旅遊板塊飄紅走強!消費情緒反彈消化利空情緒

格隆匯 05-29 10:46

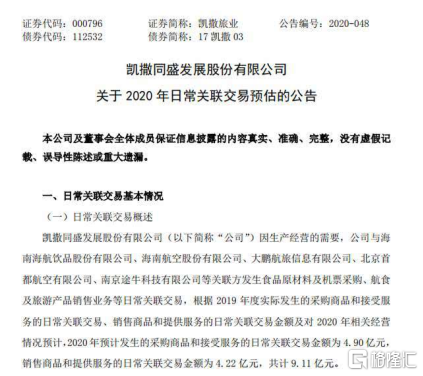

5月29日,A股旅遊板塊漲勢強勢,其中,凱撒旅業拉昇漲停,眾信旅遊漲超8%,中國國旅、騰邦國際、西安旅遊、雲南旅遊等有所跟漲。

來源於:Wind

而支撐這一漲勢背後的原因,除了受此前凱撒宣佈與途牛達成戰略合作,進而帶動旅遊板塊的整體拉昇之外,還是在於隨着國內疫情防控常態化,趨於平穩,再加上政策刺激消費的利好釋放,市場情緒對人們出遊預期向好有關。

來源於:官方公告

雖然就全球範圍內來説,新冠疫情這隻黑天鵝已然重創了旅遊業,其中,根據中國旅遊研究院測算,2020年一季度及全年,國內旅遊人次或將分別下降56%和15.5%,國內旅遊收入或將分別下降69%和20.6%,預計全年國內旅遊人次或將同比減少9.32億人次,減收或達1.18萬億元。

但基於目前國內疫情趨勢向好,消費的恢復受政策利好而得到有效引導,市場或對旅遊板塊的向好預期有所提升,根據中國社會科學院旅遊研究中心等機構發佈的4月《新冠肺炎疫情下的旅遊需求趨勢調研報告》顯示,79%的人對旅遊持正面積極態度,認可旅遊活動的價值,對旅遊具有較強的情感偏好。

東方證券認為,旅遊板塊業績利空逐步釋放帶動整體板塊估值修復,隨着各地消費提振政策落地,市場對板塊短期改善預期提升。站在當前時間點,無論是長期優質白馬,抑或是板塊彈性品種酒店、景區,均已處於歷史估值大底,具備較高的配置性價比。

民生證券分析師指出,由於國內疫情發展時間較早,且政府管制力度較大,目前國內疫情趨於平穩,若政府繼續對海外疫情輸入管控得當,我們認為暑期國內遊有望較出境遊率先恢復,同時部分出境遊需求或將轉向國內遊,對國內休閒景區、離島免税等子板塊形成利好。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.