港股又見暴跌!宏安地產突然急挫70%,金利豐或為砸盤元兇

6月4日消息,港股宏安地產(01243)在午市開盤後立即遭遇天量的拋單洗倉,在開市後一分鐘內,大量數十萬、上百萬手的賣單突然而至,導致股價迅速暴跌超60%。

截至發稿時間,股價報0.26港元,成交2.21億港元,最新市值39.52億港元,相對上日蒸發掉了超90億港元。

從消息面上看,截至目前並確切的針對該公司明顯利空的消息,公司方面亦未有對股價暴跌事件迴應。

公司資料顯示,公司為一家香港物業發展商及擁有人,主要業務包括物業發展及物業投資,專注於發展住宅和商用物業以供銷售及投資商用及工業物業以獲取資本增值。公司的法人代表陳振靜,實際控股股東為鄧清河,其與其配偶遊育燕合計控股75%,為公司第一大股東,股權較為集中。

同時,鄧清河是宏安地產公司母公司宏安集團有限公司(1222.HK)的實際控制人(持股28.68%),以及港股公司位元堂(0897.HK)的控股股東(持股58.08%)、易易壹金融(0221.HK)的控股股東。

而陳振靜亦為宏安地產、宏安集團、位元堂藥業、易易壹金融以及中國農產品交易(0149.HK)的行政總裁兼主席。

宏安地產的業績方面,據wind數據顯示,截止2019年9月6個月財報,公司營收20.13億元,同比下滑18.43%,淨利潤5.23億元,同比增長5.28%。

從上述幾家公司近期的消息面看,控股股東鄧清河方面並沒有明顯的問題,並且鄧清河在上月還建議將易易壹金融以溢價約44.38%的方式集團私有化,顯示資金面並沒有明顯壓力問題。

從盤面看,上述與鄧清河有關的上市公司中,除了暴跌的宏安地產外,其餘個股並未見有波及,股價波動及成交量並未見明顯放大。

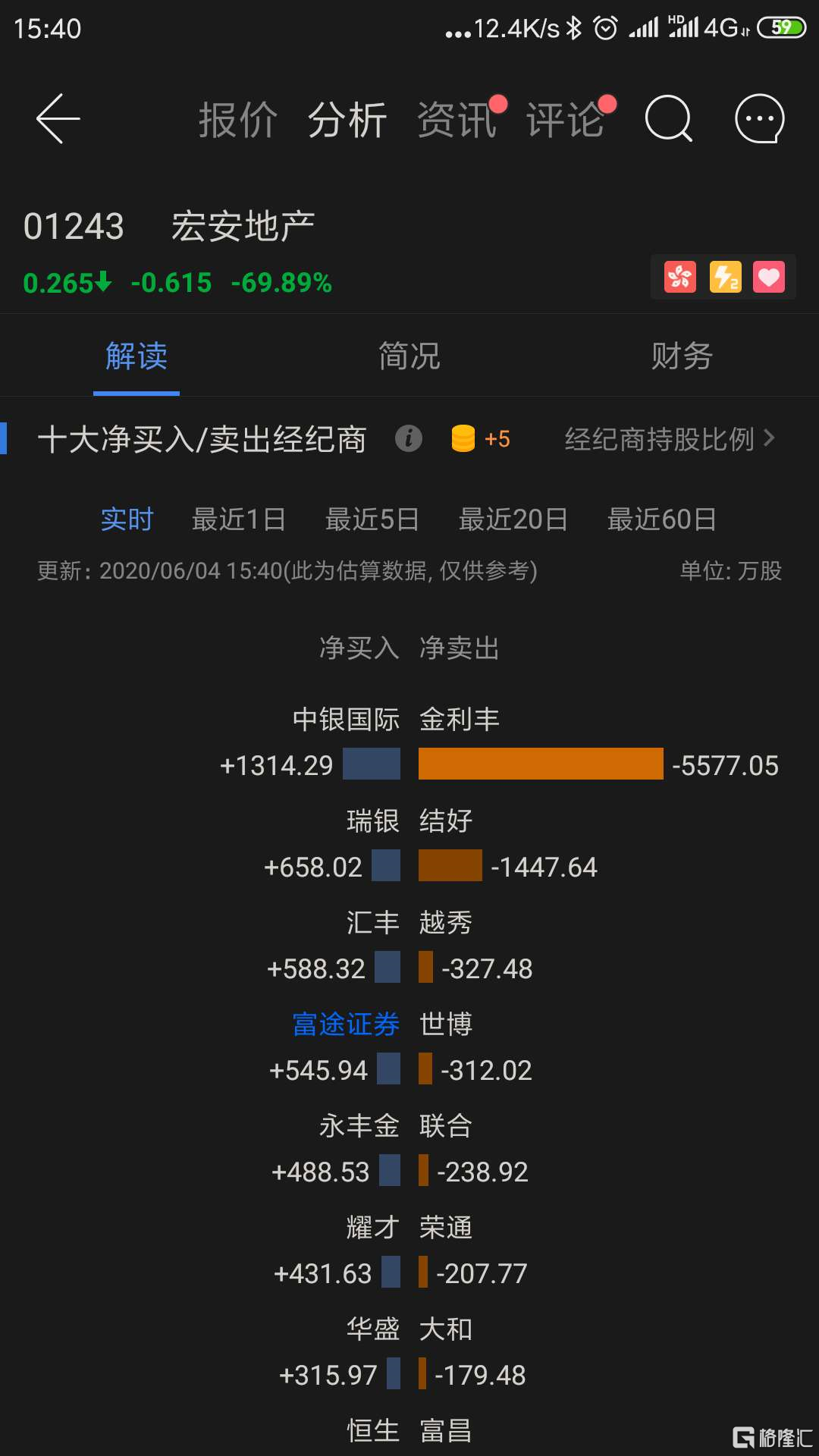

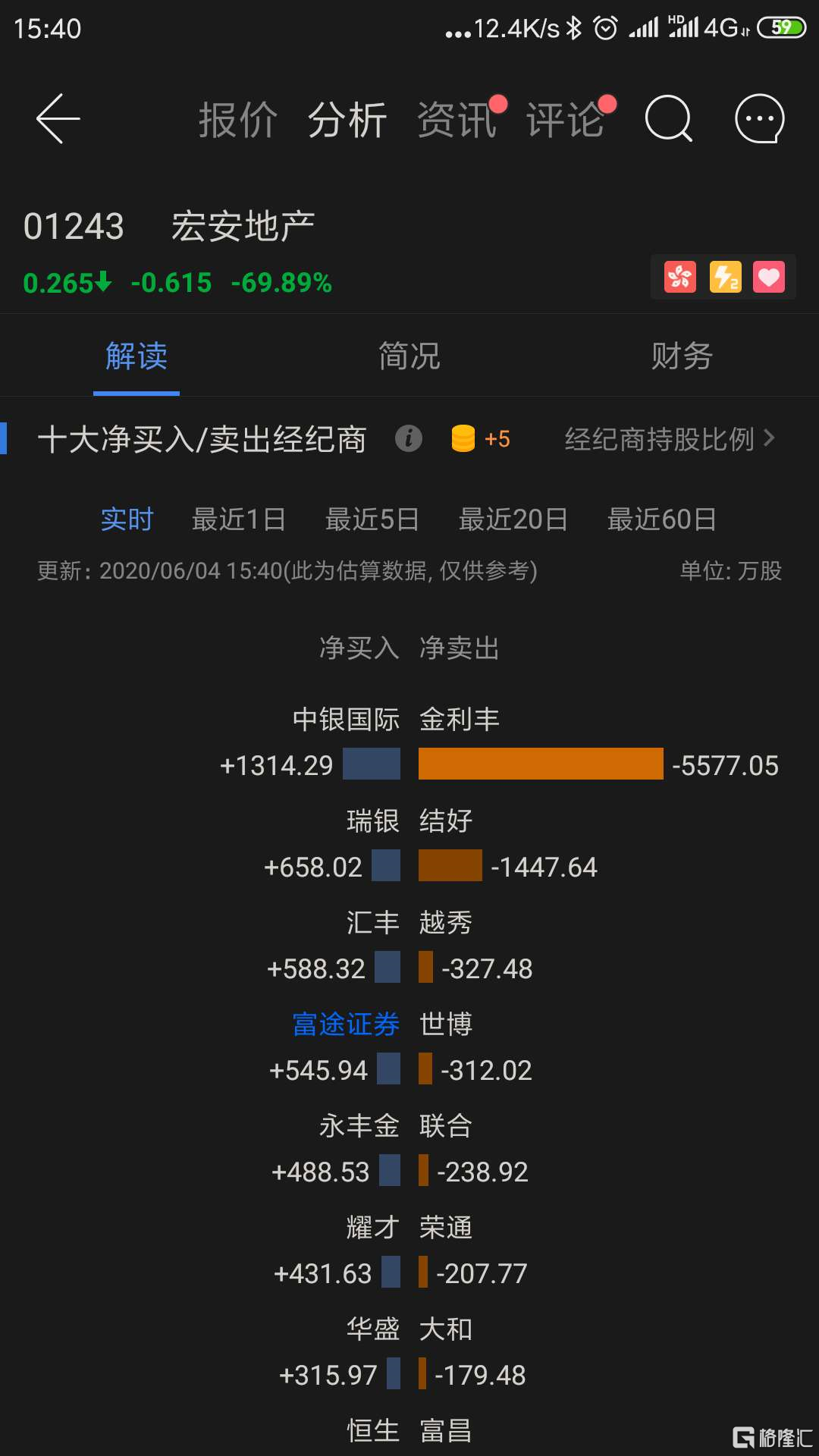

有分析認為,宏安地產的第二大經紀商為港股知名的大莊股券商金利豐證券,持倉16.68%,或是今日砸盤的元兇。據富途證券行情數據,今日淨賣出爆表的經紀商正是金利豐,截至下午15:40分,金利豐累計拋售了5577萬股,另外,結好經紀渠道也有加快拋售的趨勢,合計賣出了1447.64萬股。

分析稱,金利豐作為近年來港股運作細價股炒殼的方式而聞名金融圈內,但近兩年來,隨着香港證監會對金利豐的持續嚴查,後者被迫多次在二級市場上砍倉所持有的細價股,引發多次引人注目的港股個股突然崩盤的事件。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.