傳媒:持續看好線上娛樂消費及線下場景復甦的投資機會,維持“增持”行業評級

機構:中泰證券

評級:增持

歸母淨利增速轉正,利潤率回升。2020H1傳媒板塊營收同比-10.84%,相比2020Q1-12.29%的增速有所回暖。2020H1歸母淨利潤同比+21.31%,自2018Q3以來同比增速首次實現轉正。我們認為傳媒行業經歷2018-2019年商譽等資產減值高峯以及2020Q1新冠疫情的影響,已逐步出清,有望迎來觸底回升。

遊戲行業景氣度最高,電影行業受疫情衝擊最大。2020H1營業收入增速方面,只有遊戲板塊同比正增長(+7.97%),其他板塊按增速排列依次是廣電(-1.71%)、營銷(-2.14%)、互聯網(-3.50%)、出版(-9.64%)、影視劇(-43.02%)、電影(-82.08%)。遊戲、互聯網等線上相關行業在一定程度上受益於新冠疫情帶來的用户習慣改變,其他行業則受新冠疫情衝擊,擁有線下門店的電影受到衝擊更為明顯。隨着疫情影響減弱,下半年影院等場所逐步復工,多部大片定檔國慶檔,影視行業復甦在即。

線上娛樂消費:持續看好遊戲、在線視頻、跨境電商、直播帶貨等方向。

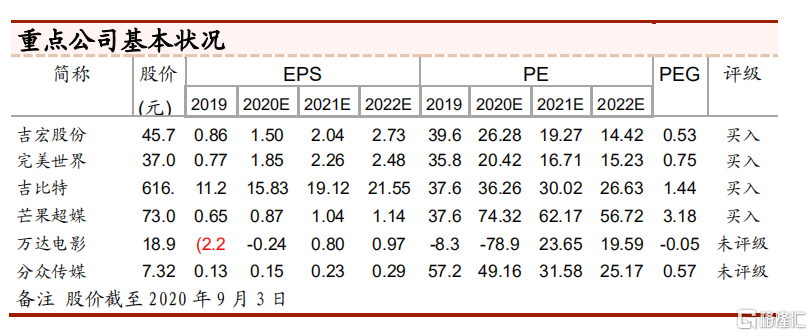

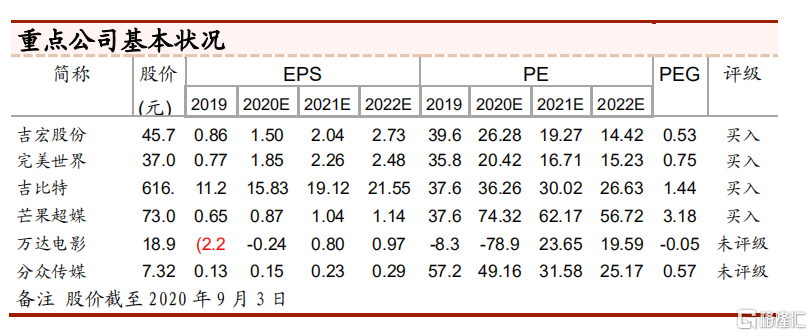

(1)遊戲:由於研發週期拉長進入門檻抬升、推廣資金投入前置、版號審核收縮這3各維度的影響,行業進一步向頭部公司集中,我們預計未來長線精品遊戲的生命週期及競爭力都會提升。核心看好三七互娛、完美世界、吉比特、心動公司。

(2)在線視頻:短視頻對長視頻的用户使用時長形成衝擊,導致長視頻用户紅利加速消退,未來內容為王,看好具有優質頭部內容的在線視頻平台機會。核心看好芒果超媒、新媒股份。

(3)跨境電商:全球在疫情影響下消費習慣由線下轉向線上,帶動我國跨境電商行業快速發展,未來全球線上消費趨勢有望持續。核心看好吉宏股份、安克創新。

(4)直播帶貨:從產品展示及用户體驗來看,短視頻、直播形式優於圖文,未來直播帶貨有望成為數字營銷標配,核心看好天下秀、星期六。

線下場景復甦:核心看好樓宇廣告及電影院線龍頭。

樓宇廣告:Q2經營拐點已得到確認,電梯屏價值有望隨着經濟復甦再度開發。核心看好分眾傳媒。

電影院線:商業大片相繼定檔有望推動行業恢復。《八佰》票房超20億再度驗證優質內容會被市場及觀影者買單。十一檔期有望成為影院復工後第一個核心重要時間窗口。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.