股權激勵計劃提振信心!今世緣不僅漲停,還帶紅了白酒板塊

今日,今世緣推出的一個限制性股票激勵計劃在市場引起熱議。

根據公告顯示,該公司擬向激勵對象授予1,250萬份股票期權,約佔總股本的1%;首次授予股票期權的行權價格為29.06元(現價28.77元;而激勵對不超過360人,包括公司高級管理人員、核心技術人員和管理骨幹,其中方誌華等三位副總經理各獲授權益24萬份,分別佔比1.92%。

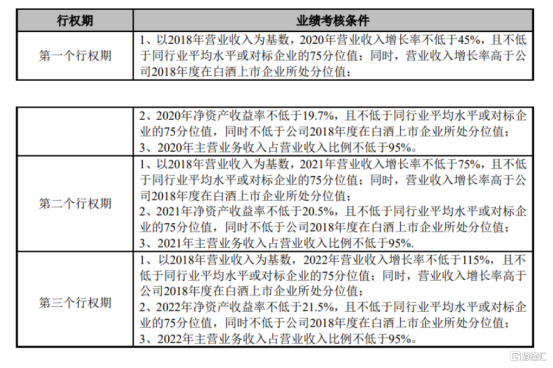

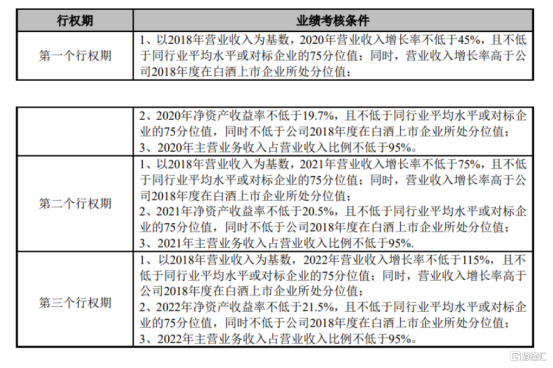

劃重點的是,該項股權激勵計劃的業績考核要求為——2020/21/22年ROE水平分別不低於19.7%/20.5%/21.5%;以2018年營業收入為基數(37.36億元),2020/21/22年營業收入增長率不低於45%/75%/115%。

(數據來源:今世緣公告)

而從上述條件推算可知,2020年,今世緣的收入目標要達到10-15%,而2021年至2020年目標進一步提升至20%-25%,若目標實現,2022年公司總營收將超過80億元,淨利潤有望超過25億元。

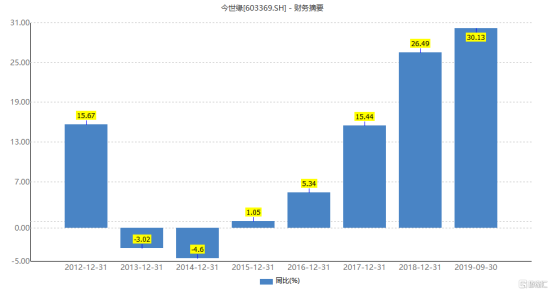

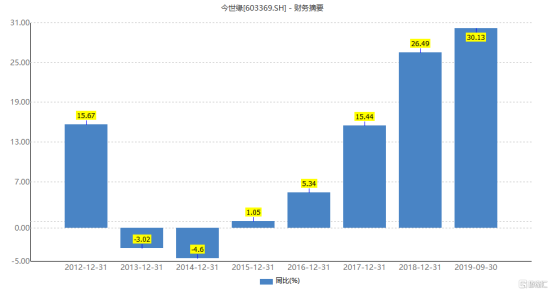

需要指出的是,就今世緣近幾年的營收增速水平來看,2017年到2019年9月30日,該公司的營收增速分別為15.44%、26.49%、30.13%,由此推算要在2020年達到15%以上的營收增速似乎並非難事。

(今世緣營收增速 數據來源:wind)

此外,對照茅台、五糧液、山西汾酒近三年的營收增速來看,2017年至2019年,茅台營收增速分別為52.07%、26.43%、15.1%;五糧液的營收分別為增速22.99%、32.61%、26.84%;而山西汾酒的營收增速分別為47.48%、25.72%、26.57%。基於上述數據可知,在整個白酒行業,收入增速在15%以上是很常見的事。

綜上所述,如果不出意外的話,今世緣要在2020年達到10-15%的收入增速水平,實際上是輕而易舉的事。

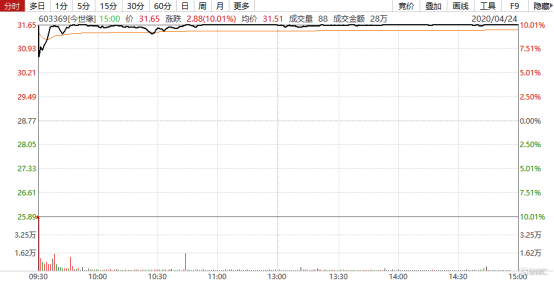

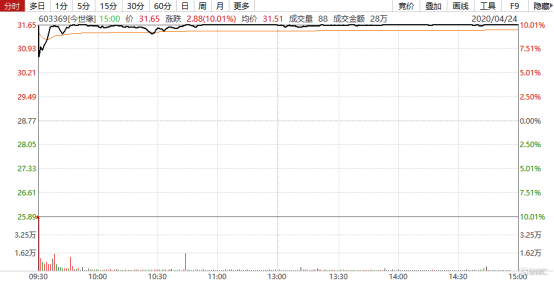

或受股權激勵計劃容易實現這一事實刺激,今日今世緣股價高開高走,截止收盤其股價已經漲停,報於31.65元,成交額高達10.52億,總市值為397.05億元。

(行情來源:wind)

而今世緣股權激勵的計劃似乎也提振了白酒板塊。截止收盤,A股白酒板塊近乎全線上漲,其中,捨得酒業漲超4%,古井貢酒漲超3%,迎駕貢酒、順鑫農業、口子窖均漲超2%,金種子酒、山西汾酒等白酒股隨之上漲。

(行情來源:wind)

此外,對於今世緣股權激勵這一計劃,不少券商機構皆給予了看好的意見,並維持“買入”“推薦”的評級。

其中,招商證券指出,此次實施股權激勵,短期有利於提振市場信心,中長期有助於激發公司內部活力,因此繼續看好公司未來成長性,維持“強烈推薦-A”評級,一年目標價為38元。而國盛證券也表示,看好公司團隊的戰鬥力和主力產品的發展空間,維持“買入”評級,並維持目標價38元,對應2020年29倍PE。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.