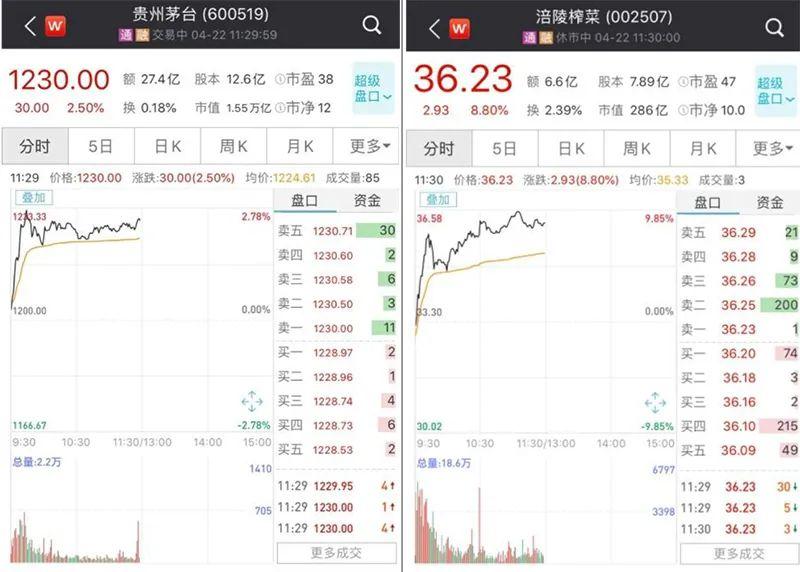

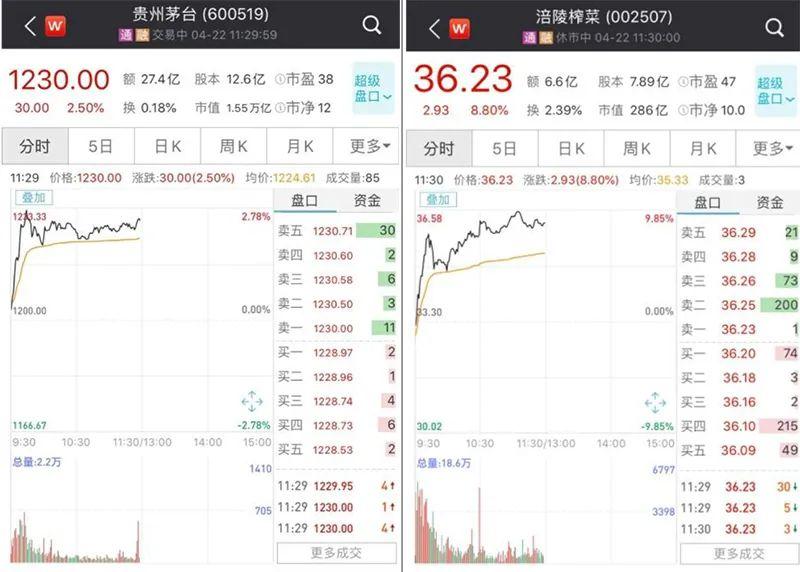

今天市場主角是茅台和涪陵榨菜……

作者:屈紅燕

來源:上海證券報

今日大盤走勢平穩,但受2019年年報業績略超預期的推動,貴州茅台今日早盤大漲超過2.5%,盤中一度摸高到1233元,達到歷史新高。

同樣受2020年一季報業績的推動,涪陵榨菜今日早盤大漲8.8%,股價創出歷史新高。

數據來源:Wind

截至午間收盤,上證指數報收於2822.57點,下跌0.16%;深證成指報收於10495.06點,下跌0.11%;創業板指報收於2016.22點,下跌0.38%。

數據來源:Wind

確定性業績能抗起股價

食品飲料板塊今日早盤表現亮眼,恆順醋業大漲3.48%,洽洽食品上漲5.98%,雙匯發展上漲3.35%;農業種植板塊漲幅居前,大北農、豐樂種業和萬向德農漲停;輸變電設備也表現強勁,四方股份漲停,國電南自上漲9.56%。

貴州茅台等個股今日的強勁表現與其業績推動密不可分。貴州茅台昨晚發佈了2019年報,2019年實現營業總收入888.54億元,同比增長15.1%,歸母淨利潤412.06億元,同比增長17.1%。

中泰證券表示,貴州茅台全年業績符合預期,中長期來看,茅台有望持續實現穩健增長,茅台護城河足夠寬,並且處在白酒價位裏增速最快的賽道,渠道價差充足和良好的收藏增值屬性,使其受本次疫情影響很小,展望未來5年,茅台仍處於賣方市場,公司具備持續提價能力,預計公司收入複合增速有望達15%以上,依舊是核心資產。

中信證券認為稀缺龍頭堅定推薦,繼續看好茅台憑藉強大的品牌力和稀缺性,表現出更抗週期波動的穩定性,享受估值溢價。維持1年目標價1500元,維持“買入”評級。

涪陵榨菜大漲的背後同樣是受到業績推動。涪陵榨菜昨晚發佈2020年一季度業績,公司一季度實現營業收入4.83億元,同比下降8.33%,歸母淨利潤1.66億元,同比上升6.67%。華創證券表示,該公司當前低庫存、高預收保障公司後續增長,同時疫情衝擊及成本上漲將導致抗風險能力弱的中小企業出清,公司定價權進一步提升。

在一些長期投資人看來,涪陵榨菜和貴州茅台今日創出或接近歷史新高並非個案。儘管一季度全球金融市場受新冠疫情影響劇烈波動,但等到暴風雨稍有平息,多隻白馬股就已經站上歷史新高。

統計數據顯示,4月份有近68只個股創出歷史新高,而確定性的業績是這些個股不斷創出新高的重要因素。比如海天味業3月25日發佈年報以來漲幅已經超過20%。

消費品+新老基建近期受寵

分析人士表示,市場反彈之路不會一帆風順,在低風險偏好背景下,以內需為主的確定性板塊是投資主線。

國都證券認為,階段性反彈的條件已具備,內外考驗窗口期與壓力釋放進入尾聲,均為A股階段性反彈提供了條件,結構性反彈可期,以內需確定性板塊為主,年內而言,“必需消費品+新老基建”內需板塊避險為主。

一是必需消費品,包括食品飲料、畜禽養殖、農業種植、醫療器械及生物疫苗等;二是5G通訊、數據中心與數字基建、工業互聯網、公共醫療(生物安全)、智慧城市、智能製造等新基建以及城市輕軌、環保、電網改造升級、城市舊改等傳統基建;三是以疫情過後消費回補、尤其是疫情加速培育的新業態新消費趨勢性機會,重點包括(新能源)汽車、綠色智能家電等大宗消費,以及在線教育、高清視頻、雲遊戲、雲辦公、生鮮冷鏈等疫情加速培育的新業態新消費趨勢性機會。

此外,低估值的券商、銀行、保險、地產等大金融板塊中的頭部公司,業績相對穩健,股息率對國債利率已具備配置價值,預計二季度隨着國內經濟政策發力、經濟企穩反彈預期上升,低估值的大金融板塊也將迎來估值修復行情。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.