港股收評:恆指收跌0.31%,光伏概念全面回撤

今日恆指高開低走,午後持續下行。截至收盤,恆指跌0.31%報24119點,近5日累計上漲2.81%;科技指數跌0.1%報7503點,近5日累計漲幅5.86%,是8月底以來表現最好的一週。大市成交額1125億港元。

數據來源:Wind

盤面上,前期強勢的熱點題材股均熄火,光伏、風電板塊全線回落,信義光能、福萊特玻璃均大跌超10%,昨日曾齊創新高;消費電子、餐飲股、電池股等全天走低,航空股尾盤跌幅擴大,東航一度大跌5%;醫療保健設備股、煤炭股、SaaS概念股、黃金股表現較強,傳媒、汽車製造板塊午後走強。

具體來看:

黃金週期間大幅走高的港股光伏股今日全線回調,卡姆丹克太陽能、信義光能跌超10%,保利協鑫、北控清潔、陽光能源等跟跌。近期光伏股的飆升,主要由於產業需求回暖致產品漲價,以及市場對十四五規劃的政策憧憬。經過近期的持續走高後,短期內或已積聚了一定的獲利盤,調整概率加大。

消費電子板塊跌幅居前,TCL電子大跌17.24%,此前3日累計漲36%,中木國際、創維集團、信佳國際等跟跌。

餐飲股走弱,高門集團跌超20%,百福控股、海底撈、千盛集團等跟跌。

香港航空股低開低走,午後跌幅擴大,東航一度跌近5%,最後收跌3.14%,南航、美蘭空港、中國國航紛紛走低。

今日醫療保健設備走強,微創醫療漲5.67%,愛康醫療、官醖控股、威高股份等跟漲。

煤炭股漲幅居前,兗州煤業、伊泰煤炭漲超4%,中國神華、易大宗、中煤能源跟漲。

內蒙古自治區價格監測中心顯示,三季度以來,內蒙古全區動力煤坑口結算價格持續上漲,9月份動力煤價格攀升至235元/噸左右,同比上漲9.36%,接近三年來的最高值。業內人士分析指出,目前煤炭價格已經接近三年來最高值,在進口煤和市場調節機制的影響下,價格上漲空間恐有限。

網易今日高開高走,收漲3.21%,報138.2港元,總市值4775億港元。大和發最新研報指,網易將於11月公佈第三季度業績,預計第三季手機遊戲收入同比升29.4%至106億元人民幣,推出的新遊戲業務也將令收入增長,預計總遊戲收入同比升24%至143億元。該行重申其“買入”評級,將目標價由180港元下調至172港元,但較現價仍有24%的上升空間。

恆指成分股中,交通銀行、吉利汽車、恆生銀行漲幅居前;瑞聲科技、舜宇光學科技、金沙中國跌幅居前。

數據來源:Wind

港股通方面,首控集團大漲近37%,中國利郎、浙江世寶、第一拖拉機股份漲幅居前;中國高速傳動大跌22.6%,TCL電子、信義能源、信義光能跌幅居前。

數據來源:Wind

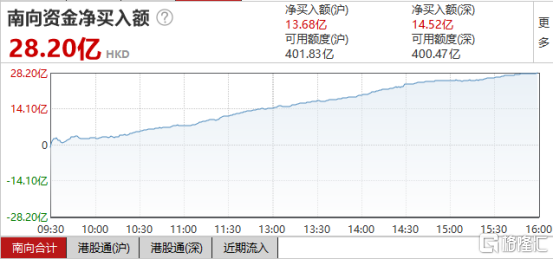

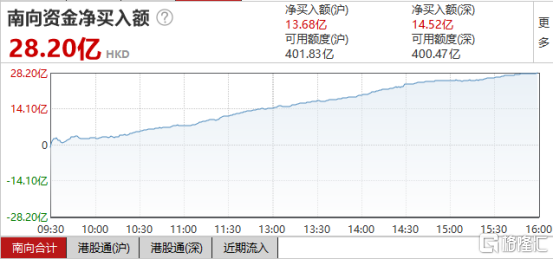

南下資金方面,今日淨流入28.2億港元,滬港通淨流入13.68億港元,深港通淨流入14.52億港元。

數據來源:Wind

招銀國際表示,展望未來一個月,市場有三大焦點:1) 衞生事件會否於歐美等主要地區惡化;2) 美國11月3日的總統大選;3) 中共五中全會於10月26-29日舉行。預期衞生事件及美國選舉將帶來不明朗因素,因此建議暫避最敏感的行業。五中全會則有利受國策支持的板塊如消費股及潔淨能源股。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.