A股收評:市場放量滬指站穩3400點,行業現普漲行情,金融股領漲

8月17日,兩市迎來放量,大金融,券商,消費白酒帶動指數全面上揚,兩市成交額再次突破萬億。截至收盤,滬指漲2.34%,報3438.80點;深成指漲1.88 %,報13742.23點;創指漲1.04%,報2696.38點。

行情來源:wind

兩市3390股收漲,漲停122家,423只個股下跌,7只個股跌停,市場整體賺錢效應極好。

盤面上,行業現普漲行情,證券、保險、銀行漲幅排名前三,數字貨幣、白酒接力。招商證券、國聯證券、中國人壽漲停;oled面板集體上漲,TCL科技,京東方A漲幅均超5%。

行業板塊方面

1、保險再度迎來大漲,中國人壽漲停,新華保險、中國人保、中國太保漲幅均超6%,中國平安成交量全市第一,漲3.72%。分析人士認為,險企將更加註重明年的開門紅工作。保險板塊的估值和機構持倉均處在三年以來的低位,行業資產端和負債端均有望持續改善,估值提升空間大。

行情來源:富途

2、證券重新扛旗大漲,掀起漲停超,招商證券、國聯證券、哈高科、國信證券漲停,其餘個股紛紛跟漲。

消息面上,證監會14日發佈《證券公司租用第三方網絡平台開展證券業務活動管理規定(試行)》,向社會公開徵求意見。主要釐清了證券公司與第三方機構的合作邊界,建立了適應互聯網特點的風險防範機制,有利於引導行業機構有序創新。

行情來源:富途

3、軍工板塊延續行情,景嘉微,星網宇達、中國衞星漲停,主要在於美國大選疊加大國博弈導致中美關係緊張、地緣政治風險持續,中美對抗逐漸蔓延至非經貿領域,大國博弈全面展開。

行情來源:富途

4、數字貨幣大漲,匯金股份、御銀股份、金固股份漲停,漢鼎宇佑、數字認證、海聯金匯等個股紛紛跟漲。

消息面上,數字人民幣即將試點,在京津冀、長三角、粵港澳大灣區及中西部具備條件的試點地區開展數字人民幣試點。人民銀行制訂政策保障措施;先由深圳、成都、蘇州、雄安新區等地及未來冬奧場景相關部門協助推進,後續視情擴大到其他地區。

行情來源:富途

5、OLED面板行業兩大權重紛紛放量,京東方大漲5.87%,TCL科技大漲5.72%,伴隨LGD、三星顯示相繼宣佈計劃退出LCD市場,顯示面板行業的拐點已現,國內面板供應商逐步替代韓廠成為確定性趨勢,面板下半年的確定性高。

行情來源:富途

主力資金方面,券商指數、銀行指數、保險指數分別是今日主力資金淨流入前三。

數據來源:wind

而餐飲旅遊指數、機場指數、醫療保健指數是今日主力資金淨流出前三。

數據來源:wind

科創板方面,上市三隻新股中漲幅最高的是N龍騰大漲707.38%,科創板已上市公司中鬆井股份、財富趨勢均大漲超10%.

行情來源:wind

但是,南新制藥、傑瑞特、奧特維跌幅超5%,領跌科創板。

行情來源:wind

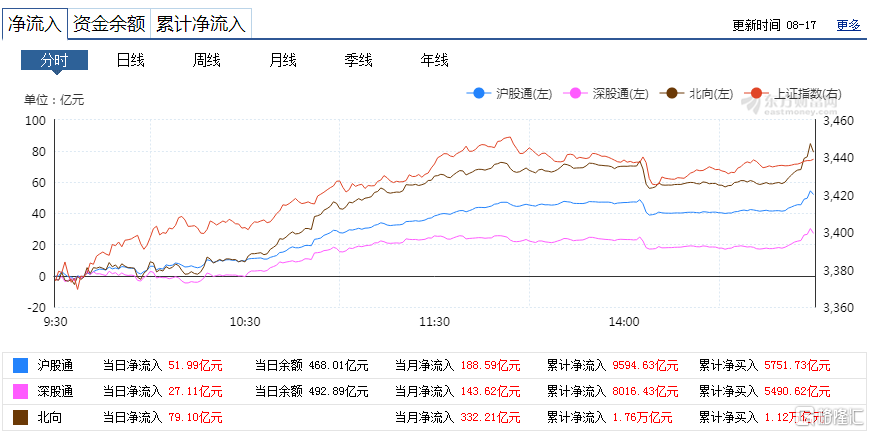

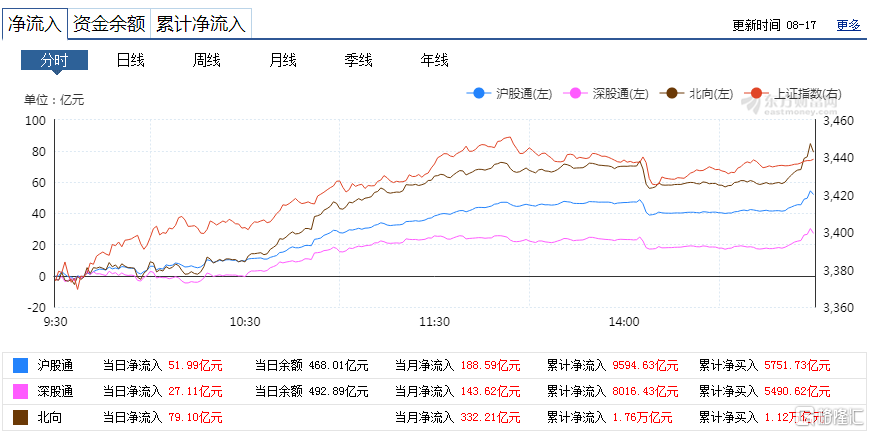

北向資金淨流入今日合計流入79.10億元,其中滬股通淨流入51.99億元,深股通淨流入27.11億元。

方正策略認為:順週期主要邏輯在於經濟的回升具有確定性,經濟的同比和環比仍在改善,寬信用狀態下基建、可選消費將支撐經濟繼續上行,大金融也將充分受益於經濟的復甦,細分行業包括券商、保險、銀行、汽車、建材等;科技成長仍具備較好的配置價值,核心在於5G引領的產業週期仍在演繹,景氣狀態延續,部分領域半年報業績較好,細分行業關注5G、半導體、消費電子、傳媒等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.