海普瑞被調入港股通名單,高盛全額行使綠鞋,穩定價格期已結束

uSMART友信智投 07-31 11:30

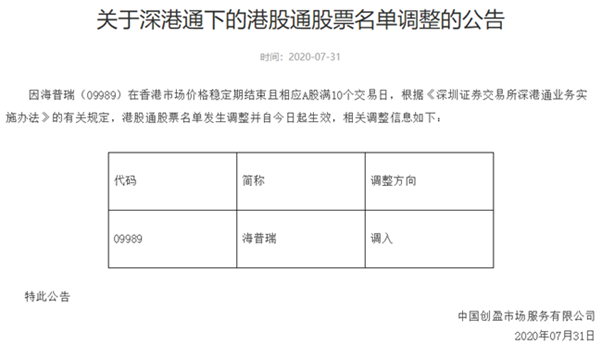

uSMART友信智投7月31日消息,深交所今日公告,因海普瑞(09989)在香港市場價格穩定期結束且相應A股滿10個交易日,將其調入深港通下的港股通股票名單,並自今日起生效。

目前海普瑞H股相較A股折價約40%,被調入深市港股通首日,便見到南向資金的買盤,根據uSMART友信智投APP的即時資料,截至10:14,深港通淨買入3.64萬股。

高盛全額行使綠鞋,穩定價格期結束

同日,海普瑞(09989)發佈公告,有關全球發售的穩定價格期於7月30日結束。

穩定價格操作人高盛(亞洲)有限責任公司、其聯屬人士或為其行事的任何人士於 穩定價格期所採取的穩定價格行動如下:

1)於國際發售中超額分配合共3301.4萬股H股,約佔全球發售項下初步可供認購發售股份的15%;

2)於穩定價格期,以每股H股15.00港元至18.40港元的價格範圍在市場上連續購買合共3301.4萬股H股,約佔全球發售項下初步可供認購發售股份的15%,意味著綠鞋全部行使完畢。

穩定價格操作人於穩定價格期在市場上的最後一次購買,乃於7月30日以每股H股16.44港元的價格作出。

從披露易的權益披露資料來看,在海普瑞上市次日(7月9日),高盛便以每股均價17.75港元買入海普瑞217.25萬,隨後又分別在10日、13日、16日、21日連續4次買入。最新的持倉資料顯示,高盛當前持有海普瑞6174.15萬股,持股比例升至28.05%。

資料來源:wind

此外,7月14日晚間,海普瑞發佈了其2020年半年報盈喜。公告顯示,2020年上半年,海普瑞實現歸母淨利潤5.46億元-6.01億元,同比增長0-10%。扣非後歸母淨利潤同比增加620%-690%,業績保持較快增長勢頭,充分驗證了公司良好的成長性。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.