总 结

1、包装饮用水是刚需行业,空间大而稳定,农夫山泉的龙头地位稳固;

2、布局的产品定位天然健康,符合消费升级趋势,行业景气度都很高;

3、营销方式独特,品牌知名度高,经销商网络广泛,未来推新能力强;

4、盈利能力首屈一指,兼具成长性和规模性,基金配置的优质标的。

打新分析

1、招股信息

(1)简称及代码: 农夫山泉,9633.HK

(2)招股日期: 8.25-8.28

定价日期: 8.28

上市日期: 9.8

(3)发行价格:19.5-21.5港元

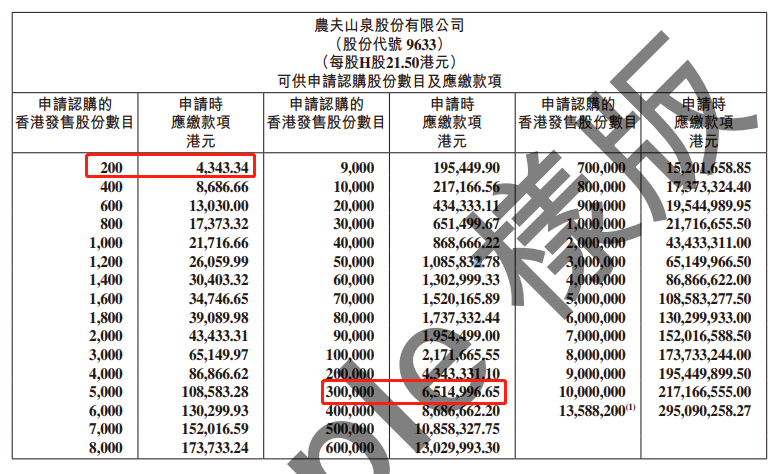

(4)每手股数:200股

(5)一手入场费: 4,343.34港元

(6)乙头门槛:需认购30万股,6,514,996.65港元

(7)发行股数: 388,231,800股,93%国际配售,7%公开发售

(8)超额配股权: 有,可按发售价发行最多58,234,600股(占发售股份的15%),以补足国配的超额认购

(9)集资金额:75.7亿-83.47亿港元

(10)市值:2181.71亿-2405.47亿港元

(11)2019年市盈率:44-48.55倍

(12)保荐人及近两年IPO首日表现:

摩根士丹利,18涨3跌2平,代表作欧康维视生物-B,首日涨152%;

中金公司,9涨11跌3平,代表作祖龙娱乐,首日涨75%

(13)稳定价格操作人: 摩根士丹利

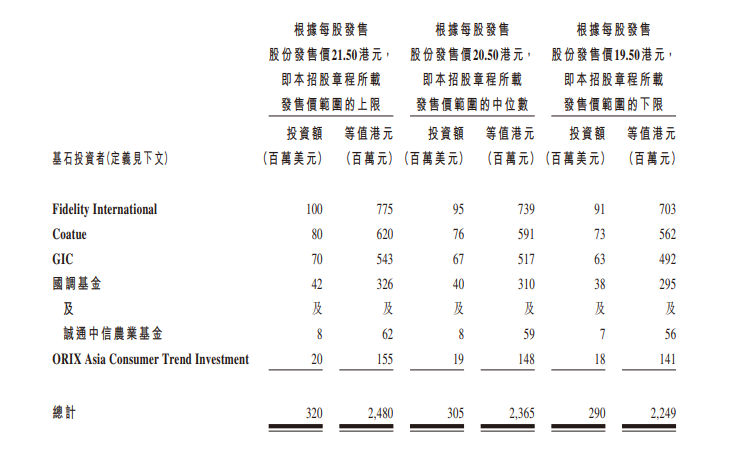

(14)基石投资者(6名):富达基金、Coatue、新加坡主权财富基金GIC、国调基金、诚通中信农业基金、欧力士亚洲资本

2、股权结构及股东

股权结构集中,上市前,大股东钟晱晱合计持股87.4%,家族成员持股6.44%,其余为员工持股。

创始人钟晱晱65岁,曾做过记者,采访过500多个企业家,有独特的洞察力和话题制造能力,也做过娃哈哈的总代理,1993年成立养生堂,即农夫山泉的前身。

3、回拨机制及中签率

农夫山泉公开发售27,176,400股,仅占发售股份的7%(常规为10%)。以每手200股计算,相当于135882手,在不启动回拨的情况下,甲乙组分别分配67941手

不同于常规的回拨机制,在公开发售认购超过94倍后,公开发售的股数最大占比也只有27%,也即甲乙组最多分别分配约262056手。

投资亮点:

1、软饮料行业龙头

农夫山泉在中国的软饮料市场排名第四,前三名分别为可口可乐、娃哈哈、康师傅,第五名为统一。

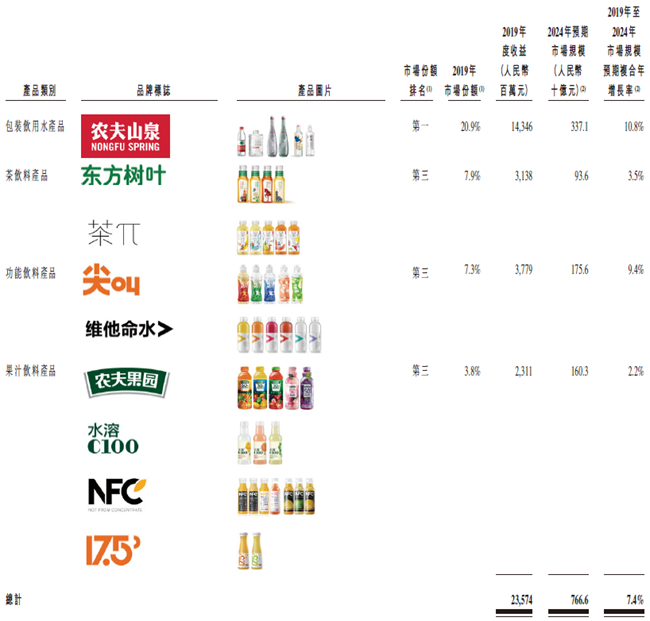

其中在包装饮用水方面,农夫山泉龙头地位稳固,连续8年市占率第一,2019年市场份额20.9%,第二名的怡宝市场份额仅12.6%。

以2019年零售额计算,农夫山泉在茶饮料、功能饮料、果汁饮料的市场份额都排在中国市场的第三位。

2、中国软饮料市场潜力巨大

2019年中国软饮料市场规模达到9914亿元,其中规模最大的包装饮用水是2017亿元,未来五年的增速10.8%。

软饮料行业的消费升级趋势明显,天然水、天然矿泉水、无糖茶、纯果汁等的未来增速都将超过同类型其他产品。农夫山泉一直主打天然健康的中高端产品,未来凭借龙头地位和极强的营销能力,将继续享受市场红利。

3、营销能力强,品牌知名度高

品牌和营销对于快消行业来说至关重要,因为产品同质化比较严重。农夫山泉善于做差异化营销,讲故事讲情怀,比如打造“天然水”概念,“农夫山泉有点甜”等广告语深入人心,拍摄的一系列微电影生动的展示了员工日常取水工作,以及水源地的生态环境。

正因如此,农夫山泉的产品种类虽然不多,但成功率都非常高,生命周期也很长,如此强劲的推新能力为业绩提供了保障。

4、产品多元化,经销商推力强

农夫山泉的产品定价中等,如饮用水定位在2元价格带,给到便利店、超市等终端的毛利可以达到1元,而康师傅、冰露等1元水的终端毛利只有0.3元,终端销售农夫山泉水的动力更强。

此外,农夫山泉其他饮料产品的定价也比较适中,一方面终端可以搭配着销售,另一方面利润会更高。如怡宝的水虽然也是定价2元,但旗下饮料产品较少。

5、十大水源地形成强壁垒

水源开采需要政府批准,目前难度越来越大,农夫山泉已经提前布局了中国十大优质水源地,分布在各个不同区域,不仅保障了产能,还有效缩短了运输半径。