復宏漢霖-B(02696.HK):曲妥珠單抗在歐盟獲批,臨牀價值國際化變現,維持“買入”評級,目標價78 港元

機構:光大證券

評級:買入

目標價:78 港元

事件:

公司的商務合作伙伴 Accord Healthcare Limited(以下簡稱“Accord”)提交的 HLX02(曲妥珠單抗,歐盟商品名:Zercepac)用於HER陽性早期乳腺癌、HER2 陽性的轉移性乳腺癌,以及未經治療的HER2 陽性轉移性胃癌或胃食管交界處腺癌治療的營銷授權申請獲歐盟委員會批准。HLX02 在所有歐盟成員國及冰島、列支敦士登和挪威獲得集中上市許可。

點評:

中國首個抗體類似藥出口歐盟,躋身國際一流抗體藥行列

Zercepac 是中國首個出口到歐盟的抗體類似藥,該產品獲批標誌着公司的產品質量已達到國際一流水平,是國際化佈局的里程碑。Zercepac 是歐洲第 6個獲批的曲妥珠單抗類似藥,在歐洲的銷售工作由合作伙伴 Accord 負責。Accord 在歐洲仿製藥銷售排名前三,腫瘤領域仿製藥銷售排名第一,有 8500+仿製藥在售,覆蓋85+國家。公司除4050萬美元(原協議)+308萬美元(新增規格)的首付款和里程碑付款之外,還將按淨銷售額產生利潤的15%-26.5%獲得許可使用費。

廣泛建立合作關係,國際化變現臨牀價值

公司的曲妥珠單抗除授權Accord歐洲權益之外,還授權Mabxience在阿根廷、烏拉圭、巴拉圭,Jacobson 在香港和澳門,Cipla 在澳大利亞、新西蘭、哥倫比亞和馬來西亞的獨家商業化權利,將曲妥珠單抗類似藥的臨牀價值在儘可能大的範圍內變現為商業價值。

國內進度領先,競爭格局優良

公司的曲妥珠單抗在國內2019年4 月提交上市申請,有望在近期獲批上市,成為國內首個曲妥珠單抗類似藥。截至2020.7.30,尚未有其他企業提交曲妥珠單抗類似藥的上市申請,公司的曲妥珠單抗將擁有較長的時間窗口,短期內競爭格局較為優良,價格戰壓力小,有望迅速提升市佔率。

盈利預測、投資評級和估值:

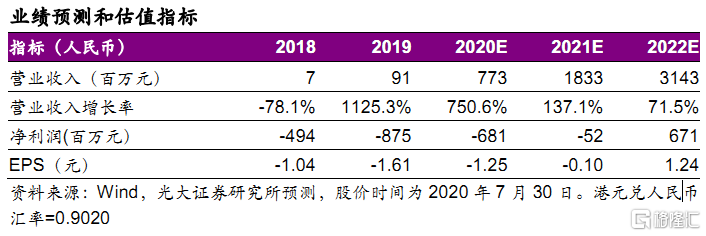

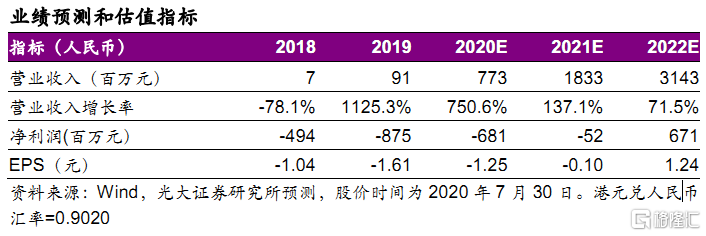

公司是中國抗體藥龍頭之一,在單抗類似藥和國際化方面進度領先,綜合競爭實力強勁。考慮利妥昔單抗增加適應症(見附錄),上調 2020-2022 年的收入預測為7.73/18.33/31.43 億元(原預測為5.98/15.08/28.43億元),同比增長 750.6%/137.1%/71.5%;歸母淨利潤-6.81/ -0.52/6.71 億元,對應 EPS 為-1.25/-0.10/1.24 元。考慮類似藥的放量節奏較快,我們調整了部分藥物的達峯時間預測,並新增了EGFR 改良型創新藥HLX07的估值預測,測算得到公司估值為381 億元,按照2020.7.30 港元兑人民幣匯率0.9020,對應 423 億港元,目標價相應上調為78 港元。維持“買入”評級。

風險提示:研發進度不達預期的風險;銷售情況不達預期的風險;全球化拓展不達預期的風險。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.