車企中考:頭部公司研發縮水,北汽藍谷毛利率跌入負值

來源:新浪財經

行業下行和新冠疫情的雙重影響,上半年國內汽車銷售進入寒冬。據中國汽車工業協會的統計,2020年1-6月,汽車市場累計產銷分別為1011.2萬輛和1025.7萬輛,同比分別下降16.8%和16.9%,仍處於明顯下滑的態勢。

跟居民日常消費相關度較高的乘用車銷量跌幅更為顯著。今年1-6月,國內乘用車累計銷售787.3萬輛,同比下滑22.4%,乘用車領域面臨着更大的壓力。

總體虧損加大北汽藍谷毛利率為負

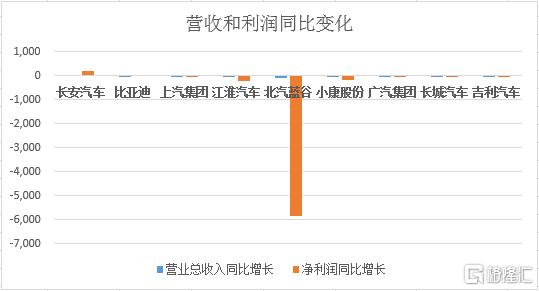

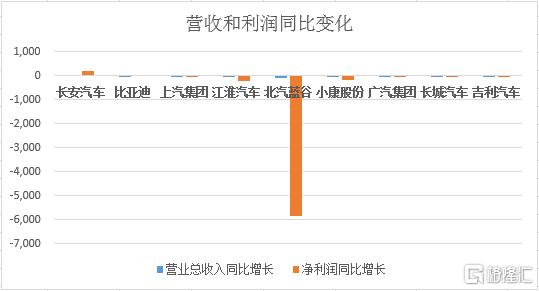

受行業下行期疊加疫情影響,在統計的9家A股和港股主要上市乘用車企中,除長安汽車營業收入同比略有增長外,其餘各家均出現不同程度下滑。其中,以新能源汽車銷售為主的北汽藍谷營收下滑最大,降幅達70%。

利潤方面,長安汽車淨利同比增長216%,同樣位列各家乘用車企第一。不過,在長安汽車取得的利潤中,有超過50億元源於剝離虧損資產和寧德時代股票升值的非經常性收益,而並非來自汽車銷售。

而營收和銷量大幅下滑的北汽藍谷,利潤方面滑坡更為嚴重。上半年,北汽藍谷淨利潤同比降幅高達5853%。

上半年各車企營收和利潤同比

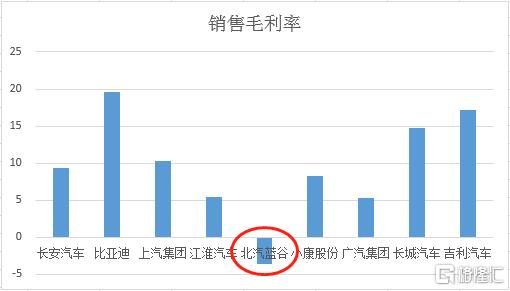

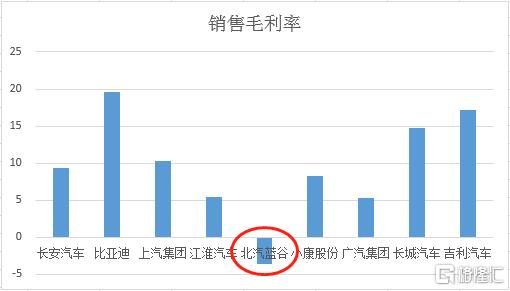

盈利能力方面,受大環境影響,多數企業毛利率出現下滑。值得注意的是,虧損嚴重的北汽藍谷毛利率竟然出現了負值,從去年同期的9.47%驟降至-3.64%,實屬罕見。

上半年各車企毛利率

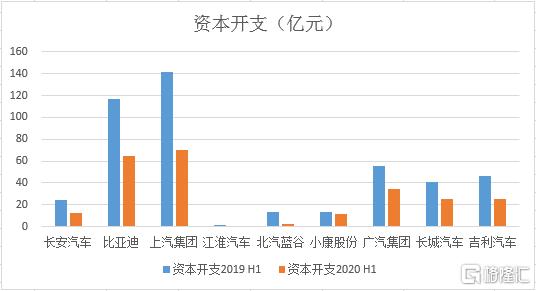

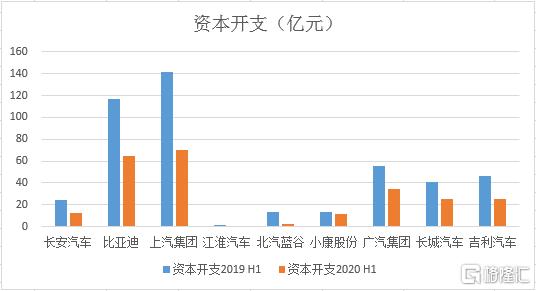

資本開支全面下滑北汽藍谷居首

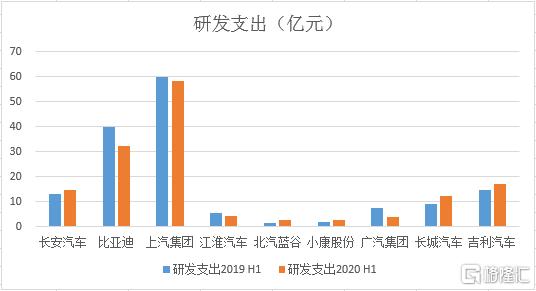

頭部車企研發投入縮水

行業遭遇最難的半年,各家公司也紛紛收縮投資力度。

數據顯示,今年上半年9家乘用車企全部減少資本性支出。其中,北汽藍谷的資本開支縮減幅度最高,達到85%,江淮汽車緊隨其後,達到78%,多數公司降幅也都超過了去年同期的一半。

上半年各車企資本開支

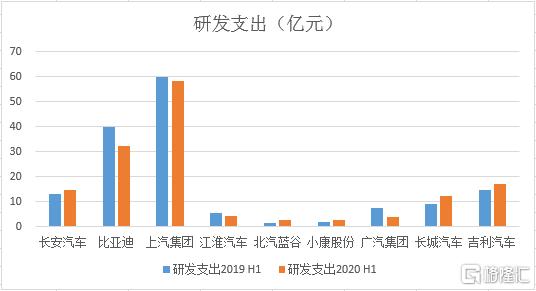

隨着行業進入存量時代,車企之間競爭進一步加劇,特別是新能源汽車浪潮的興起,各家車企正逐步增加研發投入,提升產品競爭力。然而,面對突如其來的疫情衝擊,有些企業不得不開始縮減研發投入。

數據顯示,上半年,長安汽車、北汽藍谷、小康股份、長城汽車和吉利汽車的研發支出同比仍在增加;而比亞迪、上汽集團、江淮汽車和廣汽集團的研發則開始減少。

其中,廣汽集團研發支出由7.43億元降至3.92億元,縮減近半,為9家乘用車企降幅最高,比亞迪和江淮汽車研發減少2成,上汽集團減少約3%。

上半年各車企研發支出

上汽、比亞迪、廣汽等頭部車企,不約而同縮減研發支出,凸顯了業內各家企業在疫情之下艱難的生存環境。

今年前7個月,國內乘用車產銷948.3萬輛和953.3萬輛,降幅比1-6月收窄4.7個百分點和4.0個百分點,但同比降幅依然達17.8%和18.4%,行業的困難局面仍在持續。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.