英國負利率來了!疫情之下不得不做的選擇

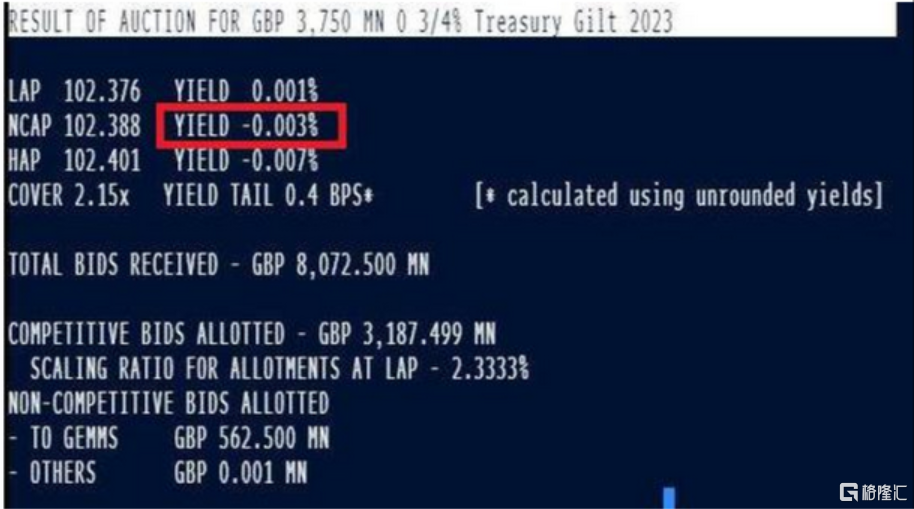

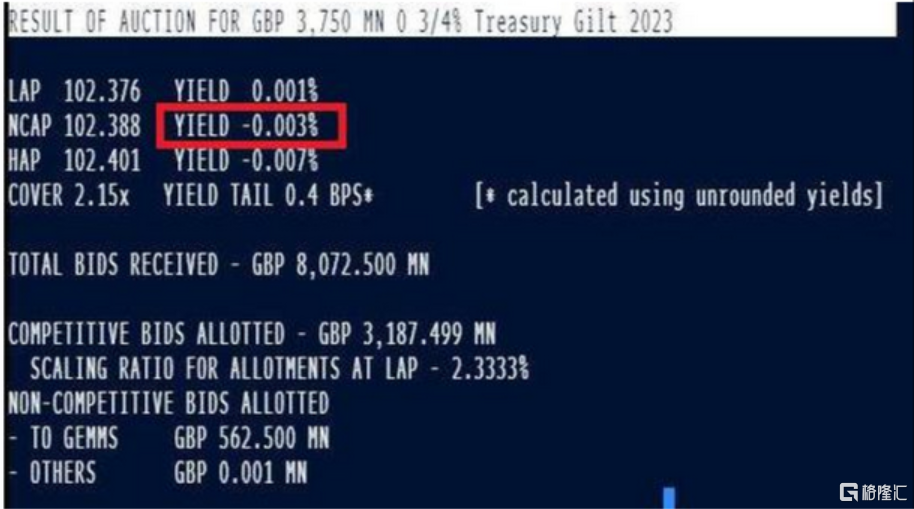

北京時間5月20日消息,英國首次以負利率發行了37.5億英鎊2023年到期的國債,收益率為-0.003%。

在此前英國央行官員一直是反對將利率降至零以下,因為直接損害銀行利益,前英國央行行長馬克-卡尼表示負利率會毀了英國,而英國央行行長安德魯·貝利在5月14日就表示“負利率這不是我們目前正在計劃或考慮的事情,這是一個重大的溝通挑戰,並且對銀行來説將是困難的。"

自3月23日英國封城之後經濟遭受重大打擊,,根據數據顯示4月份英國申領失業救濟金人數高達近210萬人,為24年來最高水平,環比增加85.6萬人,增幅為69.1%,是1971年有記錄以來最大增幅;同比增加101.7萬人,增幅達94.2%。同時英國統計署的初步估測,一季度英國GDP環比下降2%,是2008年金融危機以來的最大降幅,在3月GDP環比下降就達到5.8%,再加上疫情仍然沒有出現拐點,截至當地時間5月18日9時,英國新冠肺炎確診病例達246406例,單日新增2684例。

所以在當前,英國脱歐的擔憂加上新冠疫情的封城,造成的結果是英國經濟是近100年來最嚴重衰退,英國政府不得不做出改變。

在英國央行負責制定利率的官員西爾瓦娜·坦雷羅18日參加倫敦政治經濟學院的一場視頻研討會時,談及負利率的益處。“我個人認為,縱觀歐洲的經驗,負利率具有積極意義。”同時在週二英國央行委員滕雷羅表示:我個人的觀點是負利率對歐洲產生了積極影響。

此次實行的負利率也僅僅是在國債方面,銀行股價反應並沒有太大反應,截至發稿時間,英國股市當中的銀行股也僅僅是略微跌幅,其中渣打集團跌幅1.35%,勞埃德銀行集團跌0.63%。

實施負利率,首先利好黃金,截至發稿時間倫敦金(現貨黃金)漲0.29%報1750.17點,並且黃金指數從最低點1451.55點至今,刷新了9年以來的新高,有望衝擊1800點。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.