龍頭券商合併傳聞被否認!起風牛市行情被澆冷水

今日盤後,一則重磅消息刷屏了朋友圈:

據彭博社報道,中信證券(600030)和中信建投證券內部均同意了一項合併計劃。中信證券母公司--中信集團將作為主要買家,向中央匯金投資有限責任公司購買中信建投股權。兩家券商合併將打造一家規模820億美元的投資銀行巨擘。

但後來,中信建投發佈澄清公告稱,今日下午,本公司注意到有媒體報道稱,本公司黨委會已經批准了關於中國中信集團有限公司將收購本公司第二大股東中央匯金投資有限責任公司所持本公司股份的相關計劃,以此推動中信證券股份有限公司和本公司的合併。截至目前,本公司未曾召開過黨委會審議批准上述傳聞所稱的相關計劃,也未得到任何股東有關上述傳聞的書面或口頭的信息,本公司不存在應披露而未披露的信息。

另外,中信證券也發佈了澄清公告:

今日券商之行情,非常勁爆,截止收盤,券商ETF大漲8%,其中,中泰證券、招商證券、光大證券、山西證券、浙商證券、太平洋、中信建投、南京證券、國金證券、華安證券、哈投股份、天風證券等12只券商股漲停,國海、中原證券大漲超8%。

尤其注意的是,中信建投強勢漲停,最新總市值高達3315.47億元。而中信證券大漲5.42%,最新市值為3368.72億元。中信建投僅比中信證券少53.25億元。

而中信證券、中信建投被視為“父子”與“兒子”的關係。沒想到剝離開之後,成為A股市值最大的兩家券商巨頭。第三名為華泰證券,市值僅為1863億元,比前兩者要第一個台階。

從主力資金流向來看,今日券商板塊資金淨流入超過百億,半導體和房地產板塊均有數十億的資金流入,醫藥生物板塊資金則流出逾10億元。

(來源:Wind)

券商行情的火爆,或許跟下午的傳聞有一定關聯。不少投資也認為當下與2005年、2014年底的牛市啟動階段的行情非常類似。不過中信證券、中信建投的雙雙澄清,給已經起風的勁爆行情澆了一盆冷水。

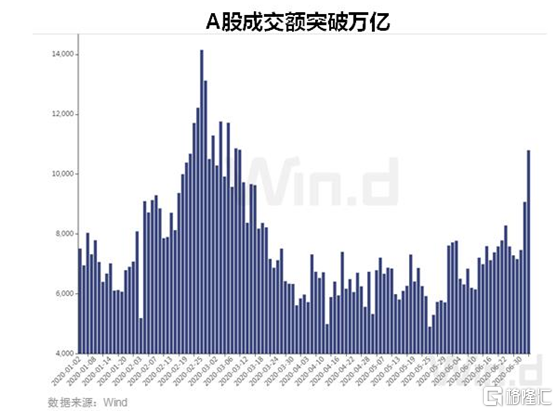

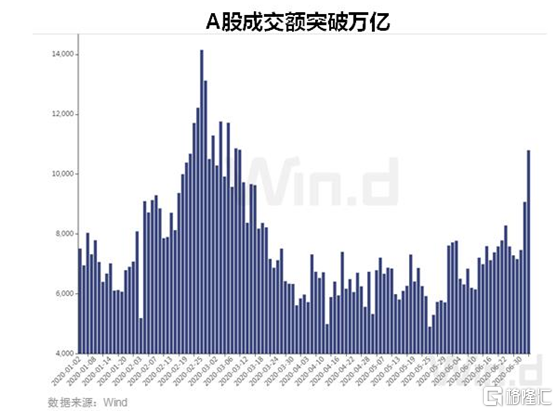

不過,今日滬深兩市時隔4個月成交突破1萬億元。此外,兩融餘額疊創新高,槓桿資金跑步進場。自六月以來,兩融餘額大增接近千億,同時場外配資近期也活躍起來。

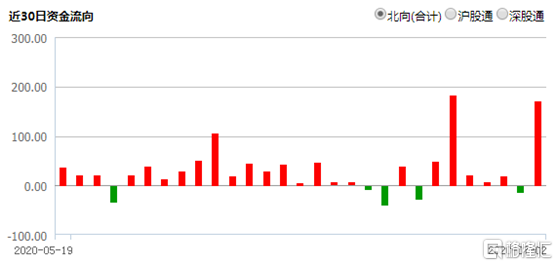

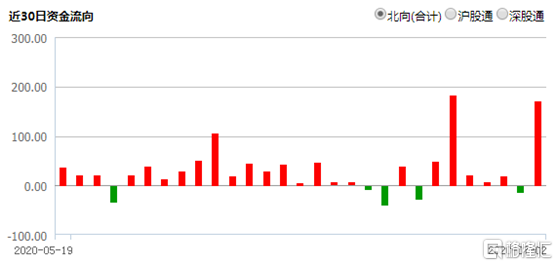

另外,北上資金今日大舉殺入A股,總計淨流入171.15億元,創6月19日以來新高。

種種跡象表明,市場情緒有點被帶動起來了。不料來了一盆冷水,但明天券商如何演繹,拭目以待。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.