万洲国际(00288.HK):中国业务表现亮眼,美国业务受疫情影响,维持“买入”评级,目标价 9.0 港元

机构:国元证券

评级:买入

目标价:9.0 港元

投资要点

2020H1 业绩简述:

生猪出栏量同比下降 1.7%至 10,400 千头,生猪屠宰量受非洲猪瘟及新冠疫 情影响,同比下降 20.6%至 22,407 千头,肉制品销量 1,575 千公吨,同比 下降 2.2%。期内,公司实现收入 124.81 亿美元,同比增加 12.2%;经营利 润同比增长 20.9%至 9.25 亿美元;归母净利润 5.5 亿美元,同比上升 18.8%。

中国地区收入、盈利创新高,二季度经营局面稳中向好:

Q2 伴随疫情得到有效控制,复工复产工作稳步进行,肉制品销量恢复 4.3% 的正增长(Q1 -7.5%);同时,得益于前期产品提价及高端产品占比提升,经 营利润同比增加 44.8%。生鲜肉业务因生猪市场供应受非洲猪瘟影响大幅 减少,生猪屠宰量锐减 61.8%至 327.4 万头,经营利润同比下降 18.4%至 1.02 亿美元,而部分损失被进口猪肉的强劲增长所弥补。展望下半年,由于美 国疫情造成开工不足、劳动力短缺影响产出,预期中美贸易价差会缩小, 对进口量会产生一定影响,业务利润会有所降低,公司正积极开发欧洲和 南美的进口渠道,尽可能保证对中国进口产品的供应。

美国加大防疫投入,业务受疫情影响较大:

由于 Q2 疫情在美国快速蔓延,肉制品消费需求疲弱;同时受到生产成本上 升、加大防疫投入(约 4 亿美元)、以及餐饮服务被关停导致公司对预期 损失作出拨备等因素影响,肉制品经营利润同比下降 45.5%;生鲜肉业务 得益于中美猪肉贸易套利空间扩大带来的出口量提升增厚业务利润,期内 录得经营利润 1.16 亿美元;生猪养殖业务得益于公司积极执行的对冲策略 有效冲抵了大部分亏损。预期伴随美国疫情得到逐步控制,下半年美国业 务有望环比改善。

维持“买入”评级,目标价 9.0 港元:

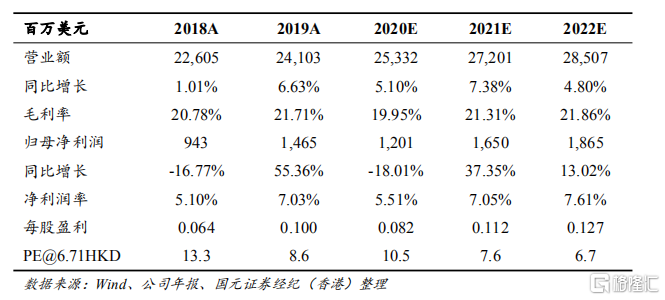

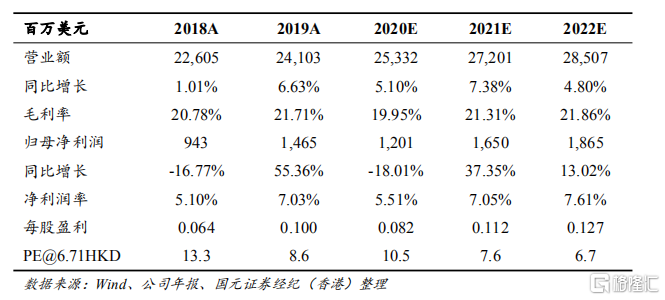

考虑到疫情的负面影响,公司加大抗疫支出,我们下调原盈利预测,预计 公司 2020/2021 年 EPS 将分别为 0.082/0.112 美元,给予 9.0 港元的目标价, 对应 2021 年 10 倍 PE,较现价有 34%的涨幅空间,维持“买入”评级。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.