北向資金大額拋售!上半年淨利預降五成!格力電器首次回購欲提振股價?

格力電器(000651)7月16日晚間公告,公司7月16日首次以集中競價方式回購公司股份,回購股份數量為91萬股,支付總金額為5139.91萬元。

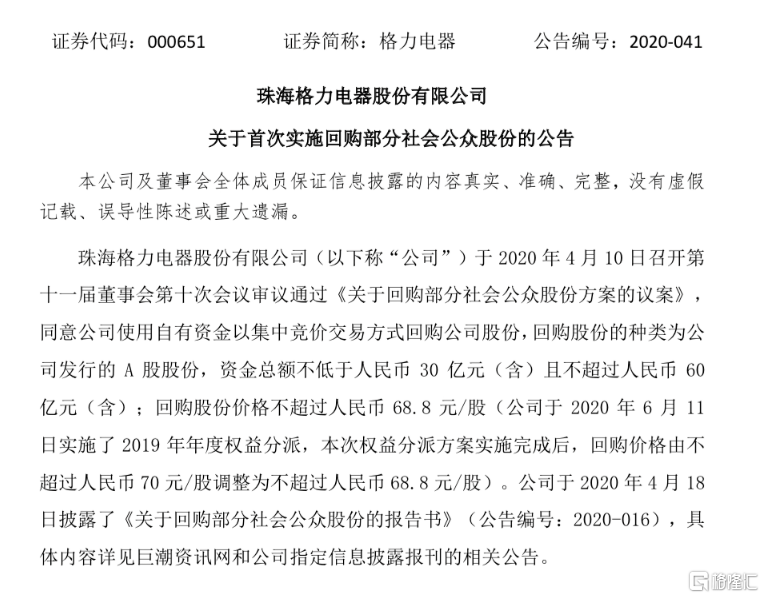

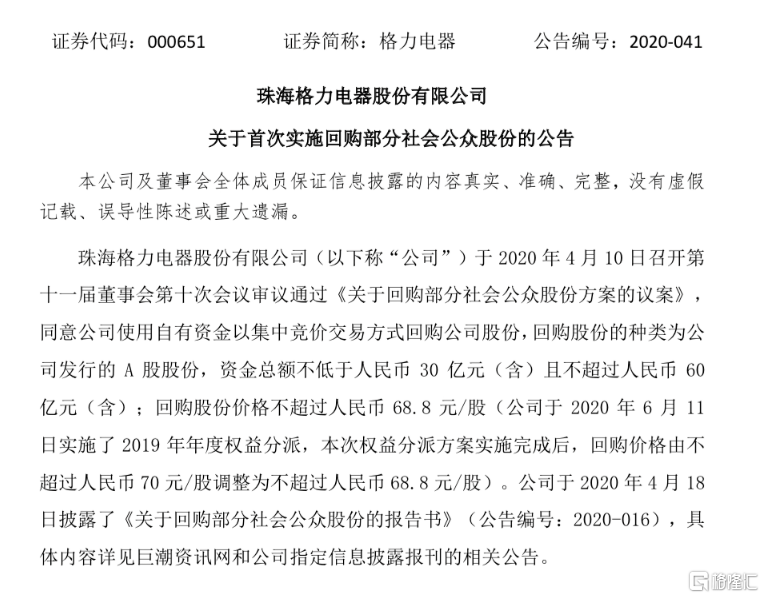

此前的4月12日,格力電器公告,公司擬使用自有資金以集中競價交易方式回購公司股份,資金總額不低於30億元(含)且不超過60億元(含);回購股份價格不超過70元/股,回購股份將用於員工持股計劃或者股權激勵。

《投資快報》記者注意到,在北向資金拋售、上半年淨利預降五成、經銷商股東減持的背景下,這是格力電器實施的首次回購。

上半年淨利預降5成的格力電器,遭遇北向資金拋售。7月16日盤後數據表明,北向資金淨流出A股69.2億元,其中,格力電器遭遇北向資金淨賣出14.52億元,位居榜首。

這個數字對於格力電器來説同樣非比尋常。數據顯示,北向資金單日淨賣出14.52億元,在格力電器歷史上極為罕見,至少是最近3個月屬於首次出現,而格力電器被北向資金單日淨賣出排名第二的是6月8日,為6.36億元。

事實上,截至7月16日,格力電器已經連續4個交易日遭遇北向資金淨賣出。其中,7月15日的淨賣出為0.79億元,7月14日和13日分別為0.4億元與0.54億元。而單日遭遇北向資金淨賣出14.52億元的格力電器,其當日股價也創下了3個多月以來的最大跌幅,下跌幅度為4.58%。

此前的7月15日,格力電器披露的2020年半年度業績預告顯示,其上半年淨利潤為63億元至72億元,比上年同期下降48%至54%,創下了其歷史同期業績最高下降幅度記錄。

今年上半年,格力電器的股價表現並不樂觀,截至目前,格力電器股價較年初下跌11.52%。而競爭對手美的集團的股價漲幅約8.08%。

去年12月,格力電器控股股東格力集團將其持有的15%格力電器股份以46.17元/股的價格轉讓給珠海明駿,而珠海明駿背後的實控人為高瓴資本。受高瓴入局帶來的溢價影響,格力電器股價自12月來一路上漲,一度漲至69.18元/股,創歷史新高。一月中旬疫情蔓延影響空調銷量,格力業績遭到重創,股價開始回落,最低跌至47.45元/股,目前已恢復至高瓴入股前的水平。

格力電器若寄希望回購股份來提振股價,不知投資者是否會為此買單。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.