阿里巴巴-SW(09988.HK)深度跟蹤報告:阿里雲—數字經濟底座,智能世界大腦,維持“買入”評級,目標價 288.0 港元

機構:中信證券

評級:買入

目標價: 288.0 港元

根據 Gartner 數據,2022 年雲計算全球市場規模預計將達 2700 億美金,CAGR約為 30%+。2019 年阿里公有云份額 9.1%,是全球第三,中國第一的算力平台。隨着阿里向下自研核心基礎能力,向上打造釘釘構建 SaaS 底座,其馬太效應或將更為顯著,我們長期看好阿里雲的發展。

▍最強算力平台,創新數據中台。1、打造最強算力:以 IOE 為代表的原有算力平台無法滿足電商業務蓬勃發展,自研操作系統的“飛天計劃”讓阿里雲破繭而出,並逐步對外輸出算力成為中國第一,全球第三的算力平台。2、構建數據中台:中台是阿里雲有別於其它雲最核心的地方,阿里認為業務中台和數據中台的搭建對於企業的長遠發展非常關鍵;3、共築智能未來:2015 年馬雲提出 DT 戰略,指出阿里未來十年戰略是打造 DT 數據時代商業發展的基礎設施,並於 2017 年推出 ET 大腦,用於挖掘數據背後的價值。

▍大空間,高成長,高壁壘。1、千億級市場空間:Gartner 預計 2022 年全球雲計算市場規模將達到 2700 億美元,其中中國通信研究院預計中國公有云市場規模將達到 1171 億元,私有云市場將達到 1172 億元。2、行業增長迅速:未來幾年雲市場將保持 30%+的增速,國內行業上雲率預計將由 2020 年的 43%提升到 2022年的 55%:3、規模效應顯著:阿里雲 2019年 H2 的國內市場份額 41.9%,約為第 2 名~第 9 名的份額總和,IDC 顯示阿里公有云連續四個季度實現市場份額增長,馬太效應顯著。

▍雲釘一體打造閉環商業生態。1、協同辦公平台:釘釘以中小企業線上溝通為切入點,之後作為 PaaS 平台引入 ISV 集成各類輕量化解決方案,逐步演化為綜合型線上協同辦公平台;2、B 端流量入口:釘釘作為 B 端流量入口,為阿里電商、金融、生活服務、雲計算等業務引流,雲釘一體運作;3、SaaS 底座:釘釘未來形態或與 Salesforce 最為相近,通過打造開放平台生態,以被集成方式逐步成為企業應用的 SaaS 底座。

▍風險因素:企業上雲需求不及預期;行業競爭加劇;阿里雲發展不及預期等。

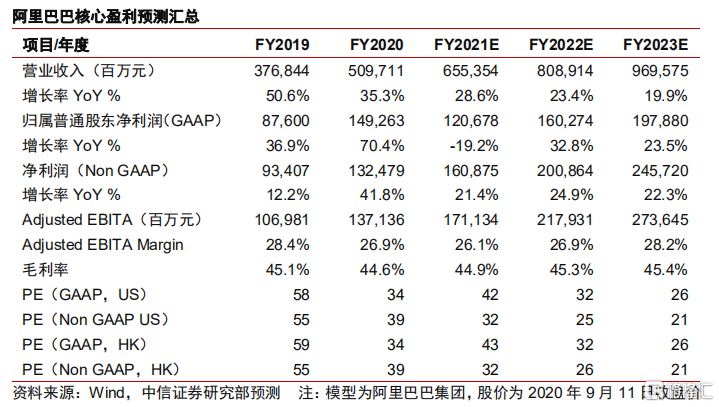

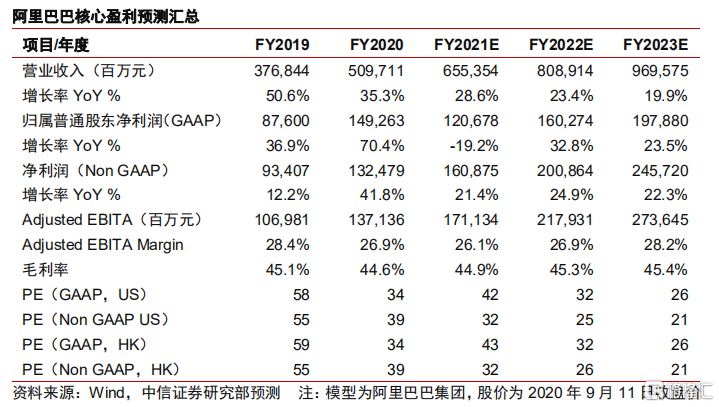

▍盈利預測及估值:中國企業數字化空間廣闊,疫情加速企業上雲,我們推演阿里雲 2021-2023 財年收入增速約為 58%、54%、45%,對應收入為 89 億、138億、199 億美元。我們認為基於雲釘一體戰略打造的 IaaS+PaaS+SaaS 商業生態閉環將打開阿里未來發展的想象空間,我們給予阿里雲 10x 的 P/S,給予2021FY 目標市值為 891 億美元。我們看好阿里巴巴集團中長期競爭力與數字經濟平台的稀缺價值,維持美股與港股“買入”評級,維持目標價 296 美元/ADR、 288.0 港元/股。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.