約1.6%,午後放量拉昇,收漲6.14%,報297.2港元,刷新歷史高點,最新總市值 17478.83億港元。最新數據顯示,2020年Q3美團及餓了麼用户規模差值逐步放大到1260.7萬,進一步鞏固了其市場主導地位。

中興通訊全天呈弱勢下跌走勢,收跌6.71%,報17.8港元,成交額4.06億港元,總市值821.19億港元。該公司28日腹部公告,前三季度實現營收741.2億元,同比增長15.39%;淨利潤27.12億元,同比下降34.3%。業績不及市場預期。

港股通方面,信義能源漲近13%,信義光能、金風科技、海信家電漲幅居前;周黑鴨跌近8%,中興通訊、中銀航空租賃、國美零售跌幅居前。

數據來源:Wind

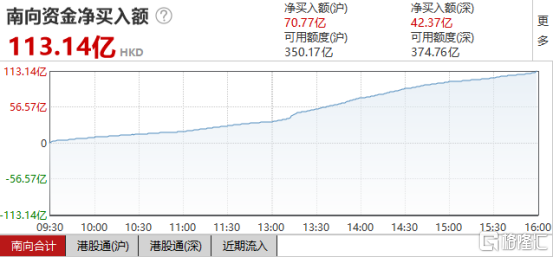

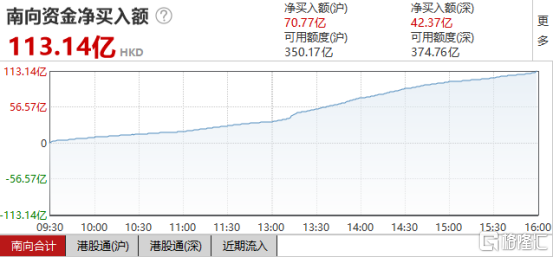

南下資金方面,今日淨流入113.14億港元,滬港通淨流入70.77億港元,深港通淨流入42.37億港元。

數據來源:Wind

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.