全线暴跌2天!受欧洲疫情反复影响,航空股持续走弱

今日,航空股再续昨日颓势,全线下跌,且跌幅普遍超过昨日。

A股方面,吉祥航空收跌8%。三大航空公司:国航、南航、东航全部跌逾5%。

港股方面,截至发稿,国航以超6.5%的幅度领跌航空服务板块,南航、东航跌幅都在5%左右;海南免税概念股美兰空港跌逾2.3%。

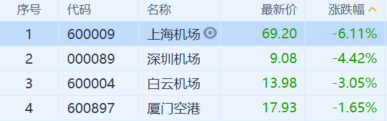

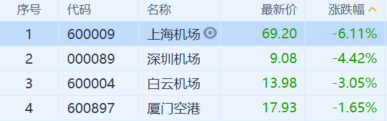

除航空股外,A股民航机场也严重受挫。截至收盘,上海机场跌逾6%,深圳机场跌近4.5%,白云机场、厦门空港分别跌逾3%和1.6%。

由于二季度以来,中国国内疫情基本得到控制,国内航空运输量逐月恢复,加之“黄金周”将近,业界乐观估计在9月下旬或国庆节前后,国内运量可能恢复到上年同期水平。

因此航空股在近2个月中都有不小的反弹,尤其是在9月的前三周(9月1日至18日),三大航空公司平均涨幅近11%。

但是航空公司并未迎来“柳暗花明”,近几日欧洲多国确诊人数持续增加,已经出现了第二波的疫情反复。

据有关部门通报,东方航空9月9日马尼拉至上海航班核酸检测出8例阳性旅客,因此根据《民航法》对东方航空再次实施航班熔断措施。即自9月28日起,暂停东方航空该航线运行1周,且通断航班量不得用于公司其他航线。

在第二波疫情已出现的情况下,中国仍面临输入风险,因此此前对航空运输量稳步回升的估计可能过于乐观。

今年下半年以及明年上半年国内航空公司的运量能否实现反弹依旧将由国际疫情形势决定。同时,运量能否恢复也是航空公司能否减亏或实现盈利的关键。

另一方面,航空运输的业绩也会随着油价变动呈现高弹性。航空公司在正常运营的情况下,燃油成本大概在30%-40%。由于上半年运输量呈断崖式下降,油价的暴跌并没有明显的对航空公司业绩带来改善。

不过目前油价仍处于低位,如果航空公司的运输量稳步回升,尽快恢复正常水平,低油价对航空公司业绩提振的作用将凸显出来。

除运输量、油价以外,近期人民币对美元升值也是此前业界普遍看好航空业的理由之一。由于航空公司的有息负债中,有不少是美元负债,因此人民币升值将使各大航空公司的财务费用有不同程度的减少。

摩根士丹利此前正是将内地航空运输复苏快于预期、油价下降、人民币升值等因素综合考虑之后,同时上调了国航、东航和南航三大航空公司A股和H股的目标价。

但是根据目前欧洲疫情反复的情况来看,欧洲各国可能会再次采取严格的反控措施,不排除限制外出的可能。因此,国内航空公司的国际航线旅客规模将在低位停留的时间或比此前预期的要长。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.