福萊特玻璃(06865.HK):光伏玻璃毛利率超預期,下半年漲價剛剛開始,維持“買入”評級,目標價15.6港元

機構:國元證券

評級:買入

目標價:15.6港元

投資要點

公司2020年上半年光伏玻璃毛利率40.05%,超出預期:

2020年上半年公司實現收入約為人民幣24.96億元,同比上升22.69%;淨利潤約為人民幣4.61億元,同比上升76.27%;擬派每股中期股息人民幣6.5分。期內光伏玻璃收入同比增長38.92%,主要受益產能擴張和雙玻需求增加以及平均價格高於去年同期。期內光伏玻璃分部的毛利率達到40.05%,同比提升11.28個百分點,主要受益2020年上半年平均光伏玻璃產品銷售價格上升,同時部分原材料價格下降所致。20201H公司光伏玻璃收入佔比達到85%(20191H:75%),光伏玻璃收入佔比的提升,疊加高毛利帶來公司綜合毛利率提升約10個百分點,達到38.14%。公司上半年業績表現特別是光伏玻璃毛利率超出市場預期。

公司順利融資,加速擴產:

2020年公司新增四條太陽能玻璃生產線,總產能為4,400噸/日,將分別於2020年底和2021年投產2,000噸/日和2,400噸/日產能,繼公司可轉債成功發行後,根據公司A股發行預案,公司將進一步擴充安徽鳳陽2*1,200t/d窯爐線,屆時未來公司總日熔量將由5,400噸增加至12,200噸,產能擴充將進一步鞏固公司龍頭行業地位,規模成本優勢更加顯著。

下半年光伏玻璃漲價剛剛開始:

上週光伏玻璃價格提前出現反彈,主要由於四季度提前搶裝帶來需求爆發,預期下半年光伏玻璃整體供需偏緊,而隨着公司產能的逐步投產,2020-2022年公司業績將持續高增長。

維持買入評級,提高目標價至15.6港元:

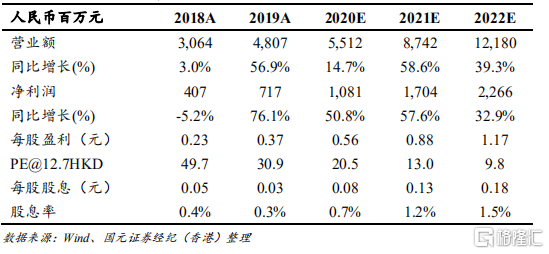

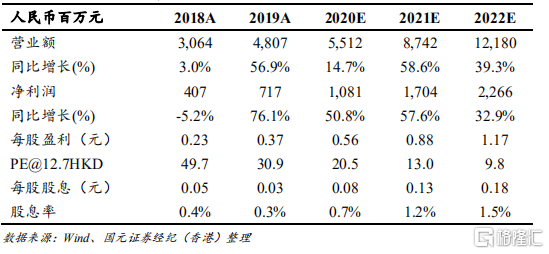

我們提高公司盈利預測並結合行業內可比公司估值情況,提高公司目標價至15.6港元,相當於2020年和2021年25倍和16倍PE,目標價較現價有23%上升空間,維持買入評級。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.