8月淨利環比下滑超50%,券商股午後突然直線攀升近4%

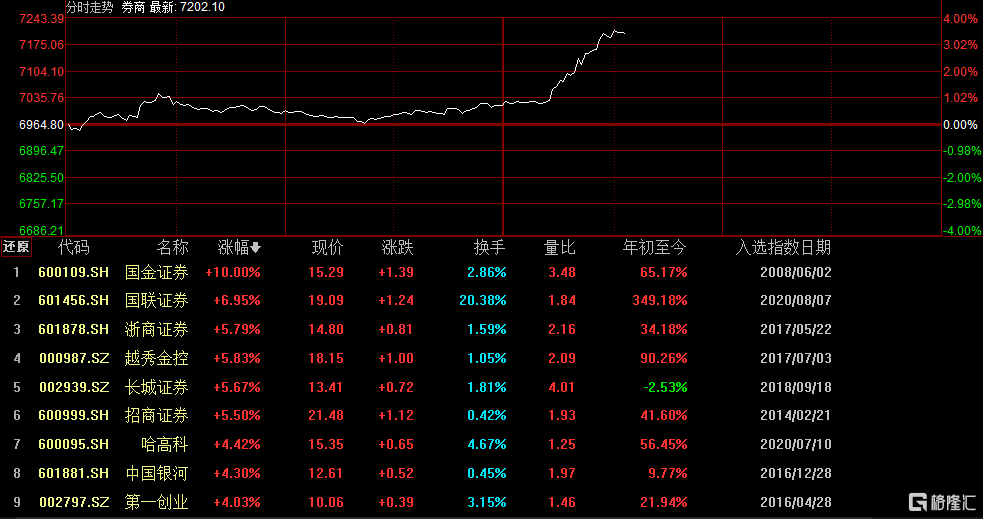

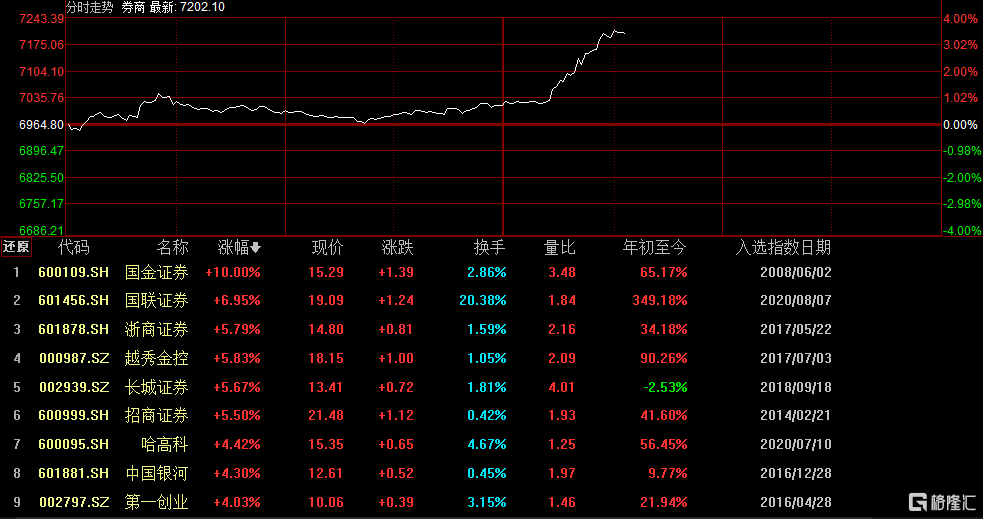

今日,券商板塊小幅低開後震盪上行,午後突然大幅直線拉昇,一度上漲近4%,40餘隻成分股全線飄紅。其中,國金證券漲停,國聯證券漲近7%,浙商證券、越秀金控、長城證券、招商證券漲逾5%;哈高科、中國銀河、第一創業等跟漲。

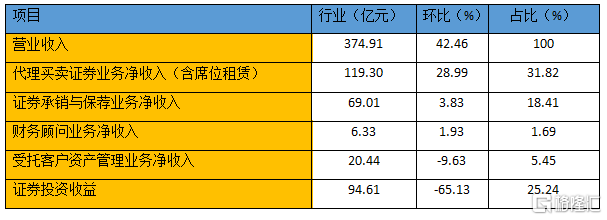

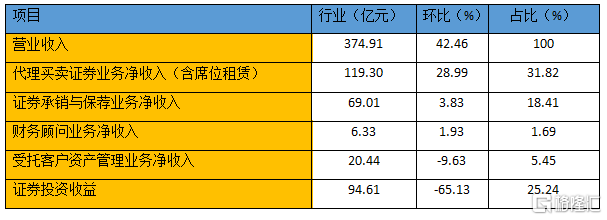

消息面上,中證協近日披露了券商8月業績。數據顯示,證券業當月實現營業收入約375億元,環比下滑42.4%;淨利潤約140億元,環比下跌52.7%。另外,8月行業平均淨利潤近1億元,僅為行業淨利潤最高額的10%左右。

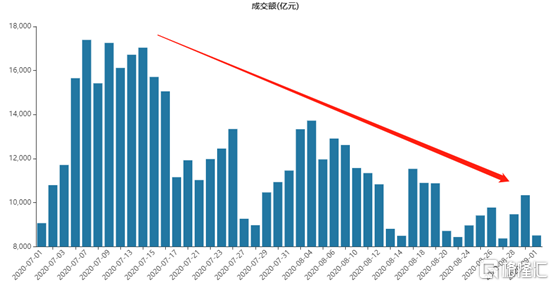

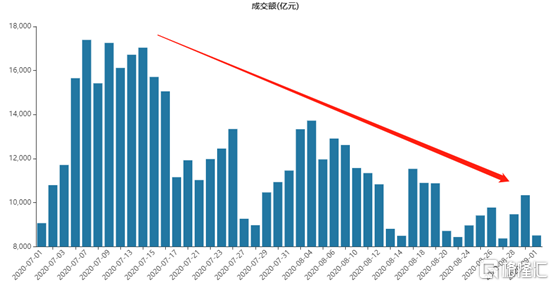

券商業績增速大幅下滑,主要是受到8月股市相對低迷、大盤震盪盤整等因素拖累。數據顯示,7月滬深兩市累計成交約30萬億元,8月則累計成交約22萬億元,環比下降近27%。7月份股市火熱,從7月6日開始,兩市成交額連續九個交易日突破1.5萬億元,整個月份日均交易量1.3萬億,創歷史第四高,環比分別上升100%、67%。

換手率上看,7月全市場平均的換手率92%,8月則只有71%。行情方面,8月上證綜指漲近2.5%,相比7月漲幅減少超過8%。

受A股市場轉冷影響,券商經紀業務和投資業務雙雙下滑。8月代理買賣證券業務淨收入(含交易單元席位租賃)119億元,環比下降近29%;證券投資收益94.6億元,環比下降65%;投行業務淨收入75.4億元,保持平穩態勢。

此外,財務顧問業務淨收入6.3億元,環比上升近2%;受託客户資產管理業務淨收入20.4億元,環比下降9.6%。

(承銷與保薦業務收入=承銷業務淨收入+保薦業務淨收入)

雖然券商8月業績短期增速減緩,但同比仍然亮眼,境內證券全行業收入和淨利潤同比增速都超過40%。

海通證券認為,牛市中1、3、5浪為上升浪,市場成交逐級放量帶動券商利潤節節高。本輪牛市日成交額最高有望破3萬億元,券商利潤彈性提升可期;

招商證券維持證券行業推薦評級,一方面政策呵護助力發展,另一方面基本面穩定向好。目前證券行業進入新一輪高質量發展時期,行業ROE上行趨勢明確,併購預期打開券商估值想象空間;

華泰證券非銀研究員沈娟預測,未來監管增量政策繼續推出,將為證券行業帶來業態的革命,券商業務廣闊空間逐步被打開;

長城證券分析師劉文強也認為,下半年隨着疫情影響的鈍化,券商線下業務將加快復甦,行業維持高景氣度。“且在行業混業想象的時代背景下,分化分層發展的趨勢將加劇。當前市場的走勢基本符合前期判斷,預計階段性調整後繼續上攻。”

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.