貓眼娛樂(01896.HK)2020半年報業績點評:上半年遭疫情嚴峻考驗,全文娛平台直接受益於復甦,維持“增持”評級

機構:光大證券

評級:增持

◆事件:公司收入由 2019H1 的 19.85 億元減少至 2020H1 為 2.03 億元,同比減少 89.8%。2019H1 毛利為 11.87 億元,2020H1 毛虧 0.21 億元。

◆點評:2020 年上半年疫情衝擊下:全國影院停業,公司參與出品、宣發的春節檔影片全部撤檔、其他項目無法按期上映,同時廣告投放需求減少,導致公司三大業務板塊全線下滑。在線娛樂票務服務收入 1.04 億元,同比-90.42%,娛樂內容服務收入 0.16 億元,同比-97.66%,廣告服務及其他收入 0.84 億元,同比-64.52%。毛利率於 2019 年及 2020 年上半年則分別為 59.8%及-10.1%,由於收入受疫情影響而大幅下降,而成本中包含部分剛性固定成本,導致毛利、毛利率及淨利率均出現大幅下降。

娛樂內容服務能力持續提升,深度參與頭部國產電影項目。1)院線電影方面,自主電影《風平浪靜》(已入圍金爵獎)、《起跑》、《平原上的摩西》等在拍攝或已完成;《緊急救援》等影片將擇機上映。2)劇集方面,公司參與出品的《局中人》《什剎海》已於 2020H1 播映且表現優異,《老酒館》等獲白玉蘭獎;與騰訊視頻合制《烏鴉小姐與蜥蜴先生》等;積極推進《庭外辯護》等自制劇。3)首次佈局影視音樂產業鏈,2020 年 7 月 10 日在央視一套、騰訊視頻、愛奇藝、優酷同步播出的劇集《什剎海》所涉 OST,由公司獨家發行。4)數據、宣發服務能力強大,公司已為全國 90%票房以上的影片提供各類宣發服務;推出「貓眼雲聊」等宣發產品,上線「智能宣發」板塊,提供 33 項宣發產品和服務。

疫情對公司是一次性衝擊,長期看不影響其核心業務能力;作為票務龍頭已參與頭部電影項目,下半年隨行業復甦,業績有望迎觸底反彈。

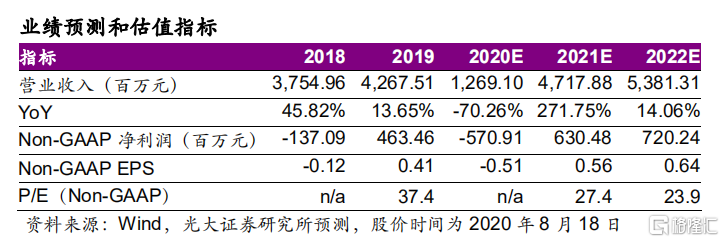

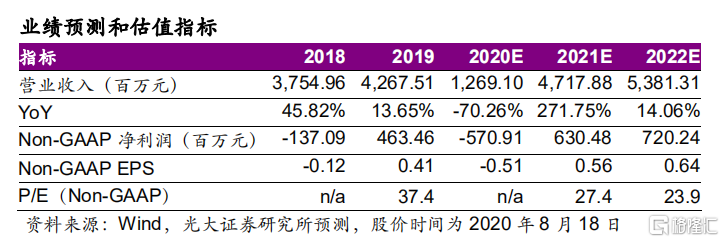

◆盈利預測、投資評級和估值:貓眼娛樂是中國領先的互聯網創新全文娛服務平台,亦是國內最大的電影票務平台,直接受益於電影行業整體復甦。隨着影院上座率的提升,近期多部重磅電影如《八佰》《姜子牙》《奪冠》逐步定檔十一國慶節,將重燃觀影熱情、進一步刺激行業復甦。我們測算 20 年營收或下滑 70.3%,毛利率或下滑至 52.5%;隨行業復甦,21 年業績將大幅恢復並超過 19 年水平。本次分別下調公司 20-22 年 Non-GAAP 淨利潤至-5.7/6.3/7.2 億,現價對應-/27.4/23.9x PE,維持“增持”評級。

◆風險提示:疫情持續時間未定、觀影需求復甦不達預期、應收減值。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.