4月乘用車日均銷售降幅大幅收窄,車市終現V型反轉

格隆匯 05-06 19:01

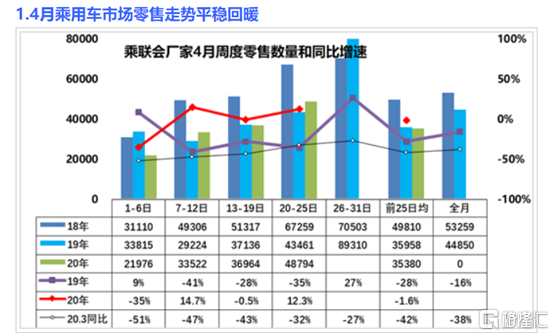

乘聯會今日發佈4月最後一週車市周度分析,顯示4月份乘用車市場明顯回暖。前四周(1-25日)日均零售乘用車3.53萬輛,同比下降1.6%。但該跌幅已較3月前四周同比跌幅42%大幅收窄。

(圖源:乘聯會網站)

分拆四個星期來看,第一週乘用車市場的日均銷量為2.19萬輛,同比增速下降35%;第二週為零售3.35萬輛,同比增速增長14%;第三週為3.69萬輛,同比增速微降0.5%;第四周乘用車市場零售表現回穩,日均零售4.87萬輛,同比增速增長12%。

乘聯會表示,考慮到疫情發生前1月份行業零售同比下滑20%,2月下滑80%,3月增速減少40%, 中國車市V型反轉態勢已經基本確定。回顧上月行業四個星期的銷售表現,協會認為產銷恢復較快、換購需求羣體對疫情後出行質量關注及有關刺激政策落地是促使V型反轉的主要因素。

但協會同時表示,參考中國人民銀行調查統計司城鎮居民家庭資產負債調查課題組的資產負債調查結果,城鎮居民家庭負債參與率為56.5%,而房貸則佔家庭總負債的75.9%,部分低資產家庭存在資不抵債,違約風險高;中青年羣體則有負債壓力大,債務風險較高等問題。

故此,協會認為在生活債務壓力相對較大,疊加購房的債務負擔情況下,年輕人購車能力大幅會下降。近幾年隨着房價上漲,該趨勢尤為明顯,對車市未來一段時間發展帶來持續隱憂。

行業對應汽車整車板塊個股今年內表現均不算太理想。龍頭上汽及廣汽集團年內股價分別跌21.24%及11.26%,北汽藍谷、福田汽車等均錄得25%以上跌幅。

(圖源:同花順iFinD)

隨着乘用車行業迎來V型反轉,今年被市場"冷落"的整車板塊有望重新迎來市場關注,有關個股估值得到一定修復。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.