新股速遞 | 金融街物業今起招股,一手入場費7,636.18港元,國泰君安保薦,引入4名基石

uSMART友信智投6月19日消息,金融街物業(1502.HK)今起招股,金融街物業是一家中國國有綜合物業管理公司,於業內有25年以上經驗。根據中指院報告,就綜合實力而言在2020年中國物業服務百強企業中排名第16位。

下圖為招股簡況:

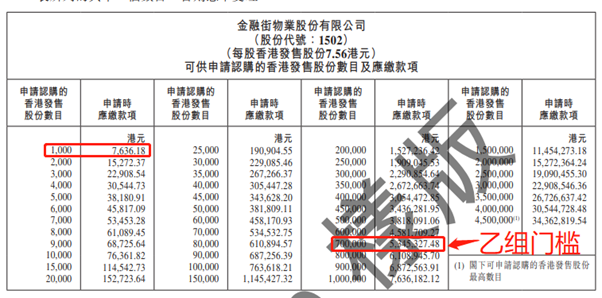

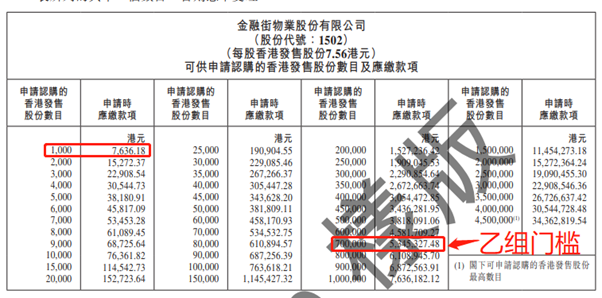

申請檔位及對應金額:

圖片來源:披露易

優勢看點:

1、純利複合年增長率為17.1%

金融街物業的總收入由截至2017年的7.57億元(單位:人民幣,下同)增加至截至2019年12月31日止年度的9.97億元,複合年增長率為14.8%。年內溢利由2017年的8270萬元增加至截至2019年12月31日止年度的1.13億元,複合年增長率為17.1%。

2、獨家保薦人暗盤戰績尚可

獨家保薦人為國泰君安,國泰君安近兩年保薦了10個項目,暗盤戰績8勝2負,首日戰績4勝3平3負。

3、國有物業企業,背靠集團

公司的三位主要股東分別為中國人壽保險間接持有29.49%;金融街集團間接持有47.52%;以管理層為主的員工持股22.99%。

於往績記錄期,金融街物業大部分收入乃產生自向金融街聯屬集團的專案提供物業管理及相關服務,有關收入分別佔金融街物業截至2017年、2018年及2019年12月31日止年度物業管理及相關服務收入的83.5%、83.4%及81.1%。

4、物業股IPO成績佳,上市後"氣勢如虹"

2018年11月以來,共有15隻物業股赴港IPO,暗盤11升1平3跌,首日12升2跌1平。上市後的股價走勢可謂"牛氣沖天",上市至今(截至19日12:00),新城悅服務累升662.17%,永升生活服務升601.71%,奧園健康升142.26%,保利物業升137.75%。

圖片來源:uSMART友信智投

風險提示:

金融街物業在招股書提示,無法保證日後的收入會有所增加,或將繼續維持穩定的收入及利潤增長率。因此,投資者不應以過往業績作為其未來財務或經營業績指標的依據。

抽新股有風險,請投資者閱讀招股書檔《金融街物業招股書》後做出是否申購的選擇。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.