打新指南丨先聲藥業:領先的製藥公司,淡馬錫、復星醫藥入股,高瓴、清池、奧博資本爲基石

打新分析

1、招股信息

(1)簡稱及代碼: 先聲藥業,2096.HK

(2)招股日期: 10.13-10.19(受颱風影響,時間表有變動)

定價日期: 10.19

上市日期: 10.27

計息日: 4天

(3)發行價格: 12.1-13.7港元

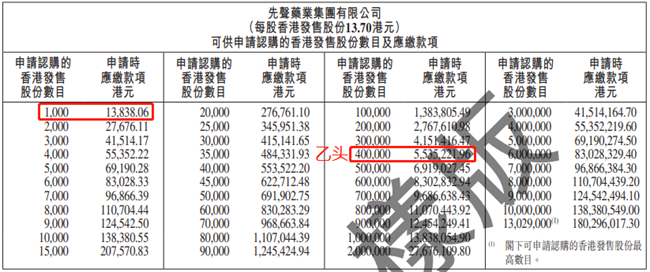

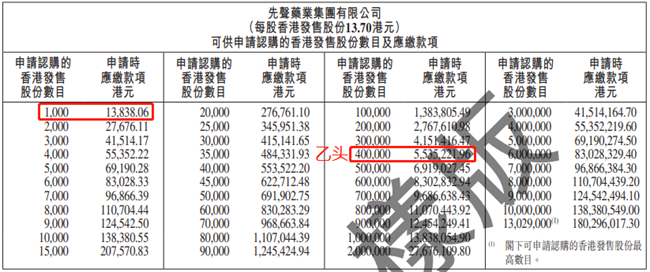

(4)入場費: 13838.06港元,乙頭需認購40萬股(400手),金額約553.5萬港元;以3.5%利率和10倍槓桿計算,融1手利息約4.8港元,乙頭利息1911港元

(5)發行股數: 2.60569億股,90%國際配售,10%公開發售,1手1000股

(6)超額配股權: 有,可按發售價發行最多3908.5萬股(佔發售股份的15%),以補足國配的超額認購

(7)集資金額: 31.5-35.7億港元

(8)市值: 315-357億港元

(9)市盈率: 2019年PE 27-31倍,公司預計2020年利潤不少於4.8億元(5.42億港元),即2020 PE 58-66倍

(10)保薦人及近兩年IPO首日表現:

摩根士丹利,20漲3跌,代表作歐康維視生物-B,首日收漲152%

中金,15漲11跌,代表作明源雲,首日收漲86%

(11)穩定價格操作人: 摩根士丹利

(12)包銷商: 摩根士丹利、中金、UBS等6家,包銷傭金2.5%+獎金最高1%

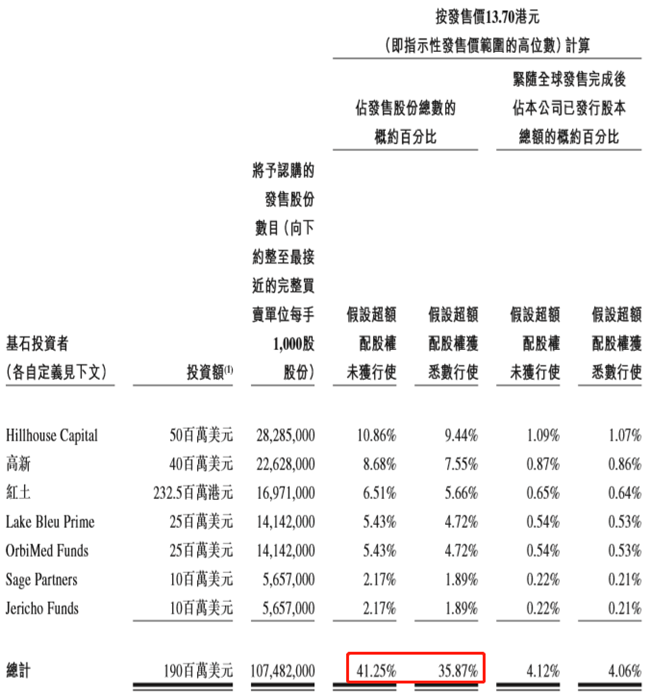

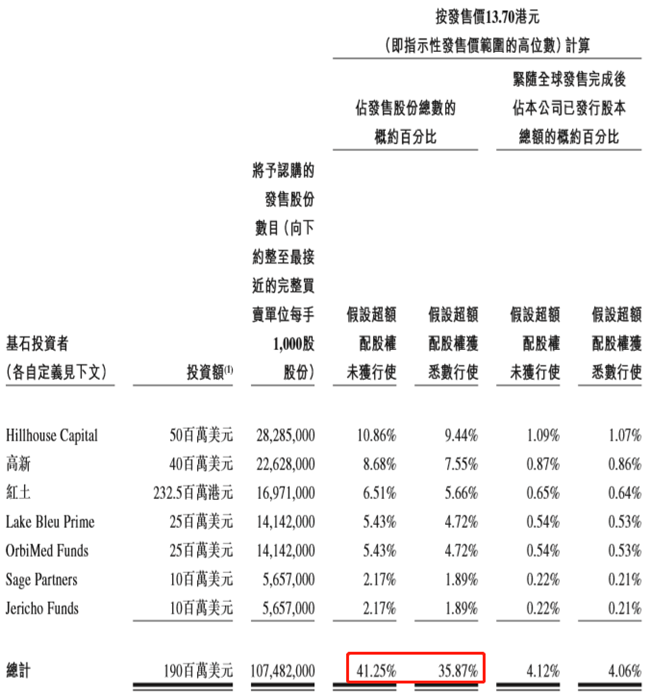

(13)基石: 7位,認購股數約佔發售股份的41.25%-46.7%,包括高瓴、清池資本、奧博資本以及深創投旗下的紅土創新,均是知名的機構投資者,近2年參與的港股IPO項目首日幾乎全部上漲,且漲幅較大,包括雲頂新耀、嘉和生物、明源雲、歐康維視等

2、回撥機制

常規回撥機制,不回撥前,甲乙組分別有1.3萬手。

當公開發售認購15-50倍時,回撥30%,即甲乙組分別有3.9萬手。

當公開發售認購50-100倍時,回撥40%,即甲乙組分別有5.2萬手。

當公開發售認購超過100倍時,回撥50%,即甲乙組分別有6.5萬手。

3、IPO前投資者

先聲藥業在IPO前共引入6位投資者,均有6個月禁售期,包括復星醫藥、淡馬錫、中信銀行。

最後一輪融資由中信銀行在2020年4月投出,每股成本1.08美元,相對於最高發售價約折價39%,對應當時公司估值180億人民幣,即210港元左右。

投資亮點

產品組合豐富,涵蓋三大治療領域

公司現有的產品組合非常豐富,超過30種產品被納入國家醫保藥品目錄,10種主要產品貢獻的收入在80%左右,包括多個No.1產品,包括恩度、艾得辛等。產品涵蓋仿製藥和創新藥,目前仍以仿製藥爲主,涉及的疾病領域主要是腫瘤、中樞神經系統和自身免疫性疾病,這三大治療領域佔整體中國醫藥市場的25%。

三款重磅產品近期已上市或臨近上市

2020年8月推出恩瑞舒、先必新。恩瑞舒是生物創新藥,用於治療中度至重度類風溼關節炎,是中國首個及唯一獲批準銷售的CTLA4-Fc融合蛋白,自身免疫性生物製劑的市場預期到2024年將達到260億元。先必新是自主研發的一類創新藥,爲腦卒中治療藥物。

此外,KN035預計今年下半年提交NDA,2021年在中國上市,這是跟康寧傑瑞製藥、思路迪合作的PD-L1單抗,用於治療晚期實體瘤,公司獲得推廣的獨家權利。PD-L1市場規模大(2020年138億元),增速快(未來5年複合增速56%)。

業績高速增長,2020年爲短暫影響

2017-2019年,收入從38.7億元增加到50.4億元,年複合增長率14%。淨利潤從3.5億元增加到10億元,年複合增長率69%。毛利率超過80%。

今年上半年收入同比下降20%,淨利潤減少60%,主要受到疫情、醫保目錄變更、集中採購、上市開支以及研發激增的影響。未來隨着在研產品進入收穫期,業績有望回升。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.