美團點評-W(03690.HK):從生鮮O2O更迭探討美團新業務發展之路,維持“買入”評級

機構:廣發證券

評級:買入

核心觀點:

O2O重塑萬億生鮮市場,多元商業模式並存。生鮮O2O從 2014年興起到 2016 年完成洗牌,發展至今已形成四種主流商業模式:前置倉模式(叮咚買菜、每日優鮮、美團買菜)、“到店+到家”模式(盒馬鮮生、永輝生活)、平台模式(京東到家、美團閃購、餓了麼)、社區拼團模式(十薈團),其發展主要圍繞:(1)線上和線下並行擴大用户羣;(2)精準定位,差異選品,提升客單價;(3)加強履約及供應鏈能力,優化體驗,提升復購率;(4)精細運營,降低成本,改善盈利。綜合評估後,我們認為分佈式建設的前置倉模式更優,具備規模化擴張潛力。

前置倉呈現 U 型盈利模型,整體市場有望加速發展。前置倉的盈利模式呈現“U”型特徵,規模化初期階段或因運營和供應鏈的加大投入導致盈利下滑,隨後隨着規模化再呈現增長,目前部分區域已成功跑通。受疫情驅動,前置倉市場有望加速發展,我們預計未來 3 年將完成一二線城市的覆蓋(開城紅利,從 0到1),隨後進行存量加密和低線下沉(下沉紅利,從 1到N),預計 2025 年總交易額有望突破千億。

“平台+自營”雙管齊下,美團積極佈局生鮮賽道。生鮮作為公司“Food戰略的延伸,無論是尋求長期增長,還是防止競對彎道趕超,其發展具有必然性。公司藉助流量體系、配送網絡的優勢,過去 4 年先後嘗試了前店後倉、閃購平台和前置倉等多種模式,19年各類生鮮業務的總交易規模近 200 億,佔生鮮電商市場 5.65%。閃購平台伴隨場景突破和整體單量持續增長,前置倉將為自營模式發展重點,20年 5月已在全國鋪設145個倉, 經過加速擴張期後長期有望佔據25%的市場份額。

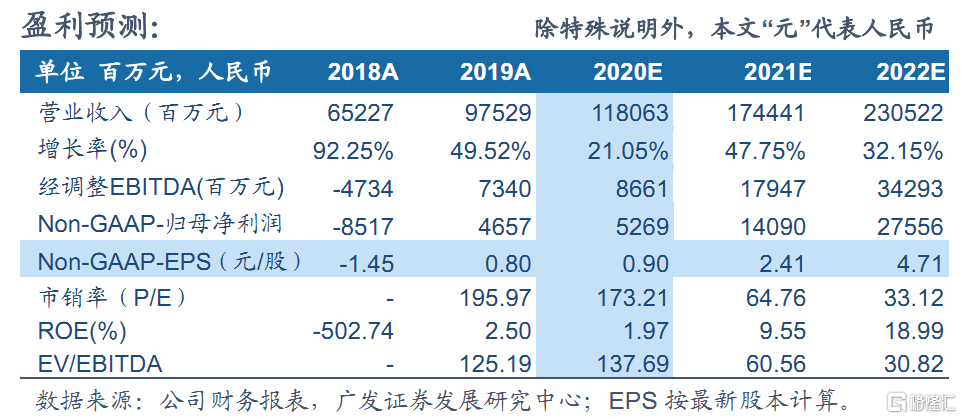

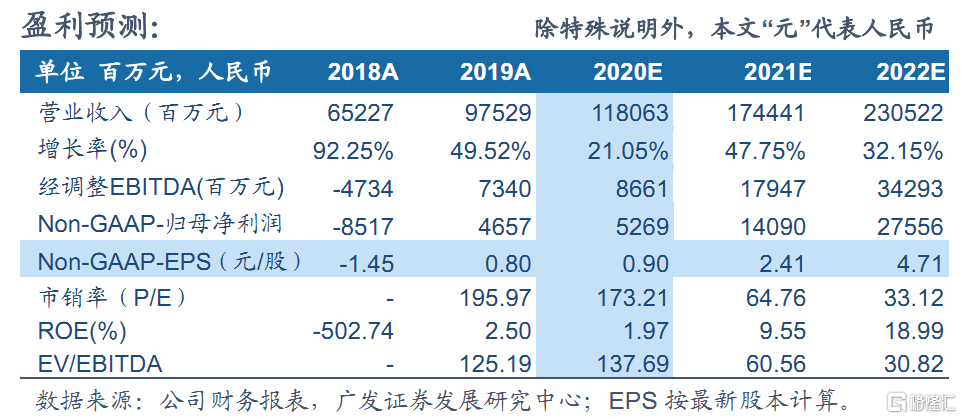

投資建議:美團作為本地生活服務龍頭,從餐飲向生鮮延伸,不斷拓展業務版圖。 未來將繼續加大閃購平台和美團買菜的投入, 生鮮營收將在21 年突破百億並保持快速增長,分部的遠期估值達到千億級別。預計公司 20~22年整體調整淨利潤為 53/141/276 億元,維持“買入”評級。

風險提示:線上需求提升低於預期,行業競爭加劇,難以規模化複製。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.