機構:浙商證券

評級:買入

投資要點

銷量穩健增長,瓦楞紙、灰底白板銷量表現靚麗

報告期內,公司造紙業務實現銷售額511.66億元(-5.9%),銷量1530萬噸(+8.5%);紙漿業務銷售額1.75億元(-23.3%)。細分紙種來看,(1)包裝紙:期內實現收入445.19億(-5.09%),銷量1434萬噸(+1.73%),單價3103.7元/噸(-6.78%);其中牛卡紙、瓦楞紙、灰底白板銷量分別為737、396、280萬噸,同比+6%、+16%、+15%,佔包裝營收佔比分別為46.4%、21.7%、18.6%;瓦楞紙、灰底白板銷量表現靚麗。(2)文化紙:期內實現收入57.80億(-10.8%),銷量102萬噸(-8.0%),單價5674.48元/噸(-3.1%)。(3)特種紙:期內實現收入8.67億元(-12.85%),佔總營收比例1.69%。

疫情下單噸盈利承壓,看好下半年景氣提升

(1)上半年疫情&春節影響公司生產經營,銷量為680萬噸,環比減少170萬噸;價格方面前期由於復工後廢紙脈衝供給產業鏈價格集體下調,箱板紙較3月高點4577元/噸下降至5月3777元/噸,對應公司剔除匯兑損益後的噸淨利僅為221元/噸,環比下降22.1%。(2)下半年下游需求復甦疊加原材料限制,預期箱板紙價格向上。伴隨下游需求有所修復疊加原材料限制(前11批外廢配額合計594.31萬噸,較去年同期減少480.88萬噸,帶動國廢價格自4月初1785元/噸上升至目前2180元/噸),本週箱板紙、瓦楞紙價格4510、3658元/噸,基本持平,較5月初低點上漲750元/噸、550元/噸。預期箱板紙傳統旺季將至,渠道庫存持續消化(8月社會庫存136.1萬噸,較6月下降9.5%;龍頭企業),此外白卡、白板持續提價拉開與箱板紙價差,預期箱板紙價格穩定向上,利好公司盈利釋放。

人民幣進入升值週期,玖龍顯著受益

近期美元兑人民幣匯率持續抬升,目前為6.8238,較5月底升值4.9%,且預期人民幣尚處於升值通道之中。由於人民幣匯率波動影響木漿、廢紙採購成本,以及美元營運資本、美元債務等經營數據,因此對於進口型的造紙板塊較為利好。由於玖龍紙業外廢採購量相對較大、且美元借款佔比較高顯著受益。根據我們詳細測算,人民幣匯率升值1%,對應玖龍紙業提升淨利潤58.95百萬元,參考2020財年淨利潤,對應提升淨利潤提升1.4%。

漿紙產能有序擴張,逐步推進產業鏈一體化

報告期內泉州35萬噸、瀋陽60萬噸包裝紙、馬來西亞再生漿投產;截止20H1公司合計擁有紙、漿產能1732萬噸,其中紙1647萬噸、漿85萬噸(海外15萬噸木漿、70萬噸再生漿)。(1)紙:20H2計劃河北、東莞共計110萬噸箱板紙產能投產,22Q2馬來西亞55萬噸包裝紙投產,2022Q3湖北漿紙基地新增120萬噸包裝紙產能,預期2022年底合計造紙產能達1932萬噸。(2)漿:於湖北荊州籌備首個漿紙一體化項目,其中包括60萬噸木漿產能;計劃擴張瀋陽60萬噸木漿產能;預計2022年底漿產能超200萬噸。此外於19年9月公司收購包裝廠延伸至下游產業鏈,總設計年產能為10億平方米,對公司擴大業務量、提升受益帶來多方協同效益。

毛利率小幅上行,費用管控良好

報告期內毛利率同比增長2.14pct至17.58%,其中20H1公司毛利率同比增長2.45pct至17.77%,主要系期內原材料廢紙價格跌幅大於原紙價格。期間費用率合計8.01%(+0.31pct),其中銷售費用率3.05%(+0.2pct);管理費用率3.62%(+0.51pct);財務費用率1.34%(-0.4pct)。綜合來看,報告期內公司歸母淨利率為8.14%(+0.20pct),20H1歸母淨利率由去年同期6.56%上行至8.18%。

負債率持續下滑,經營現金流表現靚麗

期末公司資產負債率為48.57%,較去年同期下滑1.81pct。期末公司應收賬款合計45.97億元,較期初增加6.13億元,應收賬款週轉天數30.08天同比減少2.8天;賬上存貨52.46億元,較期初增加6.13億元,存貨週轉天數同比減少1.03天至54.68天,預計系20H1銷量較低相關;賬上應付賬款及票據54.73億元,較期初減少1.13億元。期內公司經營性現金流量淨額89.49億元(+3.61%),表現優異。

盈利預測

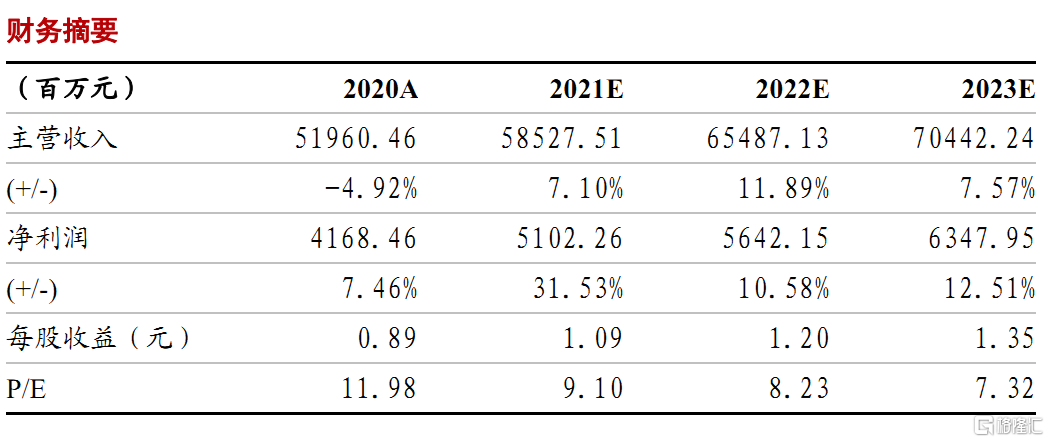

預計公司21-23財年實現營業收入585.3/654.9/704.4億元(+7.1%/+11.9%/+7.6%),歸母淨利51.0/56.4/63.5億元(+31.5%/+10.6%/+12.5%),對應PE為9.1X/8.2X/7.3X,考慮到公司盈利具有較大的向上彈性且目前估值顯著偏低,給予“買入”評級。

風險提示

原材料價格大幅波動,競爭加劇,二次疫情