IPO半年報丨醫藥股、冷門股大爆發,下半年預計70隻新股上市,醫藥、TMT會繼續成為市場亮點

新股概覽:上市數量降低,但集資額增加

受到新冠肺炎疫情爆發影響,2020年上半年香港新股上市數量出現下跌。若剔除介紹等非公開方式上市、創業板轉主機板上市新股(下同),上半年可公開認購的新股為59隻,較去年同期的74隻同比下降20%,其中2月、5月、6月的降幅都比較明顯。

從集資金額來看,上半年共861億港元,比去年同期的718億港元增長20%,主要是受惠於京東、網易這兩隻龐大的第二上市新股,集資額分別高達300億和242億,佔據了整體集資額的63%。

根據德勤報告,憑藉這兩隻回歸的超大型中概股,港交所的集資額重返全球第三寶座。

新股表現:市場情緒回暖,醫藥股大爆發

從上市首日表現來看,上半年的平均升幅14%,高於去年同期的4.5%,從圖中可以明顯看到,自2月的低谷後市場情緒明顯回暖,月度平均升幅逐漸攀升,5月更是高達56%。

其中升幅前五的都是小市值新股,Ritamix、智中國際均收升176%。但是從絕對收益來看,最賺錢的新股是沛嘉醫療,1手可賺1萬以上,緊隨其後的是康方生物和康基醫療。

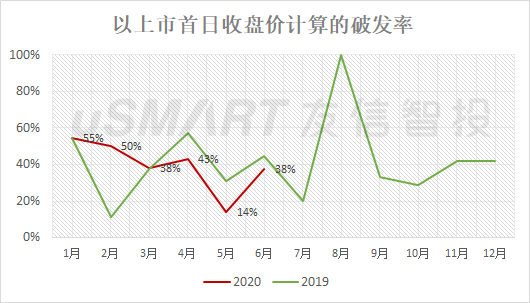

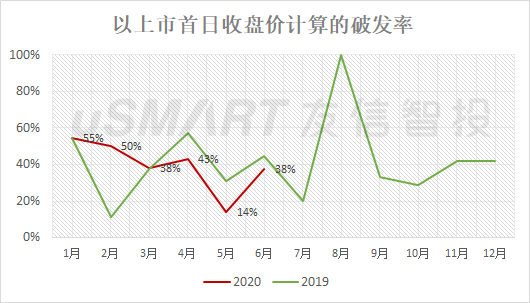

如果定義上市首日收盤價低於發行價為破發,則上半年的破發率為42%,略高於去年同期的39%。但從月度數據來看,從1月到5月是逐月降低的,6月又有所回升。

從申購積極性來看,平均每一隻新股認購帳戶數約6.4萬,明顯火熱起來,認購最火爆的是康基醫療,超過41萬戶,認購最冷的是生興控股,不到3000戶。

打新規律:精選優質股,激進搏冷門

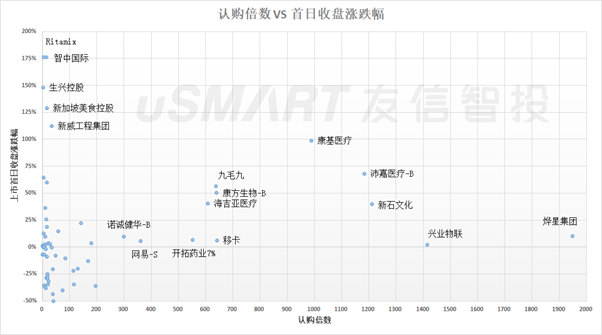

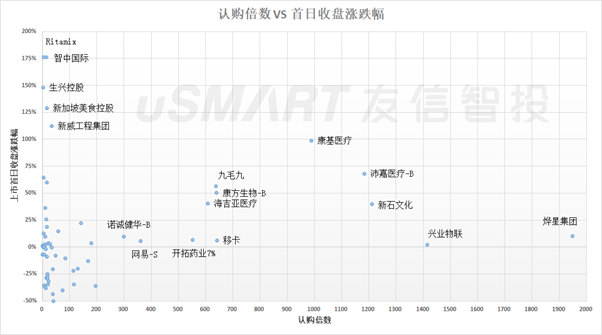

一般來說,認購倍數越高,說明投資者越看好,首日會有較好的表現。根據uSMART友信智投的統計,2019年公開發售的認購倍數多少與首日升跌大致呈正相關關係,也就是認購倍數越大,上升概率越大。

但是由於新股存在回撥機制,認購倍數越高回撥比例越大,從而導致分配給散戶的股數增多,反而不利於股價走勢,但也要視股票本身質地和大市環境而言。

從認購倍數來看,上半年新股表現明顯呈“走兩個極端”規律。

從下圖可以看到,認購倍數在15倍以內的新股有19隻,上升比例達到68%。認購200倍以上的新股有12隻,無一破發。

認購200倍以上的新股平均升33%,這一檔新股一般又分兩類,一是沛嘉醫療、康基醫療等這類基本面優秀的明星股,其餘是素質一般但由於行業等某些因素被市場猛炒的小盤股,如興業物聯、燁星集團、新石文化、移卡。

如果採用盲打策略,上半年的每一隻新股都申購並中簽一手,調整中簽率後的期望總收益大概有6000港元。

所以,上半年的打新策略相對簡單,跟著市場熱度走,精選優質股並重點申購就能獲得較好的收益,激進的投資者也可以搏冷申購冷門股。

後市展望:全年約130隻新股,生物醫藥是亮點

雖然新冠疫情對部分行業造成衝擊,拖累了上市進度,但可以看到二季度開始進程在慢慢加快,7月份將至少有24隻新股上市,預計全年香港新股市場表現將保持整體穩定。

根據德勤報告,預計2020年將有130隻新股上市,集資1600-2200億港元。同股不同權公司和第二上市公司將於8月被納入恒指和國企指數,對中概股回港上市有促進作用,預計下半年還可能有3-6隻中概股回港,根據此前新聞報導,百勝中國、中通、萬國資料、百度等正在籌劃二次上市。此外,醫療、生物科技、TMT新股會繼續成為市場亮點。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.