港股異動 | COOL LINK急跌插水90%,又見金利豐身影

uSMART友信智投6月5日消息,週五港股午後開市沒多久,新加坡食品進口商及出口商COOL LINK上演高台插水,直線暴跌90%,股價一度跌到0.182港元,創歷史最低。截至北京時間15時19分,COOL LINK跌83.42%,報0.305港元。

圖片來源:uSMART友信智投

而在昨日的午後,類似的一幕發生在宏安地產身上,午後突然直線高台插水60%,詳情可點擊回顧uSMART友信智投昨日推送的《港股異動 | 慘遭機構"血洗"!宏安地產午後股價插水60%》,經紀商淨賣出榜首的金利豐或為"砸盤元兇"。

圖片來源:uSMART友信智投

昨日割完宏安地產,今日如法炮製COOL LINK?

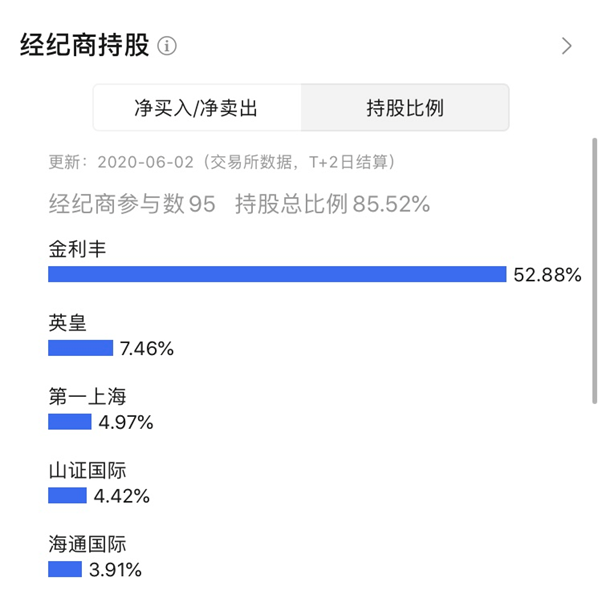

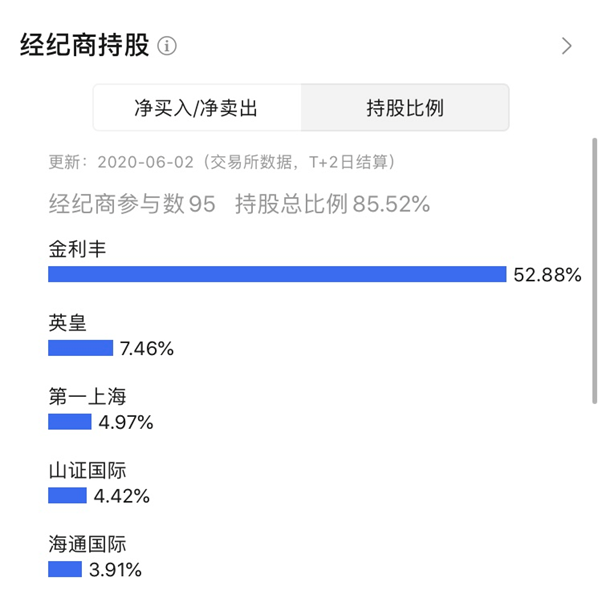

COOL LINK與金利豐也有著極大的聯繫。uSMART友信智投APP的經紀商持股比例顯示,截至2020年6月2日,金利豐為COOL LINK的第一大持股經紀商,持股比例高達52.88%。英皇為第二大持股經紀商7.46%,第一上海為第三大持股經紀商4.97%,山證國際為第四大持股經紀商4.42%,海通國際為第五大持股經紀商3.91%。

uSMART友信智投綜合了三家券商的經紀商交易榜單(每家的統計方式略有不同,顯示的資料均為估算值),山證國際、金利豐、英皇證券均位居淨賣出經紀商榜單前列。

COOL LINK的股權高度集中,截至2020年3月31日資料顯示,公司前三大股東的持股比例高達65.14%。

這或許又可以解讀為莊家"暴力洗倉"。

分析師:金利豐為香港頗有名氣的細價股莊家

《證券時報》引述香港某券商分析師的話術稱,金利豐為香港頗有名氣的細價股莊家。自2018年以來,金利豐已遭香港證監會多次“照顧”。

據《證券時報》的統計,截至2019年7月,金利豐合計持有206家香港創業板股票,且這206家股票共同點皆為:市值小、細價股、業績差、總股本偏大。這206檔股票中,出現過急跌50%以上的個股就有69隻,占比33%,盤中最大跌幅在70%以上的個股有31隻,急跌90%以上的有5隻,盤中最大跌幅的個股為星亞控股(8293.HK),達到98.06%,該股還曾被香港證監會點名股權高度集中。

風險提示:此類細價莊股,一旦遭遇急跌,股價基本上長期在底部摩擦,投資者需小心抄底風險。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.