蘋果一夜暴漲8600億!A股概念也嗨了!發佈會在即拉高預期

隔夜美股三大股指全線收漲,其中,在科技股的帶動之下,納指創9月9日以來最大單日漲幅。

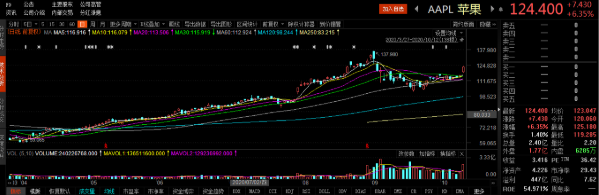

尤其是蘋果,截止收盤,股價收於124.40美元,漲6.35%,創7月31日以來最大漲幅,最新總市值為21276億美元,這一漲幅也使得蘋果領漲FAANMG六大科技龍頭。

今年以來,其股價累計漲幅超過70%。

數據來源:Choice

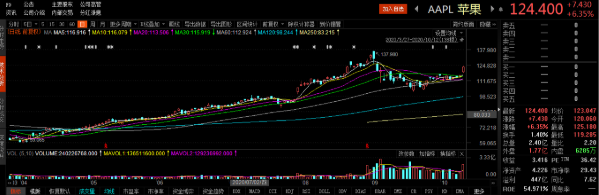

受此影響,A股市場蘋果概念股普遍活躍,其中,世紀鼎利漲超20%,錦富科技、欣旺達、賽騰股份等跟漲。

數據來源:Choice

這一上漲趨勢主要是基於市場對蘋果即將舉行新品發佈會的樂觀預期(北京時間14日凌晨1點),畢竟這將是蘋果首次發佈支持5G網絡手機的首秀,意義較為重大。

圖片來源:官網

天風國際指出,蘋果本次將發佈的新機包含了:iPhone 12 mini (5.4吋)、iPhone 12、iPhone 12 Pro (6.1吋三鏡頭) 與iPhone 12 Pro Max (6.7吋) ,而它們的出貨比重分別為20–25%、40–45%、15–20%與15–20%。

其中,郭明錤給出了有關iPhone 12售價三種情景的推演:

1、若iPhone 12的售價低於iPhone 11 (起始價699美元),則我們預測iPhone新機發佈會後供應鏈股價將持續上漲。

2、若iPhone 12的售價較iPhone 11高0–100美元,則我們預測iPhone新機發佈會後,部分投資人可能先行獲利了結,更多投資人將採取觀望態度並等待預購結果。

3、若iPhone 12的售價較iPhone 11高100美元以上,則我們預測iPhone新機發佈會後供應鏈股價將會修正。

摩根士丹利分析師Katy Huberty預計,金秋的iPhone發佈會將是多年來最重要的一次。根據模型,Huberty預計蘋果在2021財年的iPhone出貨量將達到2.2億台左右,同比增長22%。

華泰證券認為,新款iPhone作為蘋果首款5G終端,有望成為果粉5G換機週期起點;在中美貿易摩擦的背景下,iPhone銷量和全球份額有望快速提升,進而帶動蘋果生態產品銷售增長。在新品發佈及備貨啟動之際,繼續強調蘋果產業鏈龍頭公司的投資機遇。

國信證券指出,隨着iPhone定價更加親民,競爭對手的高端品牌銷量下滑,iPhone手機銷量有望扭轉此前三年的下滑重回上升軌道。5G創新推動供應鏈量價齊升。產業鏈龍頭公司大部分屬於資本密集型、人工密集型製造業,景氣週期帶動產能利用率大幅提升,標的公司業績有望超預期。

要知道5G的到來使得全球智能手機行業有望緊握重大歷史機遇,促使其加速轉型升級,進而打破此前的成長天花板。而本次新iPhone的發佈或會為蘋果帶來較為強勁的升級週期,促使更多的用户更新iPhone,從而推動iPhone出貨量的增長,以帶動新一波的購買浪潮。

“此輪換機週期將是一個“超級週期”,可能會促使更多消費者做出購買新機的決定,因為在新冠肺炎大流行期間,包括手機在內的智能設備的重要性更加顯現出來。因此,蘋果新機發布對消費者和整個行業都將至關重要。”——獨立分析師Wayne Lam

對此,Wedbush維持對蘋果的“跑贏大盤”評級,目標價為150美元,預計牛市情況下可達175美元。

RBC將其對蘋果目標價由111美元上調至132美元,維持“跑贏大盤”評級,理由是即將到來的iPhone週期和新發布的健身訂閲服務“Apple Fitness +”。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.