16家上市豬企上半年營收淨利雙增:供應偏緊、豬價維持高位

作者:陳凌瑤

來源:澎湃新聞

在生豬供給持續偏緊、豬價保持高位背景下,多家豬企上半年業績喜人。

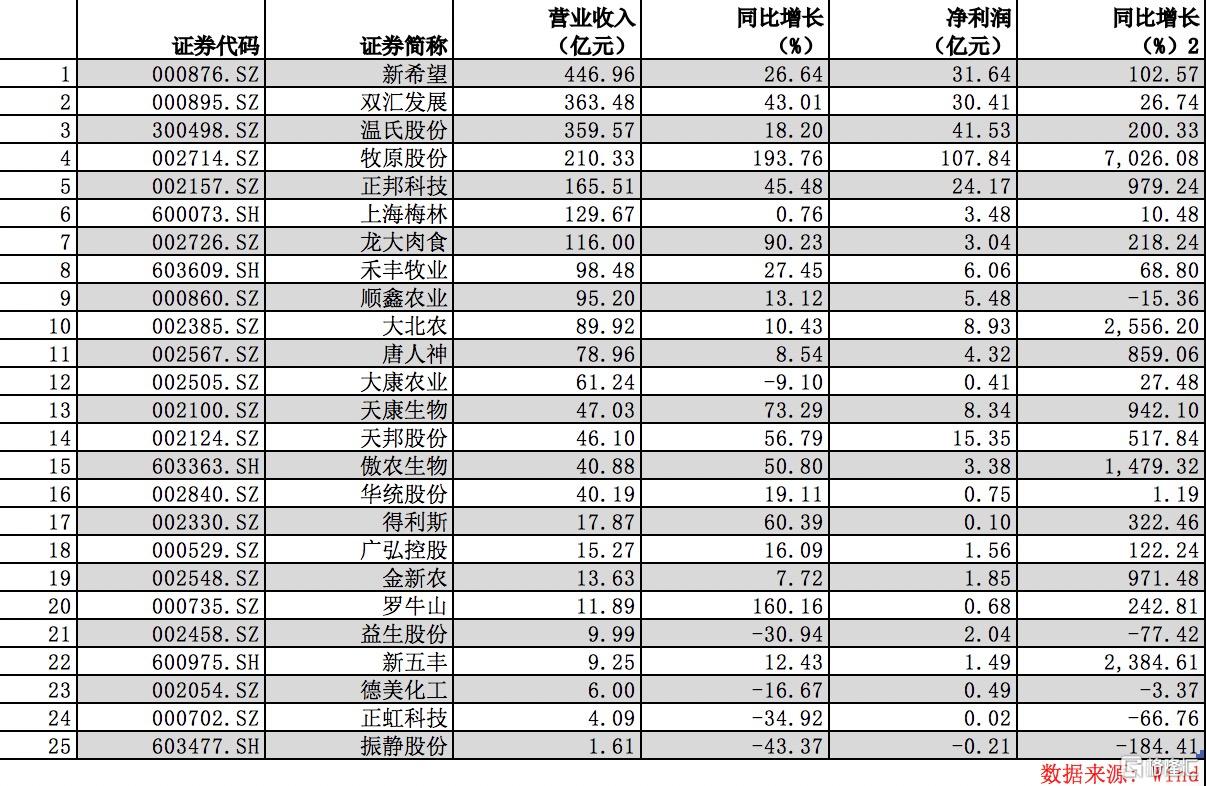

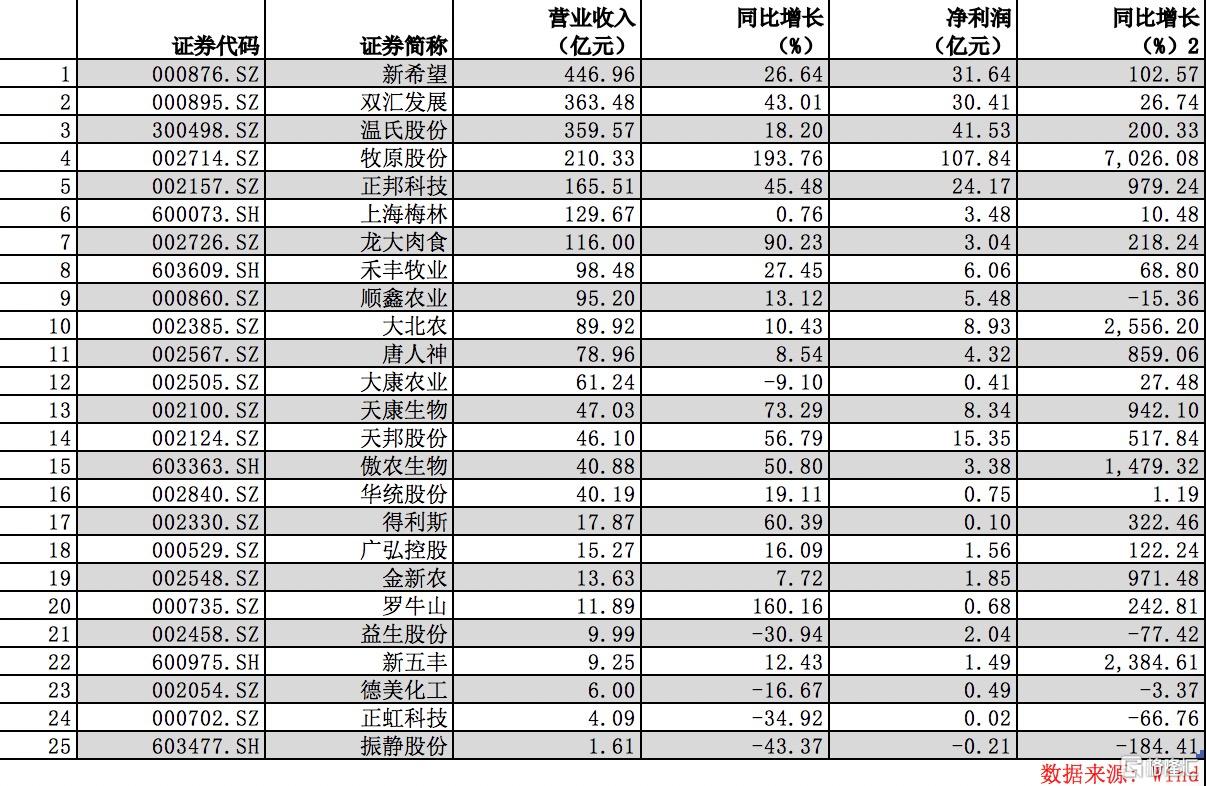

Wind數據顯示,25家涉及豬產業的上市公司中,16家企業上半年營業收入、淨利潤雙增,超過半數企業淨利潤實現翻倍增長,其中牧原股份(002714)、正邦科技(002157)、羅牛山(000735)、天邦股份(002124)4家較去年同期扭虧,僅有振靜股份(603477)1家企業上半年虧損。

具體來看,新希望(000876)、雙匯發展(000895)、温氏股份(300498)、牧原股份和正邦科技上半年營收位居上市豬企前五位,分別為446.96億元、363.48億元、359.57億元、210.33億元和165.51億元,同比增幅分別為18.8%、23.74%、27.75%、51%和10.88%。

盈利能力方面,牧原股份以107.84億元的淨利潤在上市豬企中保持領先地位,較去年同期增長7026%。温氏股份、新希望、雙匯發展和正邦股份四家位列其後,上半年淨利潤分別為41.53億元、31.64億元和30.41億元,同比增幅分別為200.3%、102.6%、26.7%和979.2%。

對於業績大幅增長,牧原股份表示,受非洲豬瘟疫情的持續影響,報告期內生豬市場供應形勢緊張,生豬價格持續高位運行,使其淨利潤明顯上升。同樣,多數豬企也都將豬價上漲列為淨利增長的主要原因。

記者梳理髮現,在豬價帶動下,25家上市豬企今年上半年淨利潤平均增長幅度達748%。除牧原股份外,還有多家企業淨利增幅超過十倍。大北農(002385)上半年實現淨利8.93億元,同比增長2556%;新五豐(600975)實現淨利1.49億元,同比增長2384%;傲農生物(603363)實現淨利3.38億元,同比增長1479%;正邦科技、金新農(002548)、天康生物(002100)等淨利增幅也接近1000%。

受非洲豬瘟影響,去年全國生豬出欄均價一路漲至41.96元/公斤,較以往歷史高點翻了近一番。今年以來,豬價雖有回調,但與往年相比仍處高位。據卓創資訊統計,今年上半年國內外三元生豬出欄均價34.73元/公斤,同比上漲142.87%,1-6月生豬自繁自養盈利均值高達2311.51元/頭。這也能夠解釋為何上市豬企上半年業績有大幅增長。

據農業農村部消息,7月份全國生豬存欄環比增長4.8%,連續6個月增長,同比增長13.1%。這是自2018年4月以來生豬存欄首次實現同比增長,也是繼今年6月能繁母豬存欄同比增長後,生豬產能恢復的又一個重要拐點。農業農村部畜牧獸醫局有關負責人表示,生豬存欄同比增長,預示着5至6個月後生豬出欄量也將實現同比增長,將從根本上扭轉市場供應偏緊的局面。

對於後續行情,開源證券研報顯示,8月豬價整體仍處於高位,由於臨近月底養殖公司為完成出欄目標加快出欄節奏,8月底豬價出現連續下跌。短期來看隨着9月初養殖場出欄節奏放緩,疊加步入“金九銀十”的消費旺季,豬價有望企穩。中期來看,今年四季度生豬供給預計逐步增加,尤其是春節後消費淡季時豬價或將明顯回落,考慮到生豬供給增加緩慢及當前養殖企業成本中樞大幅提升至18元/公斤左右,預計2021年豬價仍處於22元/公斤以上的高位,具備低成本優勢的頭部養殖企業未來兩年將實現快速擴張。

方正中期期貨分析師車紅婷分析稱,8月過後生豬出欄將開啟穩步增加的態勢,同時非瘟疫苗已進入到試生產階段,預計生豬存欄回升有更好的預期,屆時將對生豬市場價格長期壓力有望形成,產能釋放高峯期越來越近,因此短期生豬市場價格繼續走升空間有限,不過在養殖端飼料、防疫及仔豬成本較高支撐下,深跌空間有限,預計年內生豬價格中樞將維持高位。長期來看,隨着產能規模逐漸恢復,“豬週期”將進入下半場,自2020年末至明年,甚至更長時間豬價預計都將處於漫長的下行週期內。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.