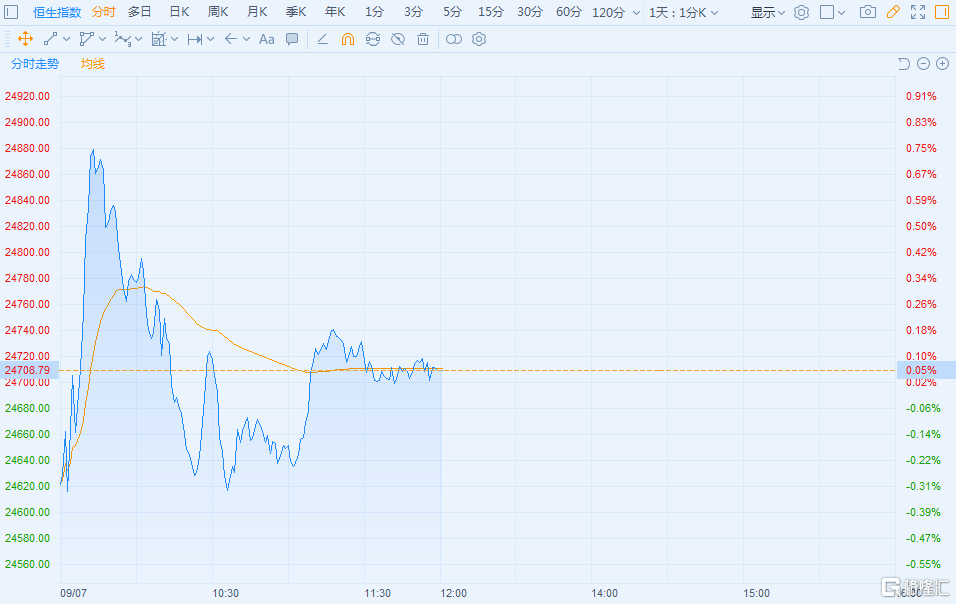

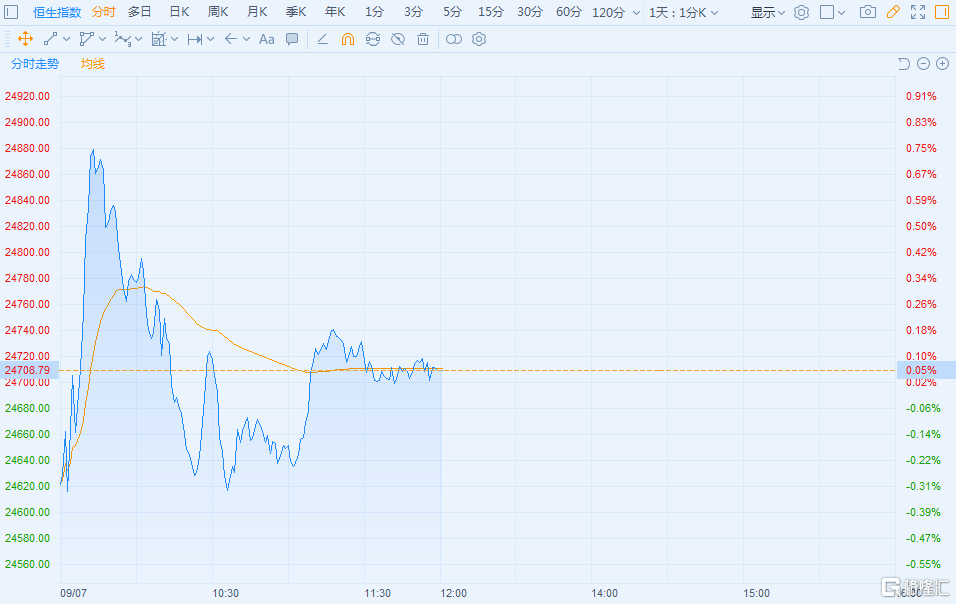

港股午评:恒指微涨0.05% 半导体板块重挫 中芯国际暴跌19.75%

格隆汇9月7日丨港股市场主要指数涨跌不一,恒指冲高回落,午间收涨0.05%报24708.79点,成交额943.52亿港元;国指跌0.46%报9838.75点,恒生科技指数跌3.34%。南下资金净买入逾30亿。

盘面上,行业板块多数下跌,医疗保健、食品添加剂、电信设备等板块大跌靠前。汽车板块午前加速拉升,长城汽车涨7.9%;教育、黄金贵金属、铜板块涨幅靠前。

半导体板块大跌居前,中芯国际暴跌19.75%。外媒援引美国国防部官员表示,特朗普政府正考虑是否将中国最大的芯片制造商中芯国际列入“贸易黑名单”。美国政府正在评估中芯国际与中国军方的关系。美国国防部发言人称,国防部正与其他机构合作,以确定是否对中芯国际采取行动。若中芯被列入黑名单,意味着美国供应商在出货给中芯前,必须取得特别许可。中芯国际随即发布声明称,任何关于“中芯国际涉军”的报道均为不实新闻,中芯国际愿以诚恳、开放、透明的态度,与美国各相关政府部门沟通交流,以化解可能的歧见和误解。

港股教育板块经过前几交易日回调后迎来反弹,天立教育涨18.21%。根据《深圳证券交易所深港通业务实施办法》的有关规定,天立教育等获加入港股通股票名单,调整自9月7日(今日)起生效。国信证券表示,公司全国扩张初见成效,发展模式值得期待,维持“买入”评级。

航空服务板块大涨,东航、南航涨逾6%。在岸和离岸人民币盘中均升破6.84关口,较今年5月底已升值超4%;原油期货价格近日明显回调,美油已跌至40美元下方。此外,根据飞常准大数据分析,8月份在暑运带动下,中国内地航线航班执行量继续保持稳定,中国内地机场8月日均起降超过28000架次,较7月环比提升12%,8月单日最高已接近2018年的日均起降水平。

广证恒生指,港股上周在业绩期后主要受地缘政治紧张局势,以及美股大幅回调等影响而下挫,但成交额上升以及恒生科技指数整周上升7点好于港股整体。短期走势或较为反复,料恒指在23800-26000点之间波动上落,国企指数则在9900-10600之间位置。港股行业配置:中资保险、新能源、可选消费。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.