金斯瑞生物科技(01548.HK):收入增長靚麗,業績超預期,維持“買入”評級

機構:廣發證券

評級:買入

收入增長36.5%,業績超預期。公司公告2020年中期業績:營收1.66億美元(YoY+36.5%),毛利1.08億美元(YoY+37.1%),虧損1.61億美元,去年同期虧損0.33億美元;經調整淨虧損0.68億美元,去年同期經調整淨虧損0.28億美元;歸母淨虧損1.13億美元,去年同期虧損0.27億美元。非細胞療法業務營收1.43億美元(YoY+41.6%),毛利0.95億美元(YoY+48.8%),利潤0.19億美元(YoY+151.4%),經調整淨利潤0.25億美元(YoY+110%)。細胞療法收入0.23億美元(YoY+11.6%),毛利潤0.23億美元(YoY+11.6%),虧損1.79億美元,去年同期虧損0.41億美元,經調整淨虧損0.93億美元。研發支出1.15億美元(YoY+83.9%),細胞療法研發投入1.02億美元(YoY+88.5%)。收入增長提速,業績超預期。

生命科學CRO和生物製劑CDMO均實現強勁增長。生命科學CRO收入1.15億美元,同比增長39.9%,毛利0.78億美元,同比增長49.1%,毛利率提升4.2pct至67.8%。增長提速由於COVID-19的新增需求以及對於新客户的成功開發。生物製劑CDMO業務實現收入0.19億美元,同比增長102.1%,其中中國增長101.2%,海外增長144.1%。待交付訂單也實現強勁增長,總訂單增長97.6%至75.3百萬美元,其中服務訂單53.2百萬美元,對外許可22.1百萬美元。隨着GMP的生產設施投入使用、人才團隊不斷加盟和質粒、病毒及抗體平台能力提升,公司生物製劑CDMO業務具備持續高增長的潛力。

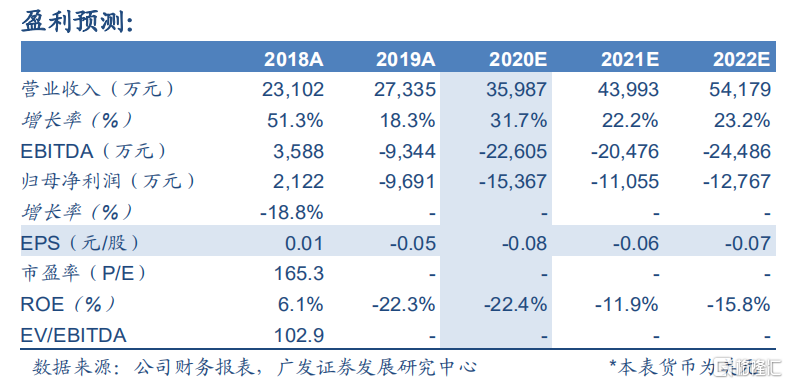

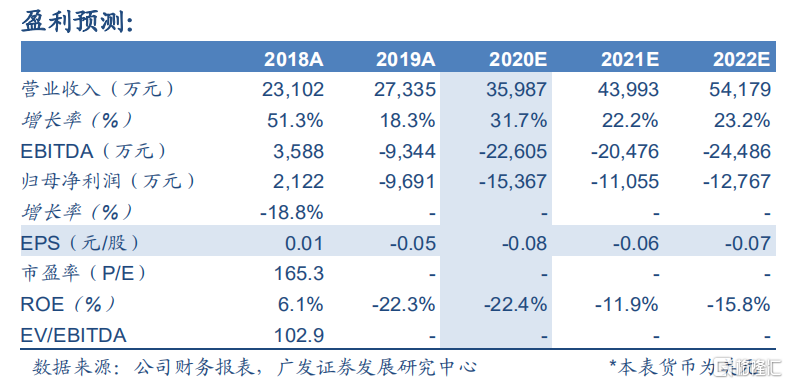

投資建議:傳統業務超預期,細胞治療業務進入收穫期。預計2020-2022年收入3.6/4.4/5.4億美元,同比增長31.7/22.2%/23.2%。採用SOTP方法得到公司合理價值為26.18港元/股。公司傳統業務增長超預期,細胞治療業務即將進入收穫期,維持“買入”評級。

風險提示:費用投入超預期;研發進展低於預期;臨牀數據不達預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.