總 結

1、中國最大的餐飲企業,餐廳數超過9900家,旗下肯德基發展迅猛;

2、股東陣容強大,景順、貝萊德、春華資本、螞蟻集團均有持股;

3、入場費較高將近24000,10%漲幅即相當於農夫山泉50%漲幅。

打新分析

1、招股信息

(1)簡稱及代碼: 百勝中國-S,9987.HK

(2)招股日期: 9.1-9.4

定價日期: 9.4

上市日期: 9.10

計息日:5天

(3)發行價格: 公開發售價將參考定價日或之前的最後交易日百勝中國在美股的收市價等因素,但不會超過468港元;若上述時間的美股股價折算後超過468港元,或機構投資者認購熱烈,國際發售價可能高於468港元

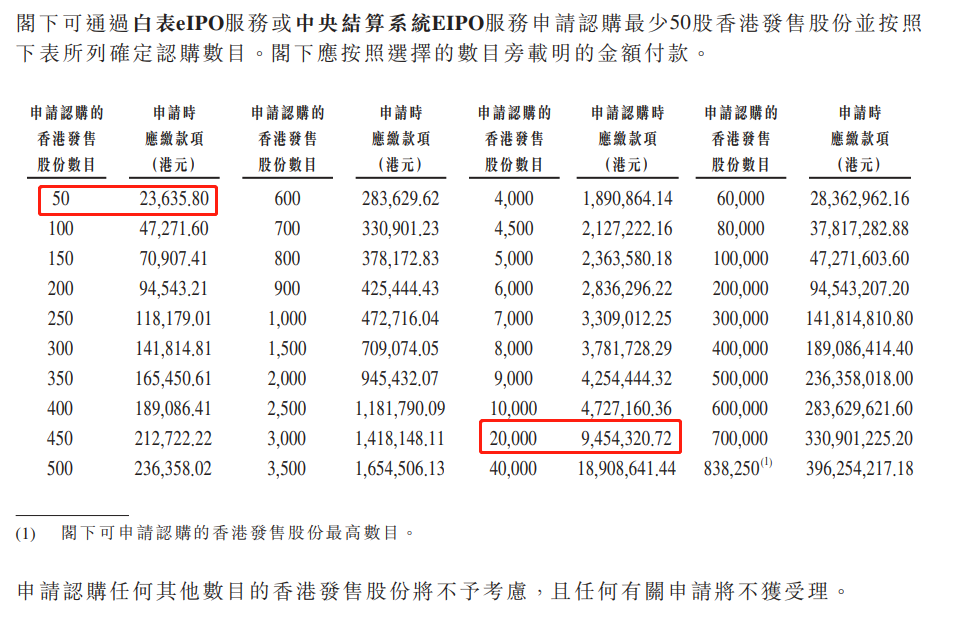

(4)每手股數:50股

(5)一手入場費: 23635.8港元

(6)乙組門檻:乙頭需認購2萬股,金額9,454,320.72港元。

uSMART曾統計,入場費大於1萬的新股,上市首日大概率是上漲的

(7)發行股數: 4191.07萬股,96%國際配售,4%公開發售

(8)超額配股權: 有,可按發售價發行最多共6,286,600股(佔發售股份的15%),以補足國配的超額認購

(9)集資金額: 196.14億港元

(10)市值:1961.42億港元

(11)2019年市盈率:約35.5倍

(12)保薦人及近兩年IPO首日表現:

高盛,10漲3跌2平,代表作歐康維視生物-B,首日漲152%;

(13)穩定價格操作人: 高盛

2、股權結構及股東

上市前,景順投信(Invesco)持股10.8%,貝萊德持股7.2%,春華資本持股4.3%,董事及高級管理層持股0.1%,公衆股東持股77.6%,此外,螞蟻集團在2016年投資5000萬美元。

3、回撥機制

百勝中國-S公開發售1,676,500股,僅佔發售股份的4%(常規爲10%)。以每手50股計算,相當於33530手,在不啓動回撥的情況下,甲乙組分別分配16765手。

不同於常規的回撥機制,在公開發售認購超過20倍後,公開發售的股數最大佔比也只有16.5%,增至6,915,300股發售股份,相當於138306手,甲乙組分別分配69153手。

投資亮點:

1、中國最大的餐飲企業

截至2020年6月30日旗下共有9900多家餐廳,覆蓋中國1400多個城市。目前港股市值最大的餐飲股爲海底撈,餐廳數量爲935家。

其中肯德基貢獻收入近70%,是中國最大的快餐品牌,餐廳數超過6700家,是同等競爭對手的2倍。

必勝客貢獻收入約24%,是中國最大的休閒餐飲品牌,有2200多家餐廳,是同等競爭對手的5倍。

2、財務表現強勁

2019年總收入高達88億美元,淨利潤7.1億美元。2016-2019年,收入和經營利潤的複合年增長率分別爲7%、12%。在疫情影響下,2020年上半年仍實現1.9億美元的正利潤,而海底撈、九毛九均實現虧損。

3、產品創新、高性價比及數字化將推動長期發展

肯德基在產品的本土化和創新上較爲成功,是首個在中國提供中式早餐的西式快餐品牌,發展速度較快,2019年新開店742家。公司的數字化策略不僅有助於提高消費頻率和客單價,還使得公司很好適應了疫情期間大幅增長的到店自提和外賣需求。