中國生物製藥(01177.HK):Q1疫情階段仍正增長,長期優質屬性突出,維持“增持”評級

機構:國泰君安

評級:增持

本報告導讀:

公司發佈 2020年一季報業績,Q1 腫瘤、抗感染、呼吸業務受疫情拉動,其他產品隨治療需求收入增速減緩,隨國內疫情穩定及新產品放量,增長可期,維持增持評級。

摘要:

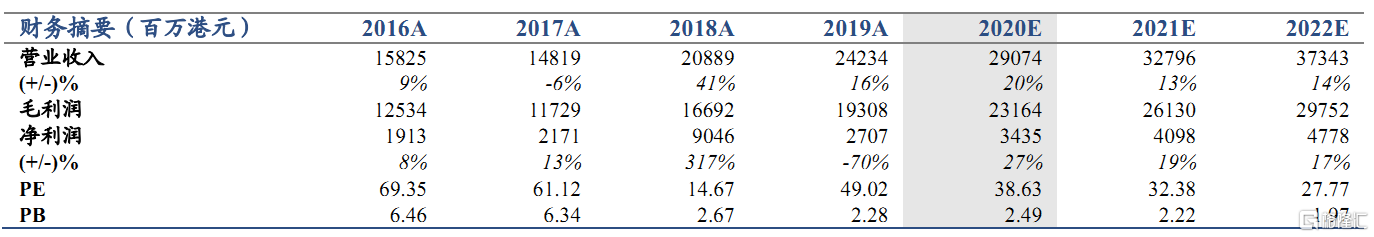

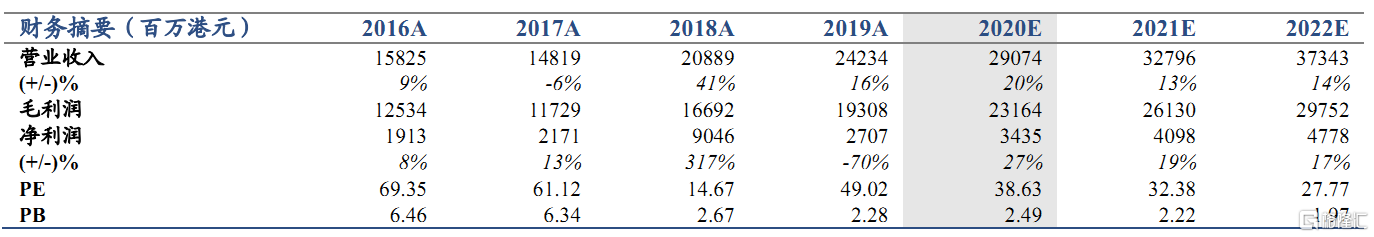

維持“增持”評級。公司發佈 2020年一季報,Q1實現收入 62.22億元,同比增長0.2%;歸屬於母公司持有者應占盈利為(歸母淨利潤)8.62億元,同比增長0.6%;歸屬於母公司持有者應占基本盈利(扣非後歸母淨利潤)為8.34億元,同比減少14.6%。我們維持公司2020-2022年EPS 預測值 0.27/0.33/0.38元,考慮到公司大品種研發成果不斷落地,產品線不斷創新升級,上調目標價至14.98港元(原為13.80港元),維持增持評級。

收入在疫情階段仍有正增長,費用增速高於收入增速。 在疫情影響下,腫瘤領域(同比+61.2%)、抗感染領域(同比+41.9%)、呼吸系統(同比+12.3%)、骨科領域(同比+10.9%)有正向增長,尤其是腫瘤、抗感染和呼吸領域受疫情有較高拉動,其它如心血管領域、消化系統領域等,由於屬於非疫情剛需用藥,同時注射劑品種較多,因此受疫情期間住院病人減少的影響,收入有所下滑,正負影響對衝下,收入增速+0.2%。 費用端增速高於收入增速: 銷售費用24.90億元,同比+1.47%(2019Q1同比增速為23.57%),疫情期間院內活動受限,使得銷售費用增速較小;2)研發費用 9.85億元,同比+9.17%(2019Q1同比增速為41.32%),雖然研發增速趨緩,但費用化的研發投入在總營收中佔比不斷提升,2019Q1、2019A、2020Q1 在總營收中佔比分別為13.9%、9.9%、15.7%;3)行政費用 4.69億元,同比-8.25%,財務成本 0.90億元,同比+157.59%。

腫瘤成為第一大收入佔比,新產品地位愈發突出。2020Q1腫瘤藥物收入19.85億元,佔比總營收 32%,為公司第一大收入來源。我們預計,憑藉強大的銷售網絡,安羅替尼約有近10 億銷售額,其他腫瘤產品受益於安羅替尼快速鋪設的 3000人腫瘤團隊,在交通受管制的疫情期間,憑藉下沉渠道仍有較好收入。新產品地位越發突出,新產品所佔營收在2019Q1、2019A、2020Q1佔比分別為17.7%、20.7%、32.9%。2019年公司有26個新產品獲批上市(含補充批件和腫瘤藥新適應症批件),其中不乏來那度胺、阿比特龍、阿扎胞苷、苯達莫司汀、布地奈德等競爭格局和市場容量較好的品種,在前列地爾、恩替卡韋、氟比洛芬酯等既往大品種體量不斷縮水的形勢下為公司及時補充業績新支撐力,長期看公司優質屬性依舊突出。

催化劑:新產品及新適應症的研發進展,光腳品種的放量。

風險提示:帶量採購的風險;新藥研發的不確定性風險。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.