驚天逆轉,兩大板塊立大功!中報業績暴增股來了,5股估值將跌至白菜價

來源:數據寶

早盤A股低開走高,創業板指強勢翻紅。早盤逆勢上漲的板塊中,出現了半年報預增板塊的身影。

美股又經歷暴跌的一夜,再一次印證了沒有什麼不可能。截至收盤,道瓊斯指數下跌1861.82點,美國近十年的歷史中,道指暴跌千點以上的僅有10次,僅2020年不到半年時間就發生了8次。

A股低開高走,創業板指強勢翻紅

早間,比A股開盤較早的日經225指數、韓國綜合指數開盤跳空下跌,而上證指數開盤瞬間跌幅一度達到1.5%。截至午盤收盤,A股三大指數中,滬指、深成指跌幅均不超過0.5%,創業板指翻紅微漲0.11%。市場下跌股數量接近八成,部分股價處於高位股今日早盤直線跌停,如實達集團、濟民製藥、吉林高速等。

以開盤價來計算,A股總市值較前一日蒸發1.21萬億,中國人壽、中國平安、貴州茅台3股市值蒸發超過150億。截至午盤收盤,上證指數跌幅收窄至0.38%,A股總市值較前一日蒸發3100億,市值縮水較嚴重的有中國平安、寧德時代、招商銀行等。

大消費、大醫藥板塊逆勢上漲

從板塊表現來看,醫療器械、生物疫苗、流感、酒店餐飲等以醫藥、消費為主的板塊今日逆勢上漲,更有多家公司逆勢漲停,如英科醫療、賽升藥業、全聚德等。

醫藥板塊今日的上漲,或與北京昨日通報的1例新增本土確診病例有關,據初步調查顯示,該患者表示近2周無出京史,無外來人員密切接觸史,該病例引起了政府的高度重視。

具體來看,漲停股賽升藥業、英科醫療均屬於醫藥板塊,兩家公司分別涉及抗病毒藥物、醫用手套業務;王府井、全聚德、供銷大集也逆勢漲停,3股分別涉及商業貿易相關細分領域。

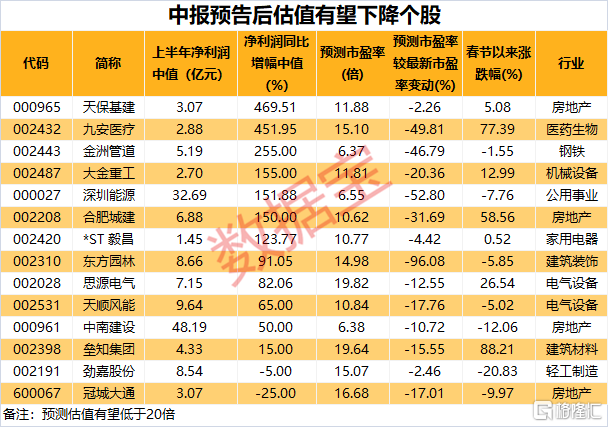

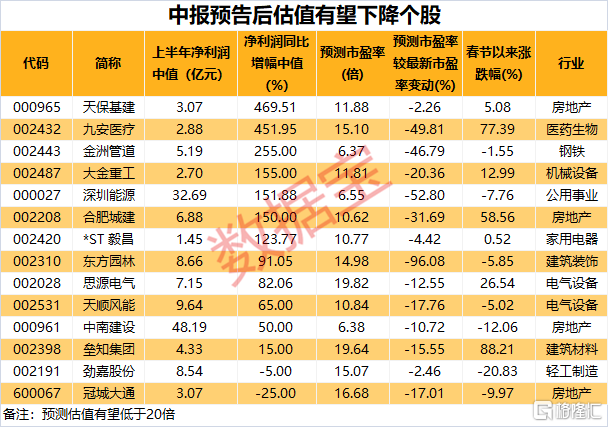

中報預告後,5股估值有望下降至20倍以內

早盤逆勢上漲的板塊中,出現了半年報預增板塊的身影。截至當前,僅有150餘股披露中報預告相關數據,以中報預告中值估算,中報披露後估值下降且滾動市盈率低於20倍的個股僅有14只,其中5股最新滾動市盈率超過20倍。

具體來看,東方園林最新估值超過300倍,其上半年預告淨利潤中值8.66億元,同比增幅中值91.05%,據此測算預測滾動市盈率不到15倍。九安醫療最新估值超過30倍,預測估值15.1倍,其上半年淨利潤增幅中值高達451.95%,其主要業務涉及醫療器械,包括血壓計等;疫情期間,公司擴大產能,業績大幅增長。冠城大通、壘知集團、思源電氣3股最新市盈率均超過20倍,根據中報預告測算滾動市盈率均低於20倍。

另外,中南建設、深圳能源等預測市盈率均低於10倍,天保基建、天順風能等股預測市盈率較最新市盈率均有不同幅度的下降。

從中報預告來看,除勁嘉股份、冠城大通有所下滑外,其餘12股淨利潤均有望上漲。淨利潤有望翻倍的除了九安醫療外,天保基建、金洲管道、大金重工、深圳能源、合肥城建5股上半年淨利潤增幅均有望超過150%。

市場表現來看,自春節以來截至6月11日,壘知集團、九安醫療、合肥城建3股累計上漲超過50%,勁嘉股份、中南建設跌幅均超過10%。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.