百年大行中國銀行原油寶穿倉,投資人“倒貼”

作者:甜茶

來源:新浪財經

4月21日中國銀行“積極聯絡CME,確認結算價格的有效性和相關結算安排”的表態於今日揭曉。

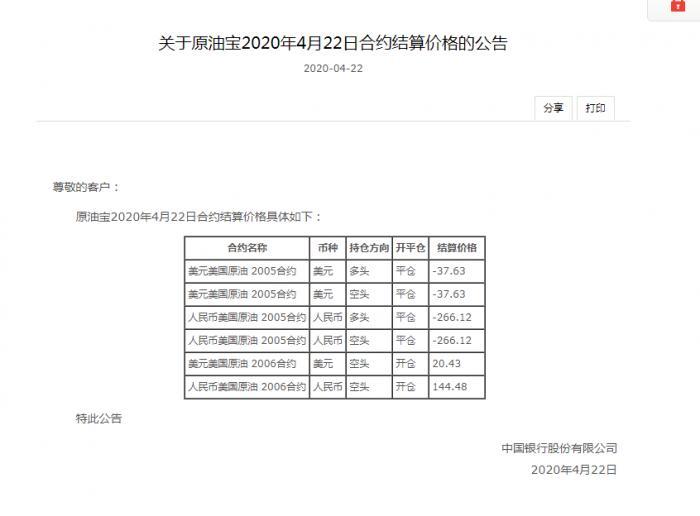

美國原油2005合約-37.63元/桶的結算價格被確認有效。消息一出,參與其中的投資者譁然。

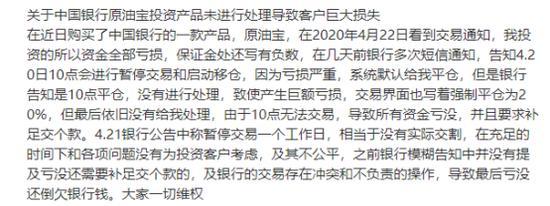

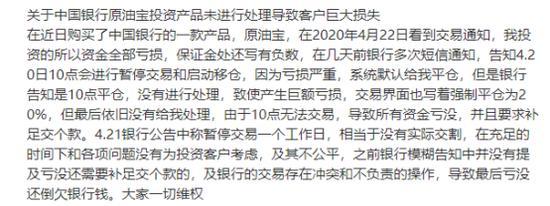

“我交了保證金買了中國銀行的原油寶產品,選擇到期移倉。20號晚上10:00被禁止交易,今天告訴我不僅保證金分文不剩(按規則應該在虧損20%本金的時候強制平倉),我還欠銀行幾十萬?”有投資者表示。

4月20日,即將交割的WTI原油5月期貨收於負值,使得抄底原油的投資者損失慘重。

受此影響,昨日中行原油寶暫停美國原油合約交易。中行稱,WTI原油5月期貨合約CME官方結算價收報-37.63美元/桶,歷史上首次收於負值,中行正聯絡CME,確認結算價格的有效性和相關結算安排。

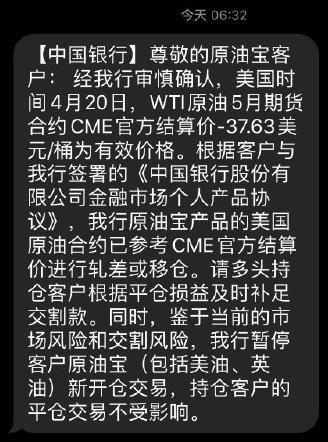

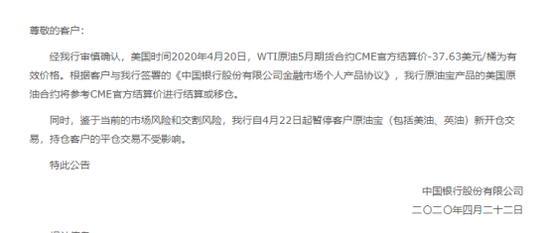

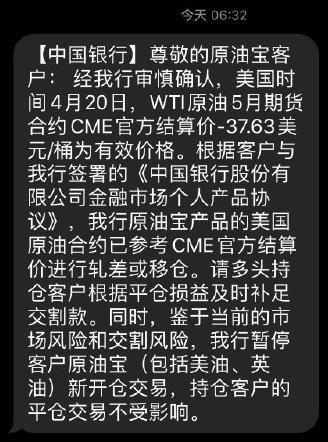

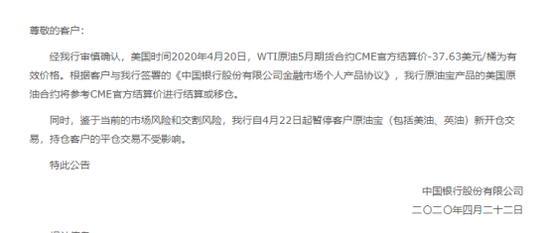

今日中行短信告知客户稱,經審慎確認,-37.63美元/桶為有效價格,中行原油寶產品的美國原油合約已參考CME官方結算價進行軋差或異常,請多頭持倉客户根據平倉損益及時補足交割款。

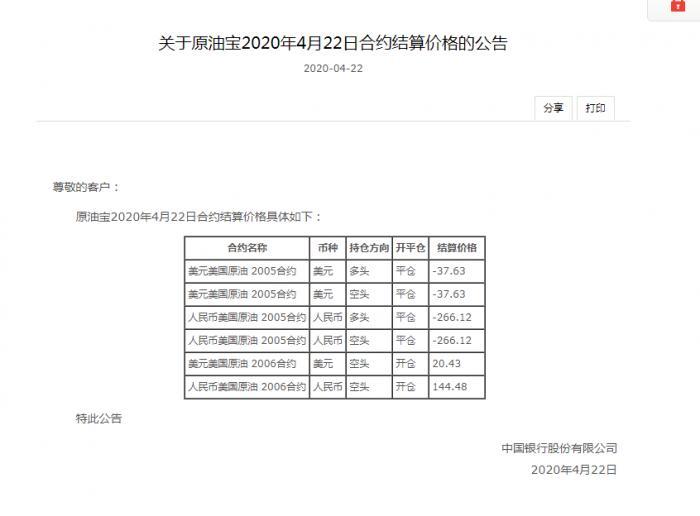

中行也於官網掛出同樣內容的公告,並稱中行自4月22日起暫停客户原油寶(包括美油、英油)新開倉交易。

按照普通紙原油投資人的理解,抄底賬户原油,最多就是本金虧淨被平倉。但按照目前中行原油寶的情況,投資人不僅虧光了保證金,還可能倒欠銀行鉅款。網絡圖片顯示,中國銀行向投資者發送的結算價格是-266.12元。

如網傳的這張結算單,投資者持倉均價194.23元,本金388.46萬元。目前虧損920.7萬元,倒欠銀行532.24萬元。中行已發出通知,要求投資者補充這部分穿倉虧損。

據新浪金融研究院此前瞭解,據瞭解,與工行紙原油類似,中行原油寶不具備槓桿效應,按期次發佈合約。中行作為做市商提供報價並進行風險管理,個人客户在中行開立綜合保證金賬户,簽訂協議,並存入足額保證金後,可實現做多與做空雙向選擇。

中行原油寶在4月20日晚自動轉期,值得注意的是,與中行不同,工行、建行、民生等銀行都在約一週前為客户完成移倉。

彼時,有客户質疑工行操作導致客户換月損耗巨大,中行原油寶事件一出,有工行紙原油投資人表示,相比中行原油寶,自己竟然“逃過一劫”?

有銀行交易員對新浪金融研究院表示,中行較其他銀行換月時間更晚的原因或源於其規則設計。在賬户商品交易設計中,各行的交易規則都不盡相同。

目前已有投資人對中行原油寶的交易制度提出明確質疑。投資人認為,中行的交易策略在充足時間下和各項問題中沒有為投資客户考慮,極其不公平,銀行的交易存在衝突和不負責任的操作。據瞭解,已有投資人表示欲組團對中行提起訴訟。

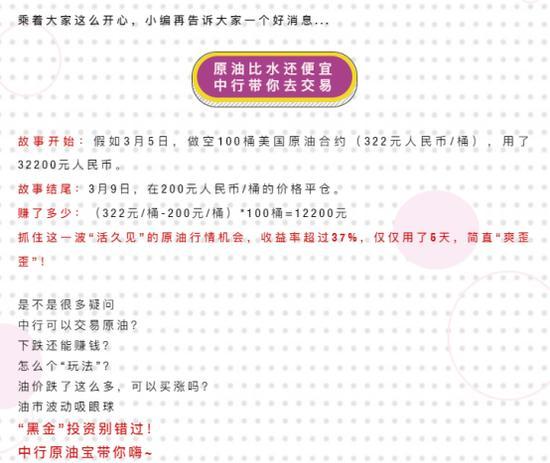

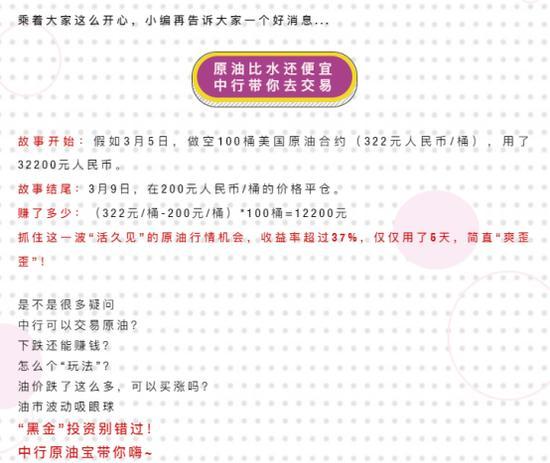

新浪金融研究院注意到,一週前株洲中行的微信公眾號“悦中行”曾發文對其原油寶產品進行推薦。文章稱有一種收穫叫中行原油寶,並表示“原油比水還便宜,中行帶你去交易”。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.