狠砸200億,北向資金連續3天抄底,外資正在大舉買入哪些股?

作者:李志強

來源:證券時報網

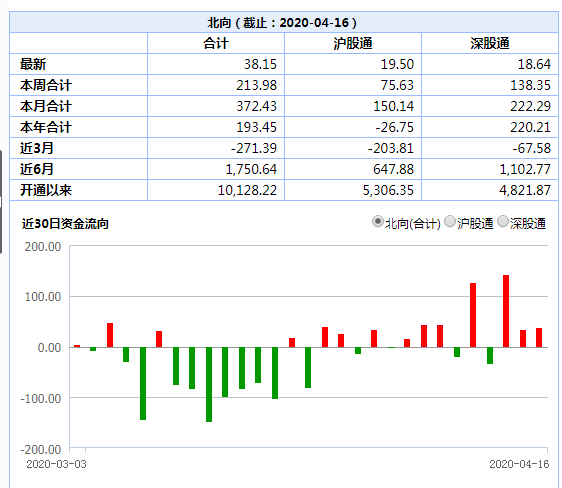

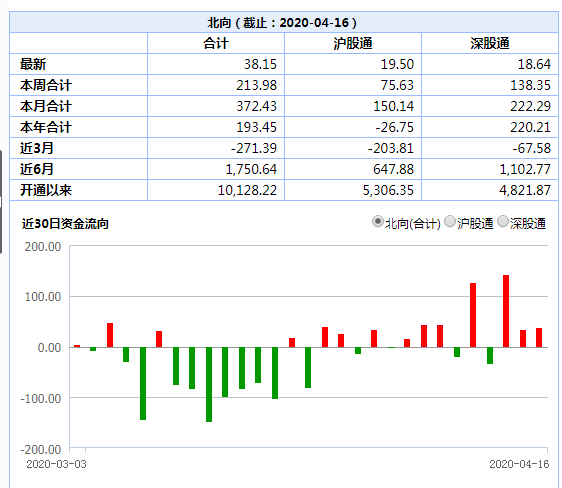

4月16日,北上資金當日淨流入38.15億元,已連續三天淨流入,本週合計淨流入超200億元,本月淨流入372.43億元,上資金風險偏好再度增強。4月以來,北上資金大幅買入,累計淨流入約400億元。

從行業來看,近3個交易日北向資金持股市值增加居前的行業為釀酒、家用電器、電氣設備、醫藥、醫療保健,釀酒和家用電器分別增加85.38億元和52.78億元,電氣設備增加37.94億元,醫藥和醫療合計增加約48億元。

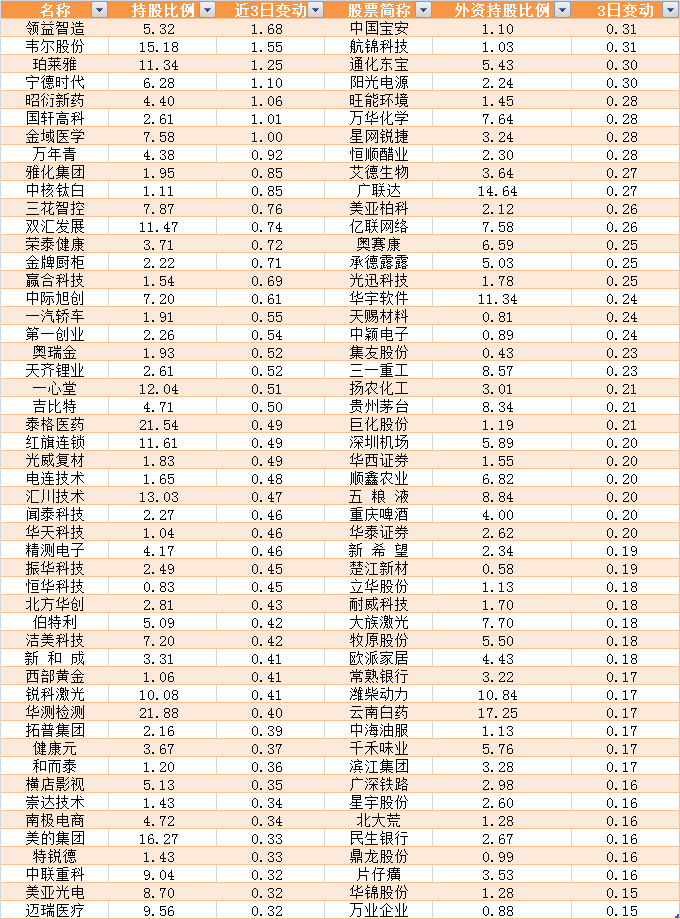

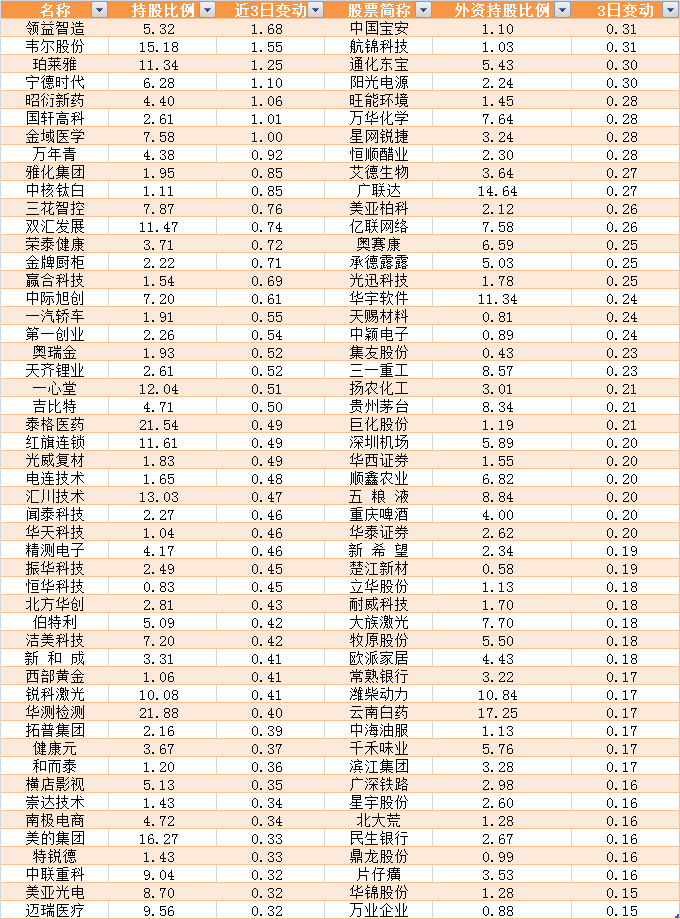

從持股比例來看,電氣設備、日用化工、半導體、電器儀表、家用電器持股提升力度居前,電氣設備、日用化工分別提升0.30%和0.29%,半導體、電器儀表、家用電器提升超過0.2%。

從個股情況來看,共有超過670只個股在近3個交易日北向資金持股上升,旭升股份、贛鋒鋰業、國藥股份、領益智造、韋爾股份、珀萊雅、華夏航空、寧德時代、欣旺達、昭衍新藥、華蘭生物、賽騰股份、國軒高科、金域醫學等北向資金持股比例提升超過1%,另外歐菲光、中科創達、中新賽克、三花智控、雙匯發展、光環新網、通富微電、中際旭創、協鑫集成、中環股份、浪潮信息等38股持股比例提升超過0.5%。

數據顯示,有近200只個股連續3天增持,平均增持比例為0.245%,金域醫學、珀萊雅、韋爾股份、昭衍新藥寧德時代、領益智造、國軒高科增持比例超過1%。

在外資持股比例超過10%的個股中,韋爾股份、珀萊雅、雙匯發展、一心堂、泰格醫藥、紅旗連鎖、匯川技術、鋭科激光、華測檢測、美的集團、廣聯達、華宇軟件、濰柴動力、雲南白藥、啟明星辰、伊利股份近3日連續增持。

蘇墾農發、基蛋生物、華培動力、地素時尚、中糧科技、天味食品近3個交易日北向資金持股比例下降超過1%。

週四(4月16日)前十大活躍股中陸股通淨買入以醫藥生物、白酒股為主,其中貴州茅台淨買入成交最多,超過10億元。

陸股通前十大活躍股中,六隻個股遭淨賣出。淨賣出個股行業分佈分散,分別是中國平安、平安銀行、格力電器、上海機場、贛鋒鋰業、立訊精密,其中中國平安連續3個交易日遭陸股通淨賣出。

山西證券指出,市場方面,北上資金已經三天淨流入,美股也進入平台期,後續外圍對A股的擾動有望逐步降低。板塊方面,邁克生物帶動檢測試劑板塊上漲。特高壓、充電樁概念走強的邏輯是新基建,隨着消息面的利好,板塊有望成為全年的熱點。另外值得關注的是業績預增概念,近期業績預增個股受到資金追捧。隨着一季報的陸續披露,資金對業績預增個股的關注度升高,板塊後續仍有上漲機會。

天風證券指出,市場情緒伴隨着疫情期海外風險的快速釋放,國內和海外股市最恐慌時候都已經過去;上市公司盈利方面,一季報也正在得到消化;隨着國內一攬子積極政策持續推進,國內經濟整體改善的趨勢有望延續,一季度和二季度是國內經濟的一個底部,後面隨着經濟數據,風險偏好和投資者情緒的恢復,加上外資的逐步流入,市場或將逐步走好。短期看市場維持謹慎,大概率還是窄幅振盪;中長期看好A股市場優質公司的投資價值。板塊方面看好:軍工,5G基礎設施,大數據,醫藥,食品飲料和建材等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.