傳媒行業深度報告:Q4電商掘金季,積極擁抱行業大趨勢投資機會,維持“優大於勢”行業評級

機構:東北證券

評級:優大於勢

報告摘要:

上半年電商/直播電商大盤迴顧:(1)後疫情時代用户線上購物習慣培養,行業景氣度不斷回升;網上商品和服務零售額同比+9.5%,線上消費滲透率8月達到25%,各類商品銷售額提速,行業趨勢向好;(2)直播電商基礎設施不斷完善,GMV實現快速增長;快手直播日活用户已突破1.7億+,電商日活突破1億,8月總訂單量超5億單躍居電商第四極,商業變現充分驗證;

Q4行業動態頻繁,重點關注:(1)“雙11”全年大促高潮,多元玩法貢獻核心增長;“雙11”作為全年核心大促地位不可動搖;今年各大平台“雙預售制”和“短視頻+直播”等玩法的推出,有望不斷提升消費者購物體驗,形成“短視頻種草,直播間收割”內容流量轉化閉環,對用户規模、交易規模都帶來更強信心;我們預測今年“雙11”總體成交額仍將保持26%-32%左右增長,對應5,178-5,411億元;

(2)直播電商交易閉環大趨勢下,服務商價值凸顯;近期抖音/快手小店政策加速平台電商生態構建,直播電商服務商從“人-貨-場”多維度高效賦能品牌和消費者鏈接,將充分享受直播電商平台發展紅利,並持續輸出核心服務價值,對應近1,500億元廣闊市場空間;

(3)“電商+內容”大趨勢,視頻內容貢獻用户活躍和變現增量;隨着近期手淘改版全面推進短視頻內容、小紅書上線視頻號、值得買平台升級短視頻/直播內容、芒果超媒發力“小芒電商”等舉措,我們認為“視頻+內容+電商”會逐漸成為各大平台標配,借力視頻內容帶動平台用户粘性和轉化提升,帶來商業變現新增長極;

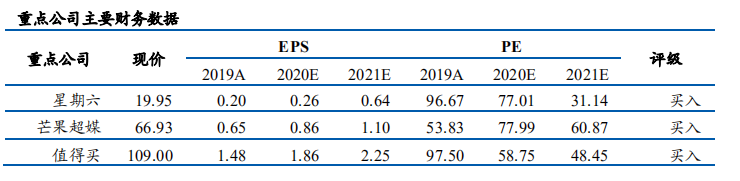

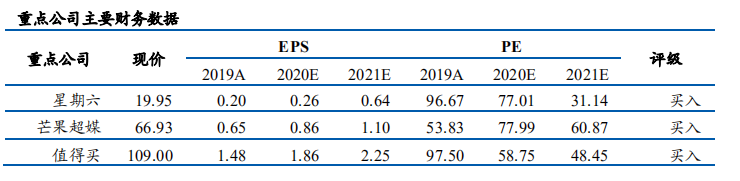

投資建議:Q4行業高景氣度,“雙11”大促新玩法驅動,電商平台有望迎來成長新動能,相關標的有【阿里巴巴、京東、拼多多】等;隨着直播電商高速發展及抖快服務商生態體系壯大,直播電商產業鏈參與者將全面受益,直播電商和MCN相關標的有【星期六、中廣天擇、元隆雅圖】等;短視頻內容賦能,提振平台活躍度和交易量顯著,推薦關注發力短視頻內容升級的導購電商平台【值得買】和發力“小芒電商”的【芒果超媒】;同時關注電商/直播電商服務及營銷細分賽道,相關標的有【中國有贊、微盟、藍色光標】等。

風險提示:宏觀經濟變化風險、政策監管變化風險、銷售不達預期風險、消費者消費意願不達預期風險。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.