三季度業績超預期,匯豐控股午後直線拉昇大漲5%!

今日匯豐控股早盤小幅高開後維持震盪,午後開盤直線拉昇4%,截至發稿漲至5.4%。現報34港元,股價升至近兩個月以來最高。暫成交28.7億港元,最新總市值約7035.6億港元。

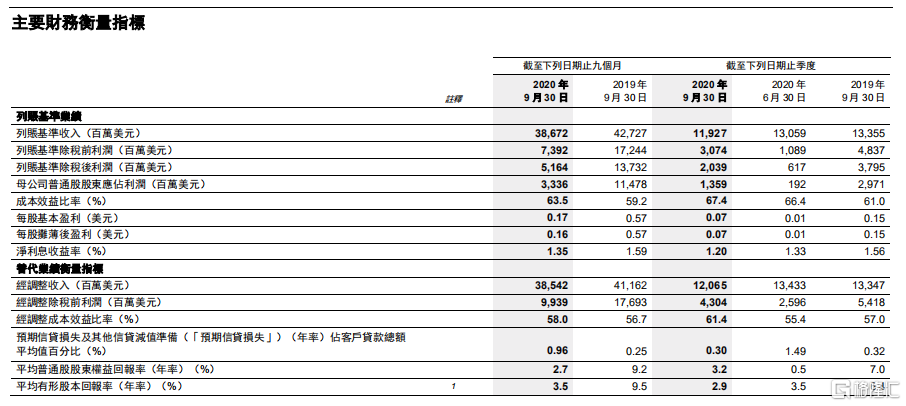

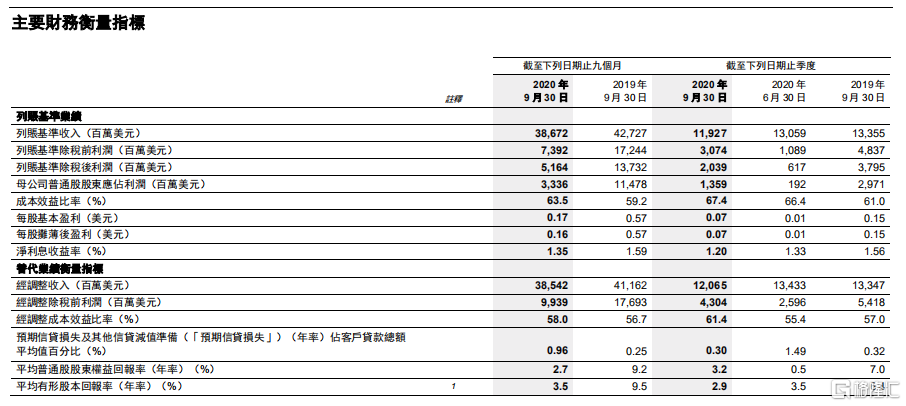

匯豐控股午後股價出現異動,主要是受中午公佈的三季度業績驅動。根據集團公佈的2020年三季度財報,匯豐控股第三季度業績超出預期。經調整除税前利潤43億美元,遠勝市場預期的28億美元;經調整營收120.7億美元,高於市場預估的118.4億美元。

從財報具體數據來看,同比2019年,匯豐控股第三季度利潤下滑46%,降至20億美元。前三季度下降62%,降至52億美元;第三季度收入下跌11%,降至119億美元;前三季度收入減少9%,降至387億美元。

收入與利潤同比下跌的原因,主要是受減息對集團各項環球業務的累進影響。同時列賬基準預期信貸損失增加56億美元,升至76億美元。

數據來源:公司財報

數據來源:公司財報

雖然同比2019年業績有所下降,但環比來看,三季度匯豐控股業績大幅改善。具體數據上,第三季歸母税後利潤13.6億美元,環比大幅增長607.8%。每股基本盈利0.07美元,環比增長600%。

環比大增的原因,在於儘管面對低息的不利因素,集團的亞洲業務仍繼續表現強韌。並且隨着第三季度封鎖措施的解除,以及寬鬆措施對企業和消費者的幫助,一些市場的經濟狀況有所改善。

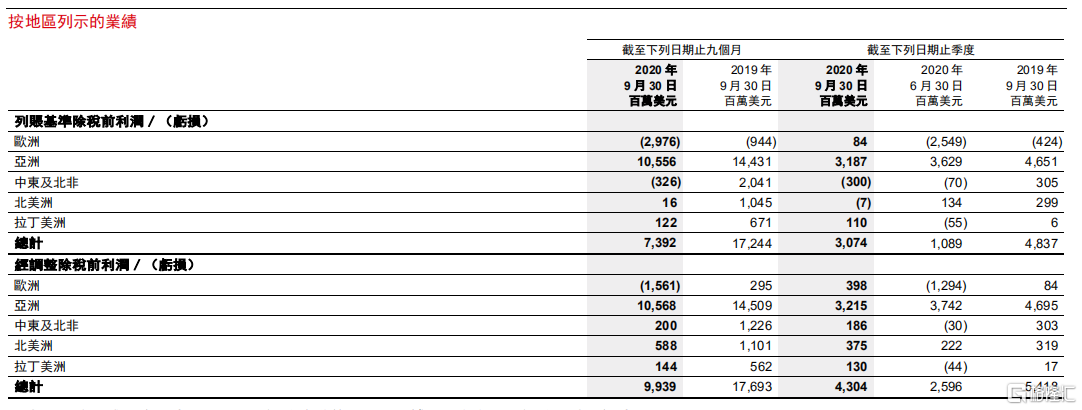

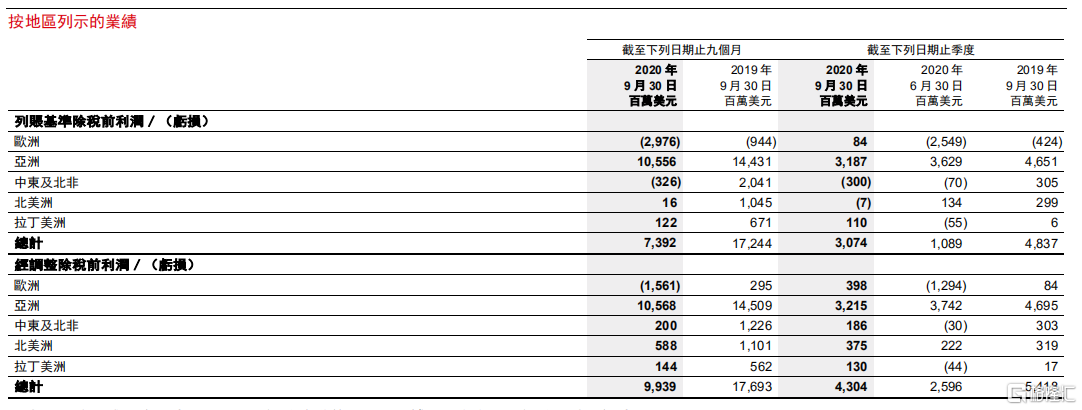

分地區來看,第三季度除亞洲市場之外,全球大部分市場均扭虧為盈。從經調整税前利潤的具體數據來看,歐洲市場約4億美元,第二季虧損近13億美元;北美洲環比增長69%至3.75億美元;中東及北非近2億美元,拉丁美洲1.3億美元。亞洲市場32億美元,環比跌14%。

數據來源:公司財報

數據來源:公司財報

總體而言,雖然受新冠病毒爆發導致利率下跌的持續影響,集團環球業務旗下存款收益有所降低。但同時壽險產品業務,及環球資本市場業務的信貸及資金估值受到有利影響,一定程度上抵消了收入的損失。

另外,第三季度集團信貸損失降低1億美元至8億美元,反映了三季度經濟前景趨於穩定。匯豐控股集團行政總裁稱第三季業績表現可喜,他還表示,如果情況允許,集團將尋求派付就2020財政年度派發一次較為保守的股息。

展望未來,匯豐控股將持續受到新冠病毒的又一輪爆發、英國退出歐盟、經濟復甦減緩,大部分金融市場央行進一步減息等風險。同時,集團應對挑戰的做法是加速調整業務模式和轉移業務重心,以適應長期低息環境;進一步削減營業支出,並計劃加大對亞洲的投資。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.

數據來源:公司財報

數據來源:公司財報  數據來源:公司財報

數據來源:公司財報