为什么说5G板块的拐点就在眼前?

来源:脱水研报

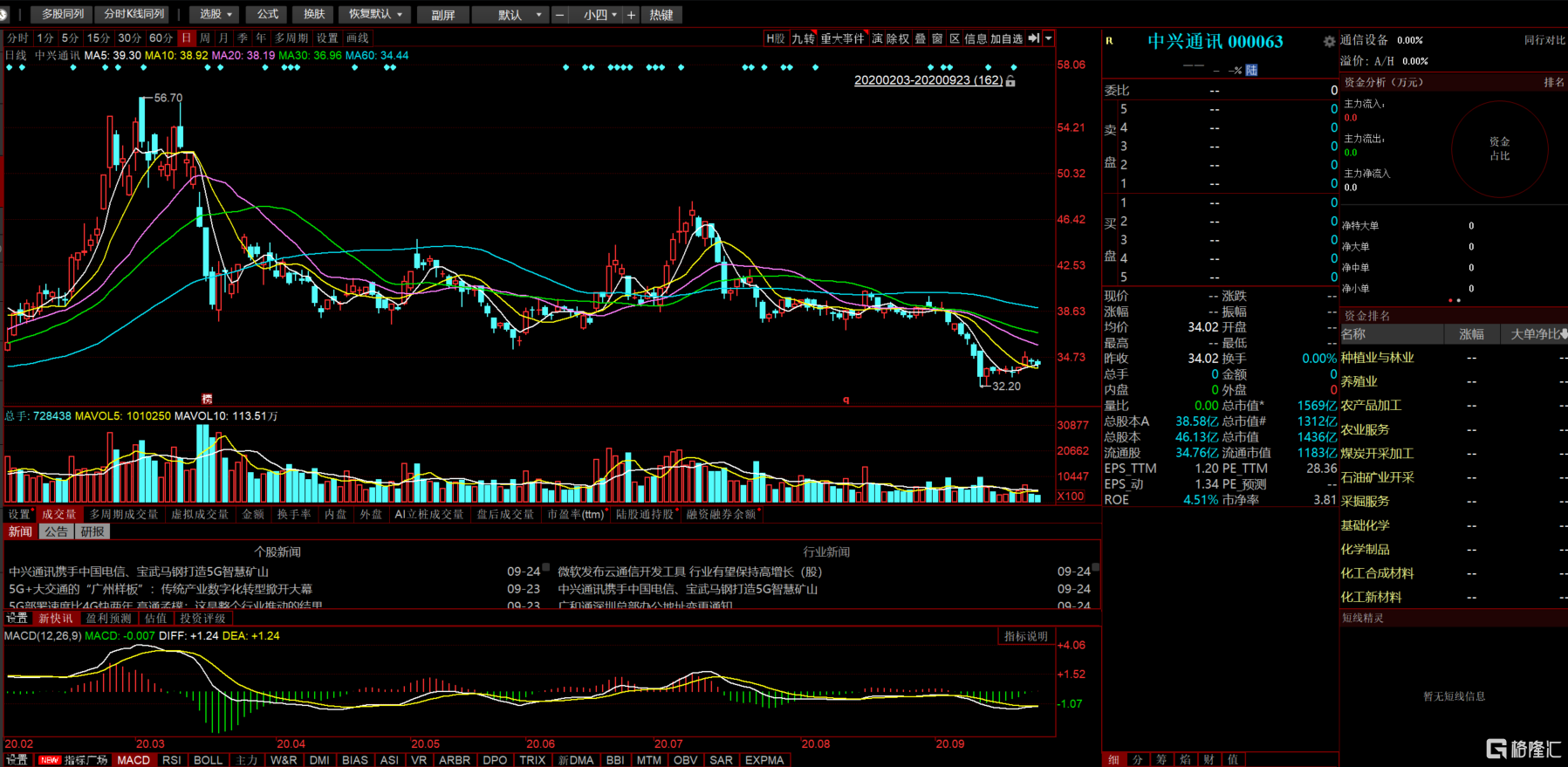

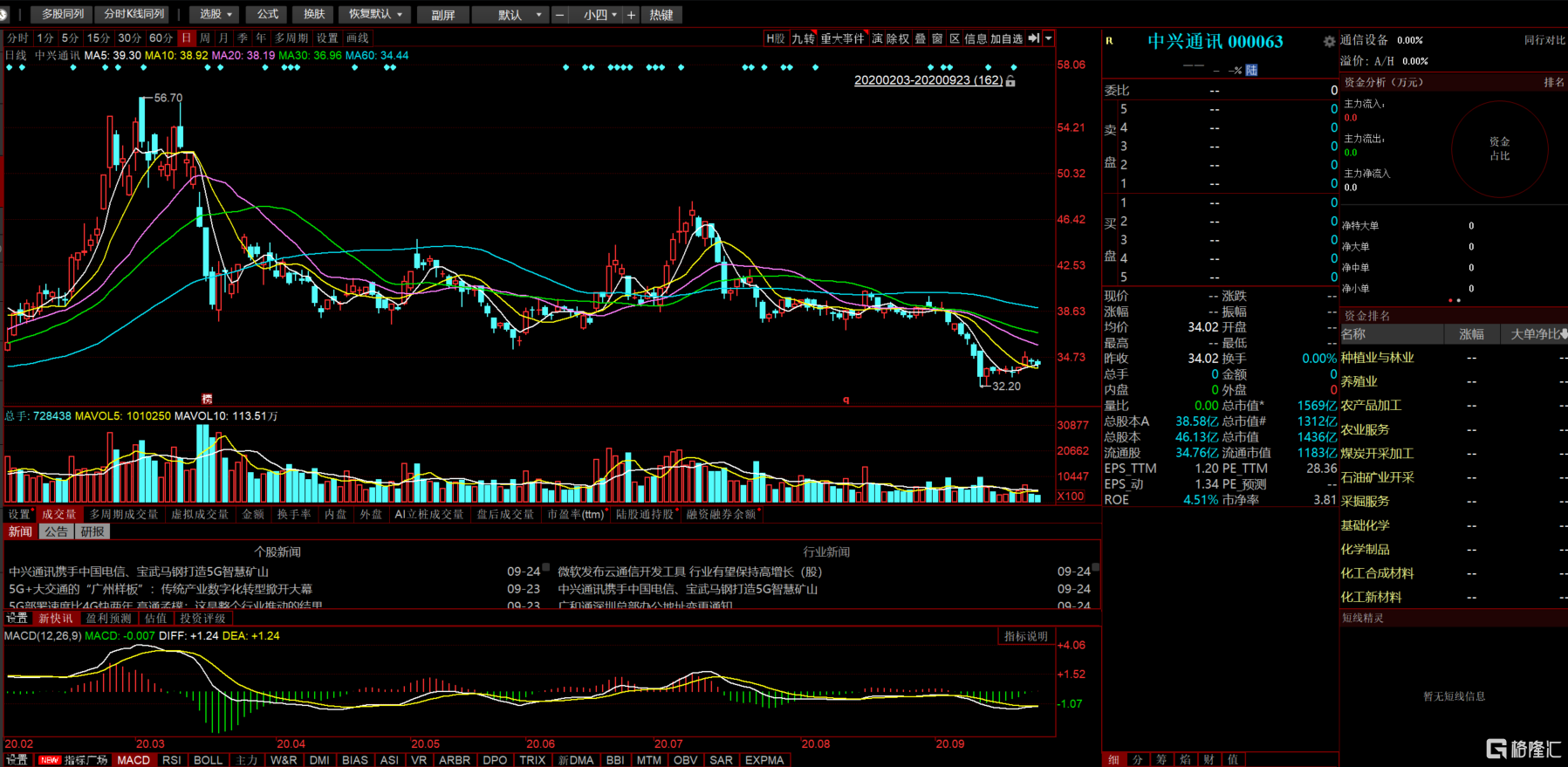

今年以来,5G板块几乎没有什么表现机会,以中兴通讯为首的5G基建股在不断的震荡中迎来了阶段新低。

中兴的股价从高点56.5回调到目前34左右,半年时间跌幅达到40%。发生了什么?

不仅中兴,其他5G基建股也是一个样子。

1、行业面临艰难时刻

据《日经亚洲评论》报道,有消息人士透露,在美国本周对华为等实体采取管制措施之前,由于第二轮制裁9月生效在即,中国最大的两家电信设备供应商华为技术有限公司(Huawei Technologies)和中兴通讯(ZTE)已经放缓了5G基站的安装速度,并分别在6月通知了部分供应商要放慢特定产品的出货,以便于两家公司改用零部件或重新设计产品以尽可能多地去除美国元件。

中兴供应商的高管表示:“我们的客户6月时告知我们放慢出货,而且几乎在7月停止出货。我们的产品须再度经过产品验证测试,因这位客户已大幅变更设计,我们不清楚这位客户何时才会要求恢复正常供货。”

为中兴供应散热模组的泰硕周四也给出了类似言论。报道称,由于美禁令加速了中兴“去美化”,因此,泰硕与中兴共同开发的基站AAU也需重新设计,且自8月开始中兴相关产品出货全面停摆

此前有券商研报称,在美国针对华为采取禁令不断升级之际,电信运营商对采购华为设备持观望态度,导致中国和全球的5G基站建设进程拖后。且由于运营商资本开支有限,预计电信运营商将进一步削减5G基站建设成本,今年第三季度开始中国5G部署或面临停滞。

从相关个股的走势上可以明显看出,三季度开始5G概念股确实处于不断走低的过程中。

不仅仅是基站需求下滑,供应链也祸不单行。

今年5G基站天线的大部分PCB结构将从四层改为双层,单个基站天线用PCB价值量从2019年的5000元降至2020年的1229元。与此同时,进一步的降本需求可能导致PPO(聚苯醚)材料更换为PTFE(聚四氟乙烯)。因后者技术壁垒相比较低,认为生益科技将逐渐失去在PCB领域的优势。另外因附带价值较低,CCL应用于5G基站PA板的上行空间有限。

至于用于载频板的PPO,预计已在此领域实现突破的台湾厂商有望从松下手中抢走部分市场份额,而生益科技在技术方面仍然处于落后水平,要进入市场则面临更多挑战。

2、曙光初现

在5G板块情绪陷入冰点之际,转折点正在悄悄酝酿之中。

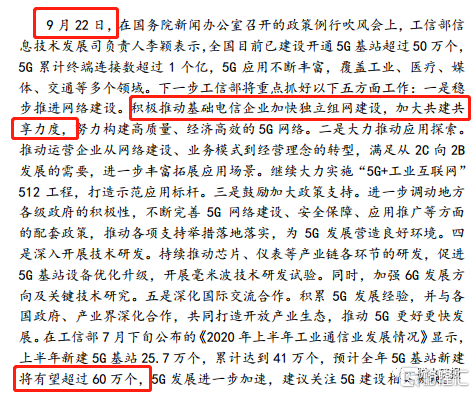

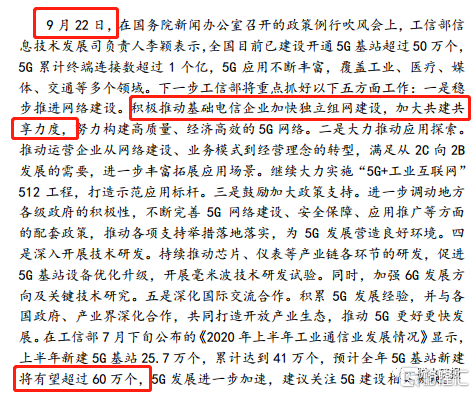

昨天工信部在例行吹风会上谈到5G行业,把加大网络建设力度放在了重点工作的第一条,东方财富分析师预计,今年的全年的基站建设数量将超过预定的目标60万个。

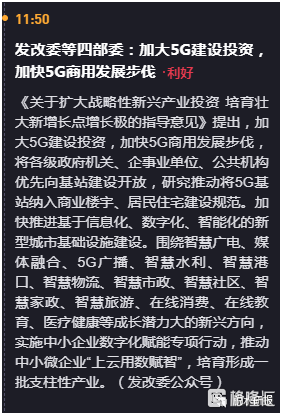

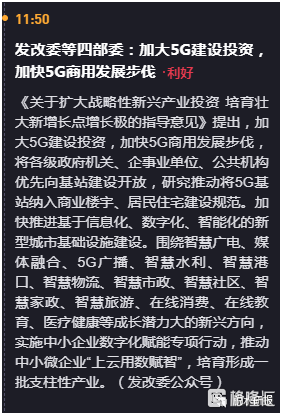

紧接着,今天国家发改委也发布了《关于扩大战略性新兴产业投资培育壮大新增长点增长极的指导意见》。里面明确提出,加大5G建设投资,放在了第一条最重要的位置,5G建设进度即将迎来曙光。

政策力量的介入有望令上游的需求复苏,届时整个5G板块将会被重新激活。

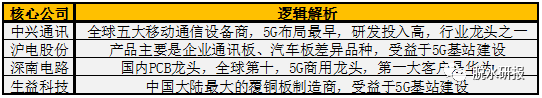

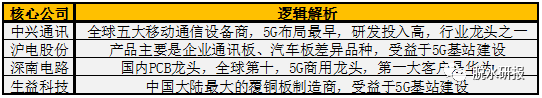

3、一图看懂5G基站建设加速受益公司

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.