玩轉ETF | 美股帳戶怎麼買A股指數?

週三,A股繼續強勢,上證綜指、深證成指、滬深300指數繼續收升超1%,滬深300從3月低位升超30%。擁有美股帳戶,卻想參與A股投資,有什麼方法呢?

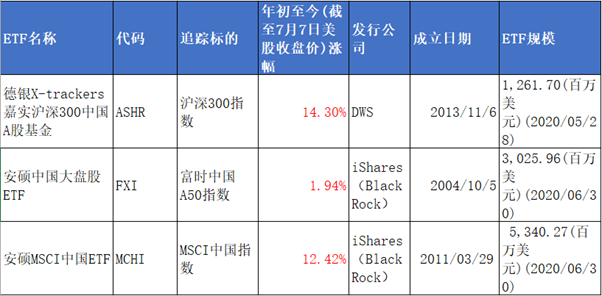

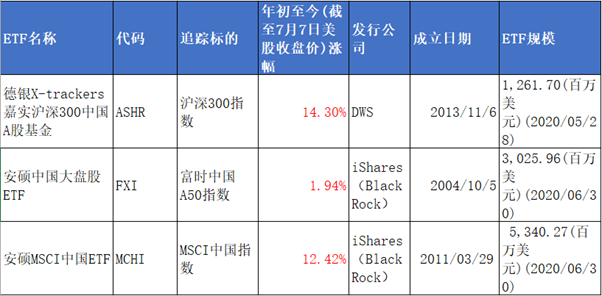

指數不能直接買賣,指數ETF可以股票交易那樣買賣,之前介紹了《玩轉ETF | 港股帳戶如何買賣A股/港股指數?》,今天介紹美股的相關ETF:

1)德銀X-trackers嘉實滬深300中國A股基金(代碼:ASHR),是追蹤滬深300的ETF,從3月低位至今(週二美股收市價)累計升幅為32.09%。

2)安碩中國大盤股ETF(代碼:FXI),是追蹤富時中國A50指數的ETF,從3月低位至今(週二美股收市價)累計升幅為30.93%。

3)安碩MSCI中國ETF(代碼:MCHI),是追蹤MSCI中國指數的ETF,從3月低位至今(週二美股收市價)累計升幅為23.67%。

A股的升勢還能持續多久?

摩根士丹利將滬深300指數12個月目標位元設在了5360點,至接近2015年峰值(5380.43點)的水準,相對於週三收市價時4774的點位高出了12.27%。

股票知識:

滬深300/CSI 300 Index

滬深300指數是由上海和深圳證券市場中市值大、流動性好的300檔股票組成,綜合反映中國A股市場上市股票價格的整體表現。

富時中國A50指數

新華富時中國A50指數於2010年更名為富時中國A50指數,是由全球四大指數公司之一的富時指數有限公司(現名為富時羅素指數),為滿足中國國內投資者以及合格境外機構投資者(QFII)需求所推出的即時可交易指數。富時中國A50指數包含了中國A股市場市值最大的50家公司,其總市值占A股總市值的33%,是最能代表中國A股市場的指數,許多國際投資者把這一指數看作是衡量中國市場的精確指標。

MSCI中國指數

MSCI中國指數是指由摩根士丹利國際資本公司(MSCI)編制的跟蹤中國概念股票表現的指數。

什麼是ETF?

ETF(Exchange Traded Funds)即交易所買賣基金。ETF兼具股票及傳統基金的特點。與股票一樣,ETF可于交易時段透過任何經紀及在大部份交易平臺進行買賣。

怎麼買賣ETF?

買賣ETF的程式與買賣股票相同,買賣方式也跟其他證券無異,投資者可在交易時間內透過經紀進行買賣。

投資ETF應注意哪些風險?

投資者須注意投資ETF的主要風險包括:市場風險丶貨幣風險丶市場波動丶投資限制丶交易對手風險丶新興市場風險等;

ETF與指數相關聯,因此價值可升可跌。ETF的資產淨值或成交價有可能下跌至低於投資者的買入價,導致低於投資本金而虧損。

投資ETF還需要留意某些ETF或會有較大的追蹤誤差,亦可能以資產淨值的溢價或折讓價交易。

何謂ETF追蹤錯誤?

追蹤誤差指ETF的每日表現與相關指數的每日表現之間的差距波幅。追蹤誤差用於衡量追蹤相關指數的ETF達到其投資目標的效率。追蹤誤差越低,ETF的表現越接近相關指數的表現。追蹤誤差一般受多項因素所影響,包括ETF的總支出比率丶交易成本丶ETF進行資產交易時引致的預扣稅和印花稅,以及ETF的資產和指數成分股的流動性。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.