半導體行業到底有多火?一份季報給出了答案

作者:李興彩

來源: 上海證券報

剛剛宣佈衝刺科創板,中芯國際又披露其一季度實現營收和利潤高增長,且二季度業績指引依然保持樂觀,半導體行業的高景氣度可見一斑。

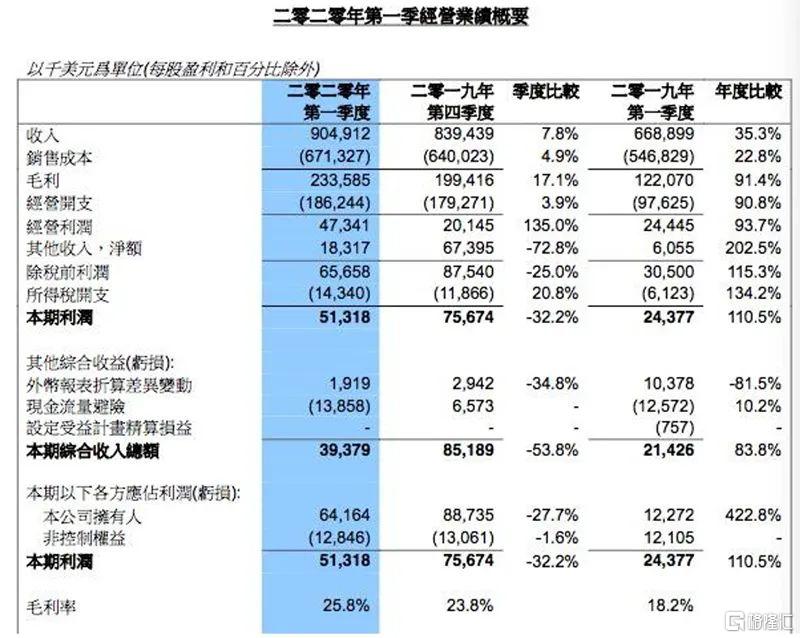

營收和利潤大增

中芯國際5月13日晚間在港交所發佈一季度報告,今年第一季度實現收入9.05億美元,環比去年第四季度增加7.8%,同比去年一季度大增35.3%,創歷史新高;實現淨利潤6416.4萬美元,環比減少27.7%,同比增加422.8%。

對於靚麗的一季報,中芯國際聯合首席執行官趙海軍和樑夢鬆表示,由於市場需求和產品結構優於預期,公司一季度營收創出新高。產品方面,通訊、電腦與消費電子相關營收同比增長,逐步增加市場份額。

中芯國際營收再創新高的同時,毛利率也大幅提升。公司第一季度毛利率25.8%,環比去年第四季度的23.8%、同比去年第一季度的18.2%,均有提升。

12nm業務已貢獻業績

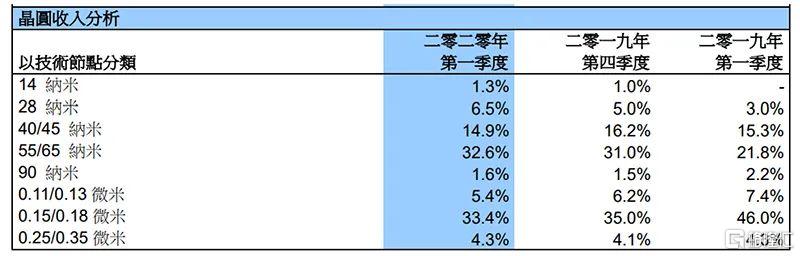

縱覽一季報,雖然中芯國際沒有特別提及先進製程,但各種跡象表明,其在先進製程量產方面又取得了新進展。

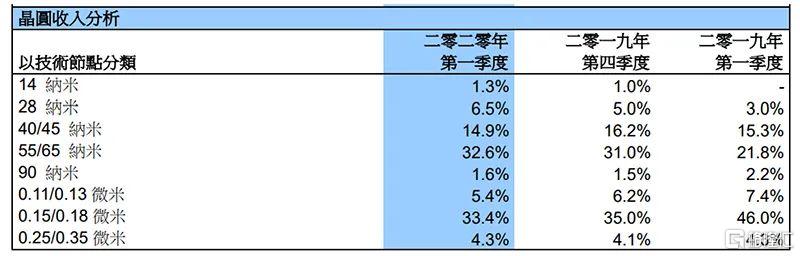

具體到一季報中,中芯國際在28nm上的業務營收佔比為6.5%,去年第一季度、第四季度的佔比分別為3%、5%;在14nm上的營收佔比則為1.3%,也高於去年四季度的1%。

上證報記者獲悉,除了14nm工藝的營收繼續增長,中芯國際的12nm工藝也已經開始貢獻業績。更有業內人士對記者透露,相比14/12nm這個過渡性工藝,中芯國際的“N+1”更為值得期待。

此前,中芯國際在2019年財報中透露,公司已經開發了14/12nm多種特色工藝平台,N+1的研發進程穩定,已進入客户導入及產品認證階段。

二季度業績指引折射高景氣度

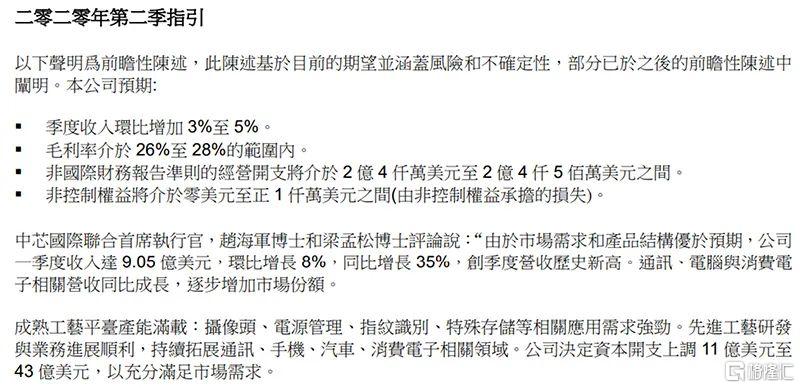

在一季報中,中芯國際給出了令人期待的第二季度業績指引。

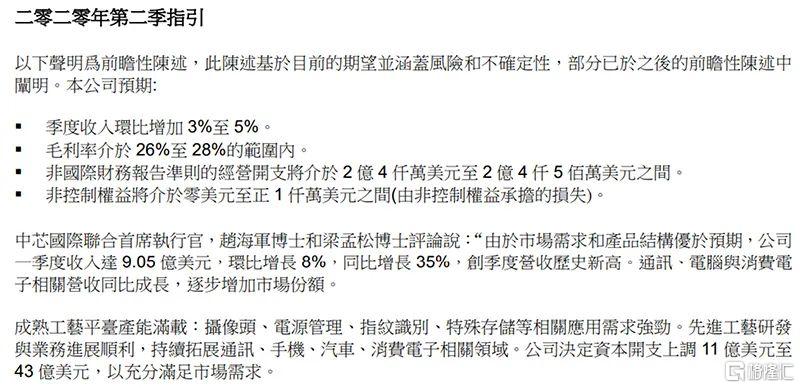

根據指引,中芯國際預計第二季度的收入環比增加3%至5%,毛利率在26%至28%之間。第二季度非國際財務報告準則的經營開支將介於2.4億美元至2.45億美元。

更為重要的是,中芯國際表示,由於市場需求旺盛,公司決定繼續增加資本支出,將資本開支上調11億美元至43億美元,以充分滿足市場需求。

中芯國際是中國大陸半導體產業的風向標,其增加資本開支,意味着行業景氣度持續走高。那麼,產業的需求都在哪裏?

中芯國際在第二季度業績指引中披露,成熟工藝平台產能滿載,攝像頭、電源管理、指紋識別、特殊存儲等相關應用需求強勁。先進工藝方面,研發與業務進展順利,持續拓展通訊、手機、汽車、消費電子等相關領域。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.