來源:Wind

近期,市場對豬肉價格下行充滿期待,而龍頭牧原股份卻準備發行100億元可轉債,加碼投資擴大產能。豬行業未來將何去何從,值得關注。

龍頭擴產積極

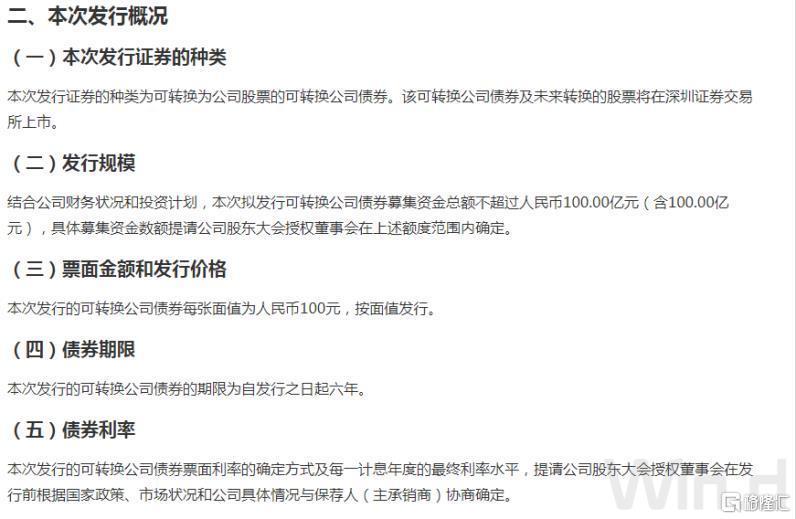

9月14日,牧原股份發佈發行可轉債預案,結合公司財務狀況和投資計劃,本次擬發行可轉換公司債券募集資金總額不超過人民幣100.00億元(含100.00億元),具體募集資金數額提請公司股東大會授權董事會在上述額度範圍內確定。公司擬募集資金扣除相關發行費用後的淨額將全部用於固鎮等23個生豬養殖建設項目和商水等4個屠宰廠項目以及償還銀行貸款等。

Wind數據顯示,本次牧原股份百億元可轉債發行,成為近年來首家除銀行外可轉債募資規模達百億的民營企業。而此前可轉債發行超百億的只有浦發銀行、中信銀行、光大銀行、平安銀行、江蘇銀行和寧波銀行6家,可見養豬龍頭企業的擴產規模巨大,投資金額較多。

此外正邦科技9月份四川片區再次從丹麥引種1040頭30-80公斤不等原種豬。豬源除在丹麥接受了60天的隔離檢疫,入川后種豬還要進行45天隔離檢疫。同時正邦集團為擴充種豬資源和配套系血緣,計劃從法國、丹麥、加拿大引10000頭種豬,滿足公司生豬養殖擴產增養力度。

豬肉產量、價格如何?

首先從產量上看,Wind數據顯示,今年二季度豬肉產量為960萬噸,較去年同期1007萬噸有小幅下降,而第一季度總產量1038萬噸較去年同期1463萬噸也下降較大,可見總體來看,上半年每個季度豬肉供應較往年都出現減少,因此價格上漲自然不言而喻。

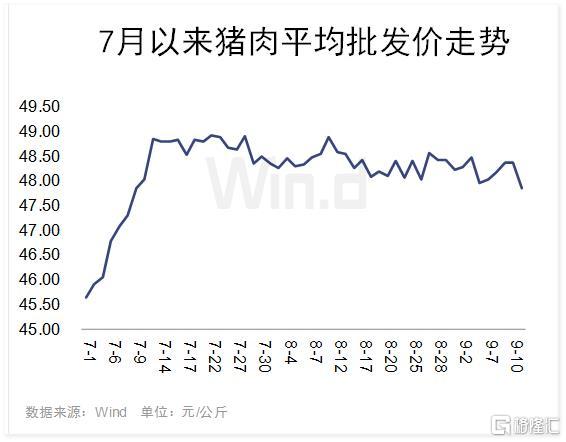

價格上,目前仍高居不下,Wind數據顯示,9月11日,最新豬肉平均批發價為47.85元/公斤,較前一天有小幅下降。不過總體看,7月中旬豬肉平均批發價突破48元/公斤後基本保持穩定,並未有明顯下降,每日僅上下小幅波動,因此目前還難言豬肉價格短期內會出現鬆動,但趨勢有拐頭跡象。

短期豬肉價格拐點已到?

市場人士表示,隨着8月份後生豬出欄量觸底回升,實現明顯增長,我國豬肉價格將步入下行通道,長期來看,豬肉價格將逐漸迴歸至合理區間。

在生豬產能逐步恢復、豬企紛紛宣佈擴產能背景下,市場開始擔憂豬肉價格將面臨下行、產能過剩等問題。

安信證券周泰團隊認為,2020年9月11日全國22個省市瘦肉型豬出欄均價為36.69元/kg,周環比下跌0.33%。供應端,隨着生豬生產逐漸恢復,能繁母豬及生豬存欄向好,生豬出欄量持續上升。此外,9月11日,華商儲備商品管理中心有限公司再次組織實施了中央儲備凍豬肉投放工作,出庫投放競價交易1萬噸,這是年內第32批投放的中央儲備凍豬肉,受此影響,屠宰企業壓價意願較強紛紛進行了收豬結算價的下調。需求端,現階段下游肉類消費尚未出現顯著好轉,屠宰企業目前由於出貨較慢收豬的積極性不高。因此,產能的不斷恢復疊加儲備凍肉的接連來襲,使得豬價大幅上漲的阻力較大,隨着後續產能的進一步釋放,生豬價格也將逐漸恢復至合理區間。

行業中長期如何走?

信達期貨分析認為,從今年後半年豬肉價格走勢來看,今年9月份,生豬出欄量開始逐步回升,供應緊張局面緩解。但受非洲豬瘟影響,存欄恢復速度緩慢,下半年供需將呈現緊平衡狀態。從大趨勢看,9月之後豬價下行趨勢基本確定,但11月在季節性提振下,價格或會有所反彈,12月份至明年一月豬價將再次走弱,年底豬價預計在28—30元/公斤。

展望未來兩到三年,我國豬肉價格的漲跌主要還是看供需間的博弈,在非洲豬瘟疫情沒有大面積暴發的情況下,價格的漲跌還是會回到“價格上漲吸引補欄,供給增加價格下降引起存欄減少”的豬週期循環之中。在這個特殊的時間段裏,價格的變動還會受行業規模化對資本的吸引、疫病和疫苗技術以及政策調控的影響等。