華夏視聽教育(01981.HK):構建“高教+影視+培訓“大生態,傳媒教育集團啟航,給予“買入”評級,目標價6.00 港元

機構:浙商證券

評級:買入

目標價:6.00 港元

報告導讀

影視+高教雙輪驅動,外延併購有望打開藝術培訓大市場,傳媒教育集團大生態成長可期。

投資要點

超預期因素:教育業務佔比提升,藝術培訓業務佈局有望超預期。市場認為公司影視製作業務面臨多方監管,業務波動不確定性大,但我們認為:1)公司憑藉影視業務良好聲譽,旗下經營南京傳媒學院享有良好的產教融合協同效應,大學業務學費水平有望提升,目前本科、國際預科和繼續教育在讀學生分別為 14,256 名、410 名和 301 名,校區二期計劃 4000 人擴容在即;2)公司攜手英皇娛樂,打造藝人短培+藝人經紀業務,同時積極尋求開辦自有藝術學校或培訓課程的機會佈局藝術培訓市場,IPO 募資有望助力外延併購優質傳媒及藝術教育機構,快速切入藝術培訓領域,催生業務新的增長極;3)教育業務佔比有望逐步提升,平滑影視業務波動,整體盈利能力改善有望超預期。

超預期路徑:營收利潤增長穩健,“大學+內容+培訓”大生態值得期待。憑藉華夏視聽的優質品牌聲譽及行業資源,公司:1)兩大基石業務協同效應顯著,影視製作為傳媒藝術高教提供實習及就業機會,院校為影視製作業務提供人才及創意內容來源,緊密合作穩健增長;2)針對娛樂行業年輕人才積極外延開拓藝術教育培訓業務,培育外延新的增長點。隨着高教及培訓業務佔比逐步提升,有望形成“影視製作+高教+培訓”三輪驅動的傳媒教育集團大生態。

催化劑:高校擴招政策持續推進、外延併購落地

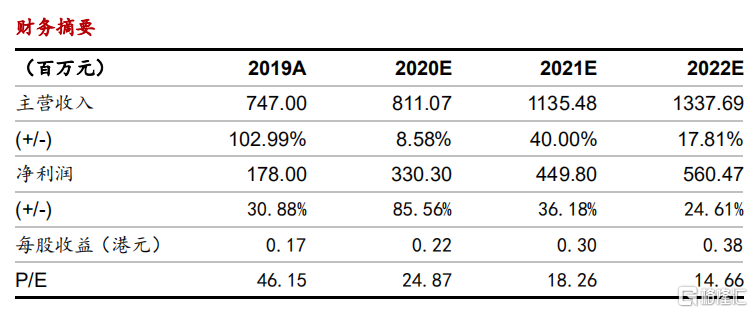

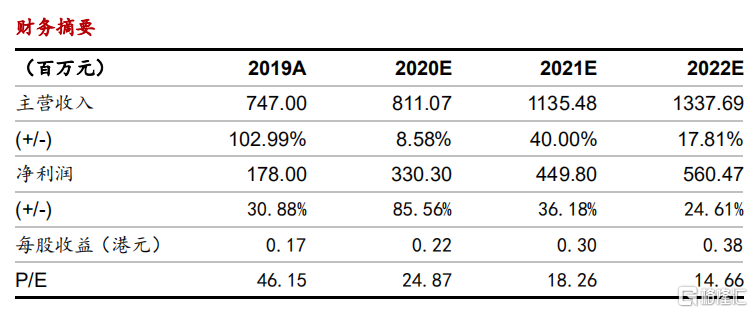

盈利預測及估值:公司現有高教業務增長穩健,影視製作劇集 IP 儲備豐富,未來有望通過外延併購快速佈局藝術培訓領域,預計 2021 年貢獻收入可達 2 億,持續提升盈利能力。預計 2020-2022 年公司 EPS 為 0.22、0.30、0.38 港元/股,結合可比公司估值,給予公司 21 年 20 倍市盈率,對應目標價為 6.00 港元。

風險提示:政策監管風險、大學業務招生不及預期、外延併購不及預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.