“港版纳指”出炉,阿里、腾讯、美团、小米领跑

格隆汇 07-20 19:50

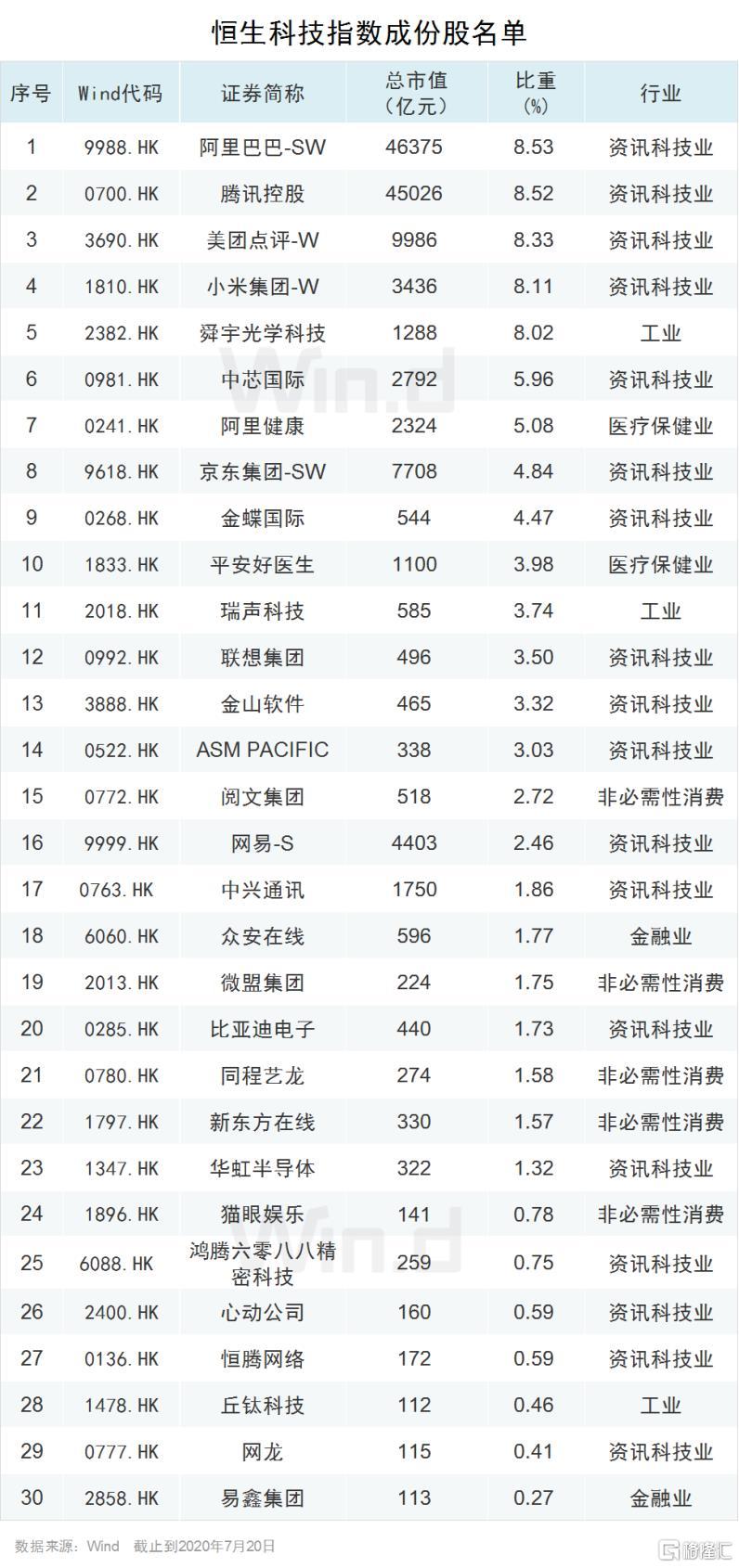

7月20日下午,恒指公司宣布推出恒生科技指数,新指数将会追踪经筛选后的最大30家于香港上市的科技企业。其中包括阿里巴巴、腾讯控股、美团点评、京东等,阿里巴巴权重最高。

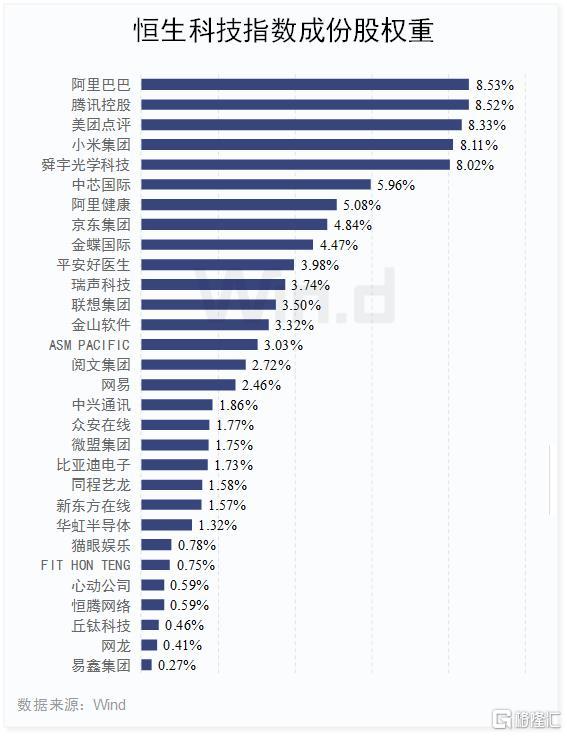

据恒指公司的公开资料显示,阿里巴巴权重最高,占8.53%,腾讯次席占8.52%, 美团位列第三占比8.33%,小米占8.11%;这四大股份合计占33.49%。

从行业分类来看,30只成分股主要分布在资讯科技业、非必需性消费、工业、医疗保健业和金融业中,其中资讯科技业有18家,占比最大达60%。

恒指公司董事兼研究及分析主管黄伟雄早前表示,有关指数将参考纳斯达克等科技股主题指数,希望其成为继恒指及国指后,另一受市场欢迎的指数。

谈到推出该指数的目的,他称投资者对科技股期望高,对有关指数具需求,但对个别科技股不太熟悉,新指数或可分散投资科技股时的风险。

新指数将会追踪经筛选后30间市值最高的、于香港上市的科技企业。根据回溯测试计算数据,恒生科技指数于 2019 年全年及 2020 年以来的回报分别高达 36.25%及 45.5%。

早前7月初,黄伟雄在发布会上就表示目前中资股占恒指比重已超过一半,而市场咨询反映无须为中港企业的比重增设特别限制。

所以虽然纳入恒指成份股需要有2年上市的要求,但如果公司市值规模足够大,则可缩短上市时间。

小米 、美团及阿里将可在今年8月季检时纳入恒指选股范围,至于上月才入港交所挂牌的及京东上市时间尚短,暂时未能纳入恒指的选股范围。

FactSet全球指数主管周鹤松预计,未来3年,约7成的成份股来自内地公司,其中科技板块更占恒生指数成份股约25%。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.