"金九"车市:乘用车零售同比增7.3%,新能源车批发销量近翻倍

来源:中新经纬客户端

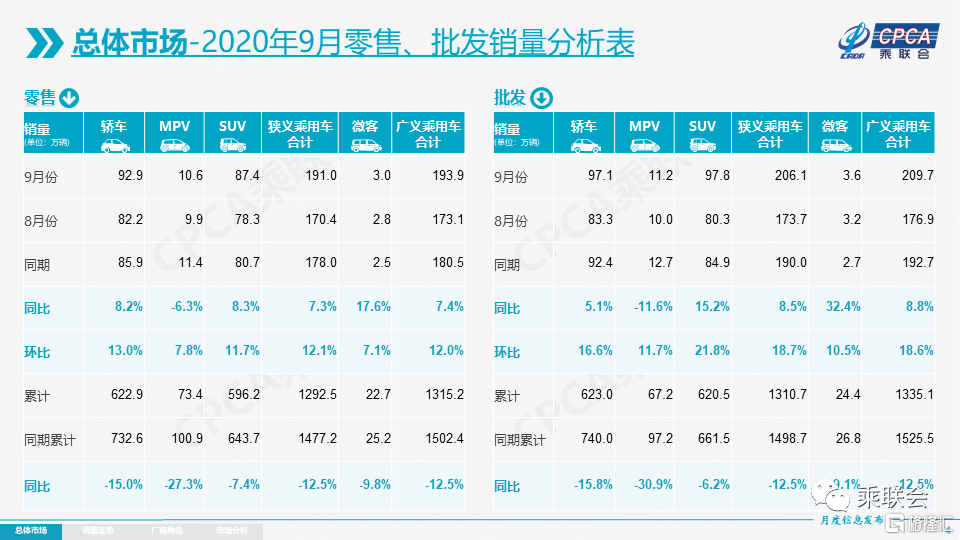

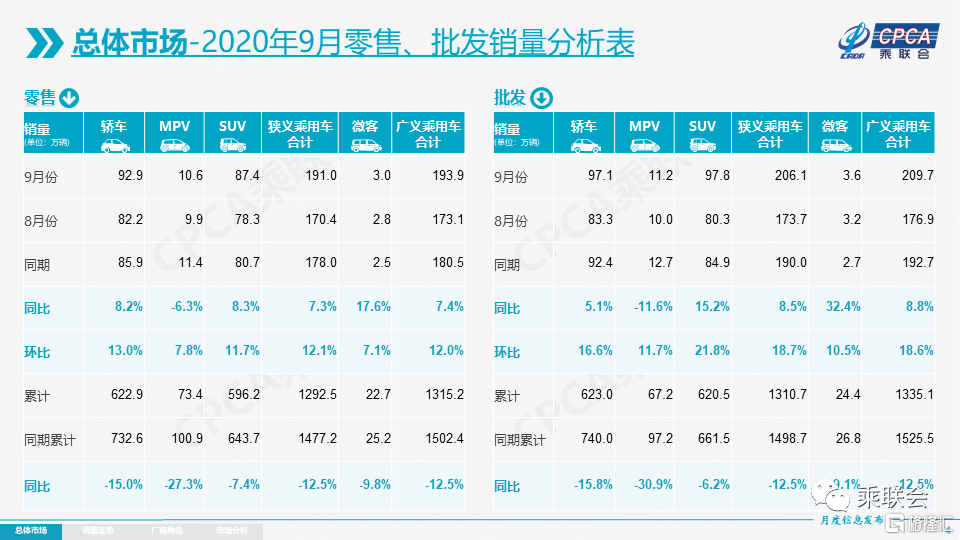

据乘联会官方微信号13日消息,9月乘用车市场零售达到191.0万辆,同比去年9月增长7.3%,其中9月新能源乘用车批发销量突破12.5万辆,同比增长99.6%,环比8月增长24.1%。

来源:乘用车市场信息联席会官方微信

乘联会公布的数据显示,9月乘用车市场零售达到191.0万辆,同比去年9月增长7.3%,实现了连续3个月8%左右的近两年最高增速。今年1-9月的零售累计增速-12.5%,较1-8月累计增速-15.2提升3个百分点,体现行业的快速回暖态势。

1-9月,全国乘用车市场累计零售1292.5万辆,零售同比累计下降12.5%,今年累计销量同比下降184.7万辆,约占去年零售总量9个百分点。今年零售下降主要是受到春节偏早和疫情因素对一季度影响208万辆,二季度零售同比损失只有17万辆,三季度的7-9月出现增量38万辆。

数据还显示,9月新能源乘用车批发销量突破12.5万辆,同比增长99.6%,环比8月增长24.1%。其中插电混动销量2.2万辆,同比增长55%。纯电动的批发销量10.2万辆,同比增长105%。9月电动车高低两端强势增长趋势明显,其中A00级销量3.25万,份额提升到纯电动的32%。9月新能源车市多元化发力,上汽通用五菱24386辆、比亚迪19048辆、特斯拉中国11329辆,分列新能源三强,蔚来、小鹏、威马、合众、零跑等新势力车企很优秀。广汽新能源等也高增长,大集团新能源表现分化加剧。9月普通混合动力乘用车批发3.37万辆,同比去年9月增长17%。今年全国乘用车市场7-9月增速保持强势态势。

乘联社分析指出,7-9月增速保持强势态势主要受以下因素影响:首先是宏观经济和出口市场超预期的回暖,尤其是欧美疫情背景下的中国出口表现较强,稳定了消费信心。其次是去年部分地区7月国六实施后导致的车市低基数的特殊因素促进。第三是新能源车零售的翻倍回暖态势明显,推动车市走强。

乘联社表示,考虑到今年中秋后移到10月,9月环比8月的零售增长12.1%,这相对历年的平均环比增速15%并不高,主要也是成都车展带动的秋季购车潮启动早,北京车展引发的新品等待现象并不明显,9月车市保持较强的火爆增长气氛。世界疫情背景下的开学季前的购车需求属于刚性的安全出行需求,因此9月的双节前消费需求难抵开学季拉动。

展望10月,乘联社指出,10月有17个工作日,较19年10月少两个工作日,因此车市销量增长压力相对较大。

乘联会认为,近期国外部分地区疫情出现二次暴发现象,但国内经济平稳可控,居民消费信心进一步恢复,因此对车市回暖还是有更大期待的。今年北京车展集客和拉升人气效果较好,接触到的部分经销商和用户的心态很好,也预示着今年中国四季度车市持续走强的美好前景。

新能源产品方面,伴随着北京增加放号2万张和电动车新品性能普遍增强,插混车的性价比持续提升,预计四季度国内新能源车市将迎来全面发力的增长期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.