石药集团(01093.HK):疫情影响下仍经营稳健,拟科创板CDR发行引活水,维持“买入”评级

机构:光大证券

评级:买入

疫情影响下 Q1业绩略超预期。公司20Q1 收入61.3 亿元(+11.5%) ,经营溢利11.6亿元(+0.6%),归母净利润11.6 亿元(+21.8%),每股盈利18.59 分(+21.8%),收入端增速略超市场预期。毛利率同比提升 4.0pp至73.9%,公司盈利结构持续优化。此外,在六大疾病领域核心品种驱动下成药业务增长18.3%,原料药增长放缓。

成药业务表现理想,心脑血管与呼吸条线成亮点。1)成药产品线表现靓丽,Q1 营收达到 50.22 亿元(+18.3%) 。其中神经系统用药收入 16.5亿元(-4.3%),恩必普持续市场下沉,Q1 仍增长18.1%至 14.5 亿元,考虑到终端下沉与学术推广齐发力,预计全年有望保持较快增长。2)其他板块中,心血管产品收入5.82 亿元(+66.5%),其中恩存于19年集采中标已带来增量收入,玄宁恢复快速增长;呼吸系统用药收入 1.9 亿元(+98.9%)中,琦效受疫情影响录得可观收入。

克艾力销售强劲,抗肿瘤产品线增长动力充足。抗肿瘤产品 Q1 营收达15.52亿元(+53.7%,15-19 年CAGR 达87%) 。其中,多美素和津优力销售同比分别增长 13.7%/64.5%;克艾力受益于产品起效快与线上推广,贡献超 5 亿元(+114%) ,降价纳入集采后有望迎来渗透率大幅提升和对普通剂型的替代空间,预计 20 年有望实现 25%以上增长。随着公司在抗肿瘤领域影响力的逐步建立,预计该板块未来几年有望维持强劲增长。

研发投入强劲,管线稳步推进。公司研发力度持续增加,Q1 研发费用达5.68亿元,占成药收入比重为11.3%,处于行业领先水平且有望持续加码。仿制药共有 23个品种、35 个品规通过一致性评价,有望借助带量采购政策快速切入市场。新药方面,新型制剂、大分子和小分子研发平台各具特色,预计 21~22 年有望每年推动 3~5 个新药品种上市,其中两性霉素B脂质体、米托蒽醌脂质体、RANKL、PI3K抑制剂有望于20~21年获批,预计将成为公司新一代重磅产品。

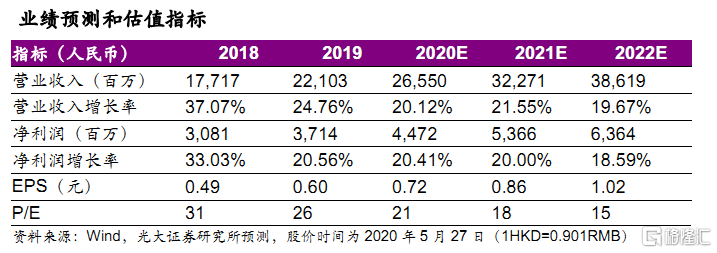

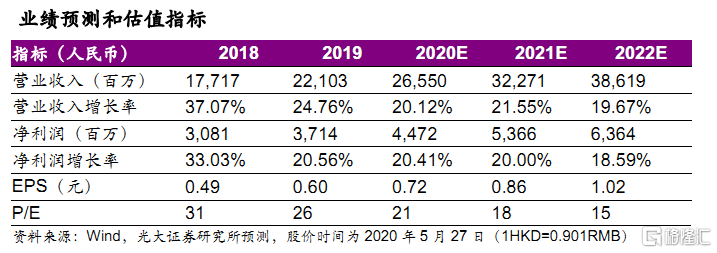

盈利预测与投资评级。疫情对1季度的影响有限,销售和研发层面各项进展正陆续恢复,此外公司披露拟进行人民币股份或中国存托凭证发行并于科创板上市,有望拓宽融资渠道。我们维持 20~22 年 EPS 预测为0.72/0.86/1.02 元,对应20~22年 PE分别为21/18/15x。公司储备重磅品种有望有序上市,当前估值具吸引力,维持“买入”评级。

风险提示:原料药价格波动,产品销售不及预期,研发不及预期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.